Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Test I. Billy Young is the author of a bestseller book being published by Beta Publishing House. He received P20,000 upon signing of contract

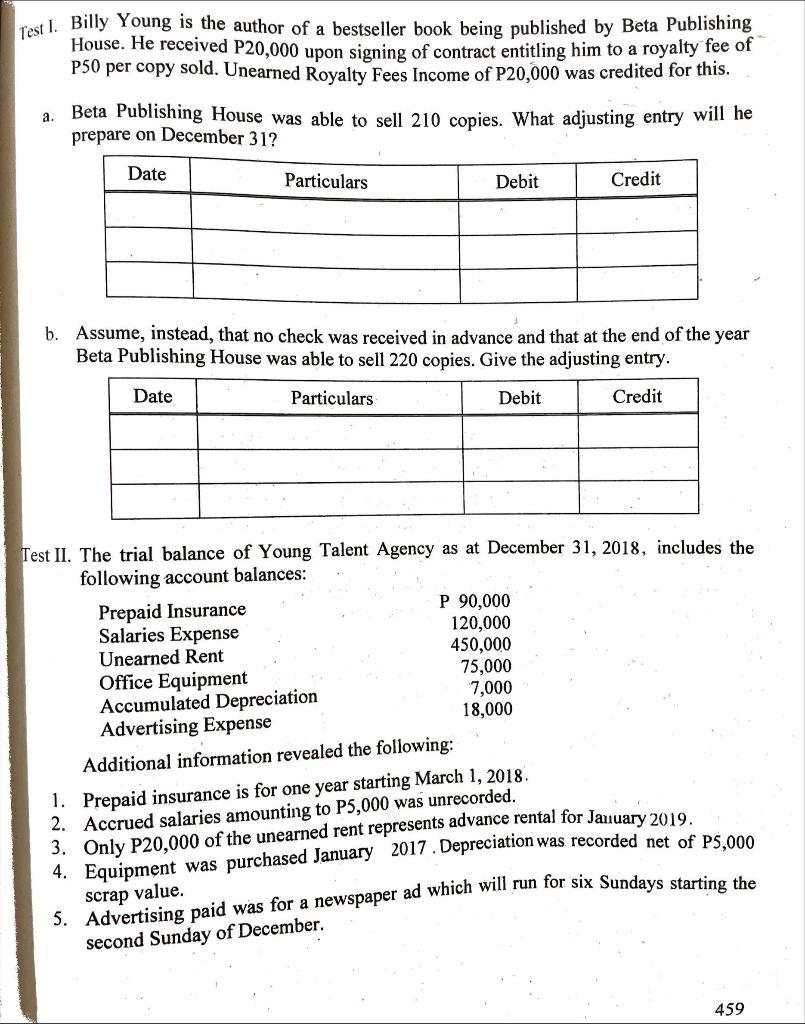

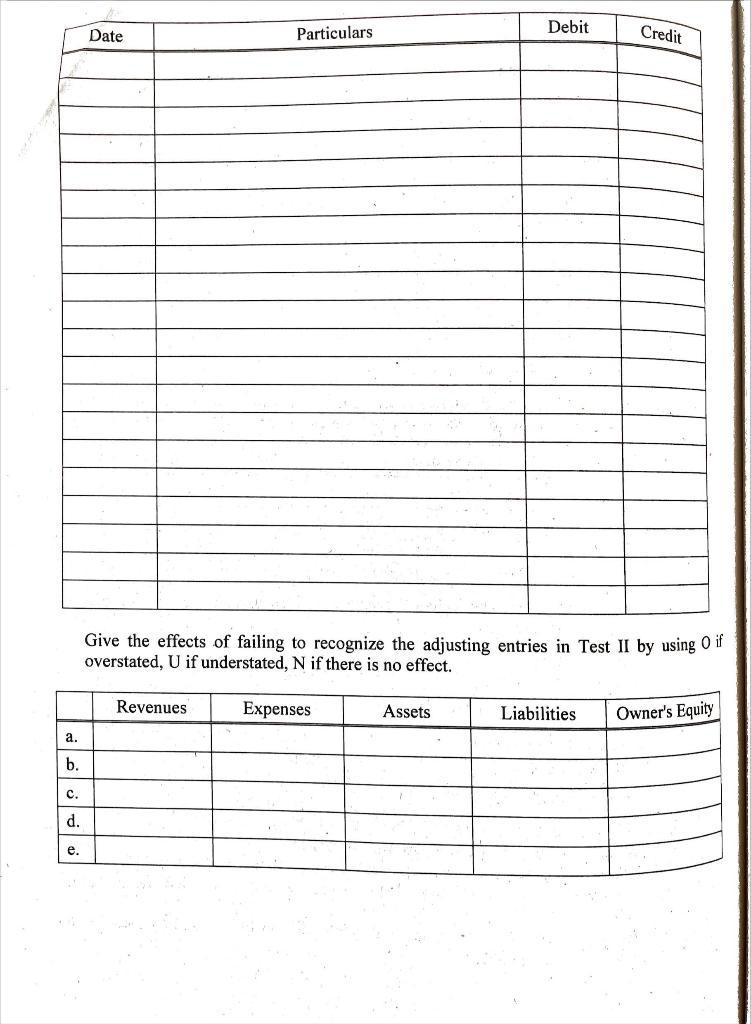

Test I. Billy Young is the author of a bestseller book being published by Beta Publishing House. He received P20,000 upon signing of contract entitling him to a royalty fee of P50 per copy sold. Unearned Royalty Fees Income of P20,000 was credited for this. a. Beta Publishing House was able to sell 210 copies. What adjusting entry will he prepare on December 31? Date Particulars Debit b. Assume, instead, that no check was received in advance and that at the end of the year Beta Publishing House was able to sell 220 copies. Give the adjusting entry. Date Particulars Debit Credit Test II. The trial balance of Young Talent Agency as at December 31, 2018, includes the following account balances: P 90,000 120,000 450,000 75,000 7,000 18,000 Prepaid Insurance Salaries Expense Unearned Rent Office Equipment Accumulated Depreciation Advertising Expense Additional information revealed the following: Credit 1. Prepaid insurance is for one year starting March 1, 2018. 2. Accrued salaries amounting to P5,000 was unrecorded. 3. Only P20,000 of the unearned rent represents advance rental for January 2019. 4. Equipment was purchased January 2017. Depreciation was recorded net of P5,000 scrap value. 5. Advertising paid was for a newspaper ad which will run for six Sundays starting the second Sunday of December. 459 a. b. C. d. e. Date Particulars Revenues Give the effects of failing to recognize the adjusting entries in Test II by using O if overstated, U if understated, N if there is no effect. Expenses Debit Assets Credit Liabilities Owner's Equity

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started