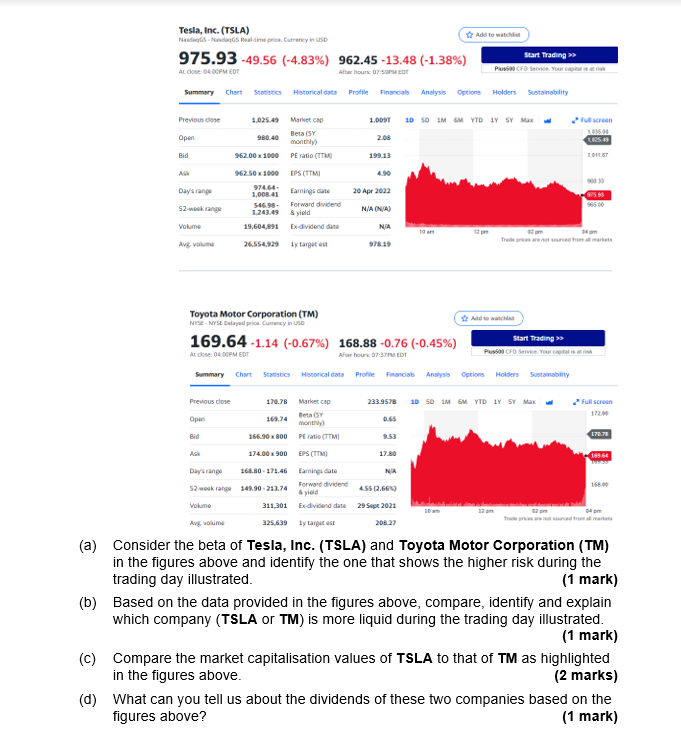

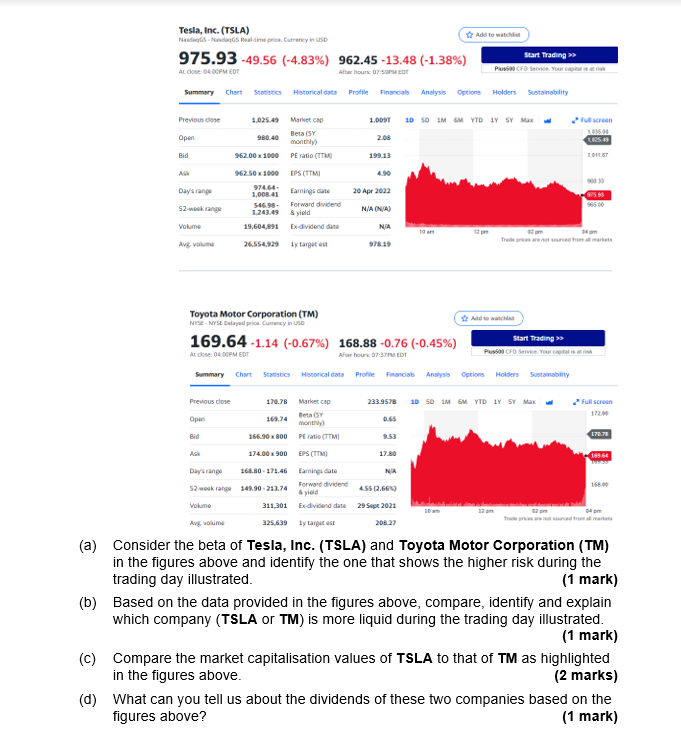

Tesla, Inc. (TSLA) Na-Nasa Real-time price. Currency in USD Start Trading >> 975.93-49.56 (-4.83 % ) 962.45-13.48 (-1.38%) Plus500 CFD Service. Your capital is at risk At close: 04:00PM EDT Afterhours: 07:50PM EDT Summary Chart Statistics Historical data Profile Financial Analysis Options Holders Sustainability Previous close 1,025.49 Market cap 1.009T 1D 50 1M GM YTD 1Y SY Max Full screen 1.036.00 142549 Open Beta (5 monthly) 980.40 2.08 199.13 Bid 962.00 x 1000 PE ratio (TTM) Ask 962.50 x 1000 EPS (TTM) 4.90 Day's range 975.93 974.64. 1,008.41 546.98- 1,243.49 19,604,891 Ex-dividend date Earnings date Forward dividend & yield 20 Apr 2022 N/A (N/A) 52-week range Volume N/A 10 am 42 pm 04 pm Trade prices are not sourced from markets Avg, volume 26,554,929 ly target out 978.19 Toyota Motor Corporation (TM) NYSE-NYSE Delayed price. Cumency in USD Start Trading >>> 169.64-1.14 (-0.67%) 168.88 -0.76 (-0.45%) At close: 04:00PM EDT Plus500 CFD Service. Your capitalistisk Afterhours: 07:37PM EDT Summary Chart Statistics Historical data Profile Financial Analysis Options Holders Sustainability Previous close Open 170.78 Market cap Beta (SY 169.74 monthly) 233.9578 1D 5D 1M GM YTD 1Y SY Max 0.65 Bid PE ratio (TTM) 9.53 17.80 EPS (TTM) Earnings date NA Ask Day's range 52-week range Volume Avg, volume 166.90 x 800 174.00 x 900 168.80-171.46 Forward dividend 455(2.661) 149.90-213.74 & yield 311,301 Ex-dividend date 29 Sept 2021 325,639 ly target ast 208.27 04 pm Trade prices are not sourced from all markas (a) Consider the beta of Tesla, Inc. (TSLA) and Toyota Motor Corporation (TM) in the figures above and identify the one that shows the higher risk during the trading day illustrated. (1 mark) (b) Based on the data provided in the figures above, compare, identify and explain which company (TSLA or TM) is more liquid during the trading day illustrated. (1 mark) (c) Compare the market capitalisation values of TSLA to that of TM as in the figures above. highlighted (2 marks) (d) What can you tell us about the dividends of these two companies figures above? based on the (1 mark) Add to watchlist Add to watch Full screen 172.00 170.78 169.64 166.00