Answered step by step

Verified Expert Solution

Question

1 Approved Answer

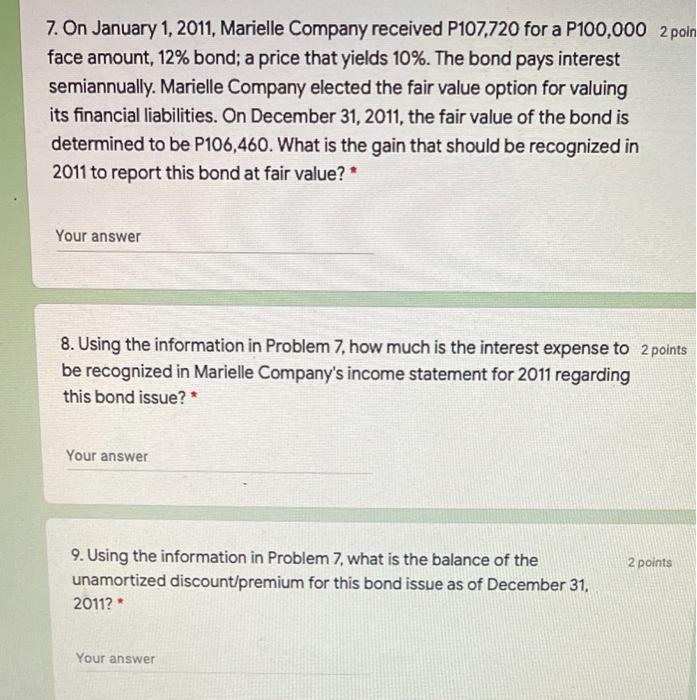

TEST 2 7,8,9,10 i need all answer please help me please 7. On January 1, 2011, Marielle Company received P107,720 for a P100,000 2 poin

TEST 2 7,8,9,10 i need all answer please help me please

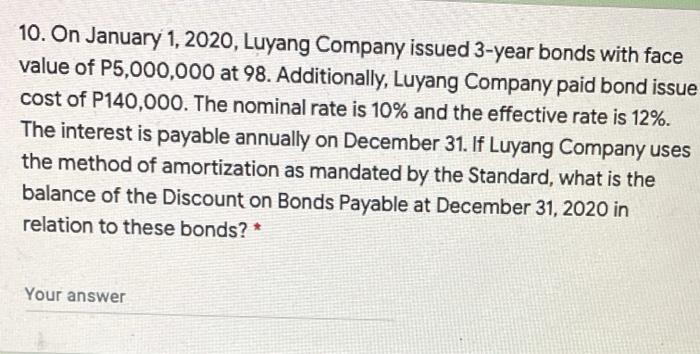

7. On January 1, 2011, Marielle Company received P107,720 for a P100,000 2 poin face amount, 12% bond; a price that yields 10%. The bond pays interest semiannually. Marielle Company elected the fair value option for valuing its financial liabilities. On December 31, 2011, the fair value of the bond is determined to be P106,460. What is the gain that should be recognized in 2011 to report this bond at fair value? Your answer 8. Using the information in Problem 7, how much is the interest expense to 2 points be recognized in Marielle Company's income statement for 2011 regarding this bond issue? * Your answer 2 points 9. Using the information in Problem 7, what is the balance of the unamortized discount/premium for this bond issue as of December 31, 2011? * Your answer 10. On January 1, 2020, Luyang Company issued 3-year bonds with face value of P5,000,000 at 98. Additionally, Luyang Company paid bond issue cost of P140,000. The nominal rate is 10% and the effective rate is 12%. The interest is payable annually on December 31. If Luyang Company uses the method of amortization as mandated by the Standard, what is the balance of the Discount on Bonds Payable at December 31, 2020 in relation to these bonds? * Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started