Question

Tesla (TSLA) is currently trading at So = $273/share. A dealer is offering a 3-month forward at a price of F = $275/share. One

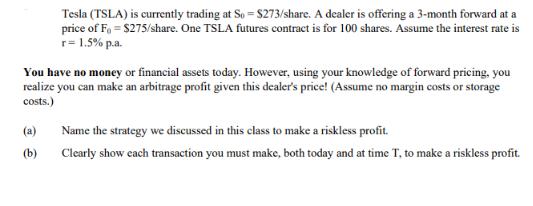

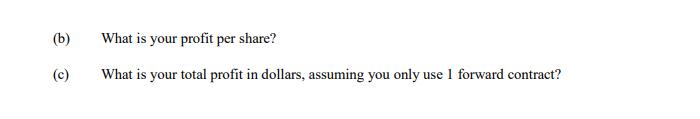

Tesla (TSLA) is currently trading at So = $273/share. A dealer is offering a 3-month forward at a price of F = $275/share. One TSLA futures contract is for 100 shares. Assume the interest rate is r = 1.5% p.a. You have no money or financial assets today. However, using your knowledge of forward pricing, you realize you can make an arbitrage profit given this dealer's price! (Assume no margin costs or storage costs.) (b) Name the strategy we discussed in this class to make a riskless profit. Clearly show each transaction you must make, both today and at time T, to make a riskless profit. (b) (c) What is your profit per share? What is your total profit in dollars, assuming you only use I forward contract?

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: J . chris leach, Ronald w. melicher

4th edition

538478152, 978-0538478151

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App