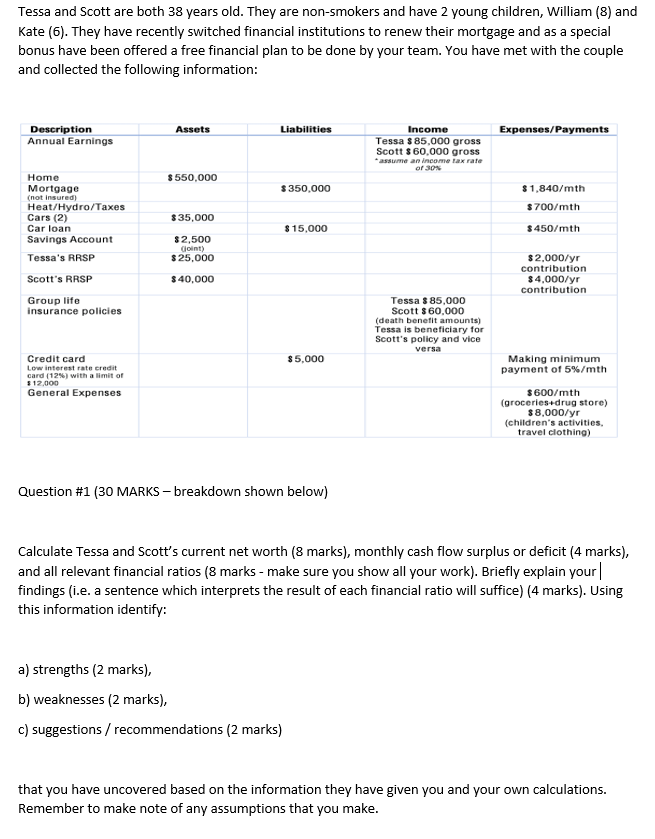

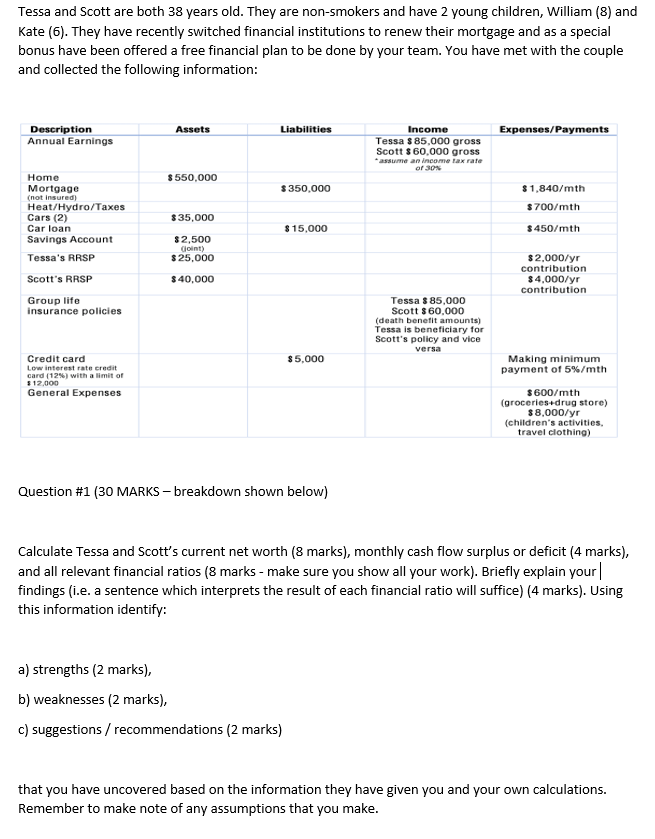

Tessa and Scott are both 38 years old. They are non-smokers and have 2 young children, William (8) and Kate (6). They have recently switched financial institutions to renew their mortgage and as a special bonus have been offered a free financial plan to be done by your team. You have met with the couple and collected the following information: Assets Description Annual Earnings Liabilities Expenses/Payments Income Tessa $ 85,000 gross Scott $60,000 gross assume an income tax rate of 30% $550,000 $ 350,000 $1,840/mth $ 700/mth $ 35,000 Home Mortgage (not insured) Heat/Hydro/Taxes Cars (2) Car loan Savings Account Tessa's RRSP Scott's RRSP $15,000 $450/mth 82,500 Goint) $ 25,000 $40,000 $2.000/yr contribution $4.000/yr contribution Group life insurance policies Tessa 885,000 Scott $60,000 (death benefit amounts) Tessa is beneficiary for Scott's policy and vice versa $5.000 Credit card Lew interest rate credit card (12%) with a limit of 312,000 General Expenses Making minimum payment of 5%/mth $ 600/mth (groceries drug store) $8.000/yr (children's activities, travel clothing) Question #1 (30 MARKS - breakdown shown below) Calculate Tessa and Scott's current net worth (8 marks), monthly cash flow surplus or deficit (4 marks), and all relevant financial ratios (8 marks - make sure you show all your work). Briefly explain your findings (i.e. a sentence which interprets the result of each financial ratio will suffice) (4 marks). Using this information identify: a) strengths (2 marks), b) weaknesses (2 marks), c) suggestions / recommendations (2 marks) that you have uncovered based on the information they have given you and your own calculations. Remember to make note of any assumptions that you make. Tessa and Scott are both 38 years old. They are non-smokers and have 2 young children, William (8) and Kate (6). They have recently switched financial institutions to renew their mortgage and as a special bonus have been offered a free financial plan to be done by your team. You have met with the couple and collected the following information: Assets Description Annual Earnings Liabilities Expenses/Payments Income Tessa $ 85,000 gross Scott $60,000 gross assume an income tax rate of 30% $550,000 $ 350,000 $1,840/mth $ 700/mth $ 35,000 Home Mortgage (not insured) Heat/Hydro/Taxes Cars (2) Car loan Savings Account Tessa's RRSP Scott's RRSP $15,000 $450/mth 82,500 Goint) $ 25,000 $40,000 $2.000/yr contribution $4.000/yr contribution Group life insurance policies Tessa 885,000 Scott $60,000 (death benefit amounts) Tessa is beneficiary for Scott's policy and vice versa $5.000 Credit card Lew interest rate credit card (12%) with a limit of 312,000 General Expenses Making minimum payment of 5%/mth $ 600/mth (groceries drug store) $8.000/yr (children's activities, travel clothing) Question #1 (30 MARKS - breakdown shown below) Calculate Tessa and Scott's current net worth (8 marks), monthly cash flow surplus or deficit (4 marks), and all relevant financial ratios (8 marks - make sure you show all your work). Briefly explain your findings (i.e. a sentence which interprets the result of each financial ratio will suffice) (4 marks). Using this information identify: a) strengths (2 marks), b) weaknesses (2 marks), c) suggestions / recommendations (2 marks) that you have uncovered based on the information they have given you and your own calculations. Remember to make note of any assumptions that you make