Question

Tessa and Scott are both 38 years old. They are non-smokers and have 2 young children, William (8) and Kate (6). They have recently switched

Tessa and Scott are both 38 years old. They are non-smokers and have 2 young children, William (8) and Kate (6). They have recently switched financial institutions to renew their mortgage and as a special bonus have been offered a free financial plan to be done by your team.

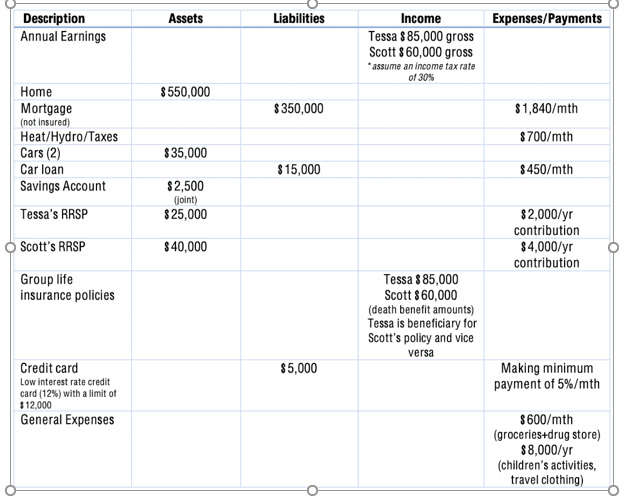

Calculate Tessa and Scotts current net worth (8 marks), monthly cash flow surplus or deficit (4 marks), and all relevant financial ratios (8 marks - make sure you show all your work). Briefly explain your findings (i.e. a sentence which interprets the result of each financial ratio will suffice) (4 marks). Using this information identify:

a) strengths (2 marks),

b) weaknesses (2 marks),

c) suggestions / recommendations (2 marks)

Assets Liabilities Expenses/Payments Description Annual Earnings Income Tessa $ 85,000 gross Scott 860,000 gross *assume an income tax rate of 30% $550,000 $350,000 $1,840/mth $700/mth Home Mortgage (not insured) Heat/Hydro/Taxes Cars (2) Car loan Savings Account Tessa's RRSP $35,000 $15,000 8450/mth $2,500 (joint) $ 25,000 Scott's RRSP $40,000 $2,000/yr contribution $4,000/yr contribution Group life insurance policies Tessa $ 85,000 Scott $60,000 (death benefit amounts) Tessa is beneficiary for Scott's policy and vice versa $5,000 Making minimum payment of 5%/mth Credit card Low interest rate credit card (12%) with a limit of $12,000 General Expenses $600/mth (groceries+drug store) $8,000/yr (children's activities travel clothing) Assets Liabilities Expenses/Payments Description Annual Earnings Income Tessa $ 85,000 gross Scott 860,000 gross *assume an income tax rate of 30% $550,000 $350,000 $1,840/mth $700/mth Home Mortgage (not insured) Heat/Hydro/Taxes Cars (2) Car loan Savings Account Tessa's RRSP $35,000 $15,000 8450/mth $2,500 (joint) $ 25,000 Scott's RRSP $40,000 $2,000/yr contribution $4,000/yr contribution Group life insurance policies Tessa $ 85,000 Scott $60,000 (death benefit amounts) Tessa is beneficiary for Scott's policy and vice versa $5,000 Making minimum payment of 5%/mth Credit card Low interest rate credit card (12%) with a limit of $12,000 General Expenses $600/mth (groceries+drug store) $8,000/yr (children's activities travel clothing)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started