Answered step by step

Verified Expert Solution

Question

1 Approved Answer

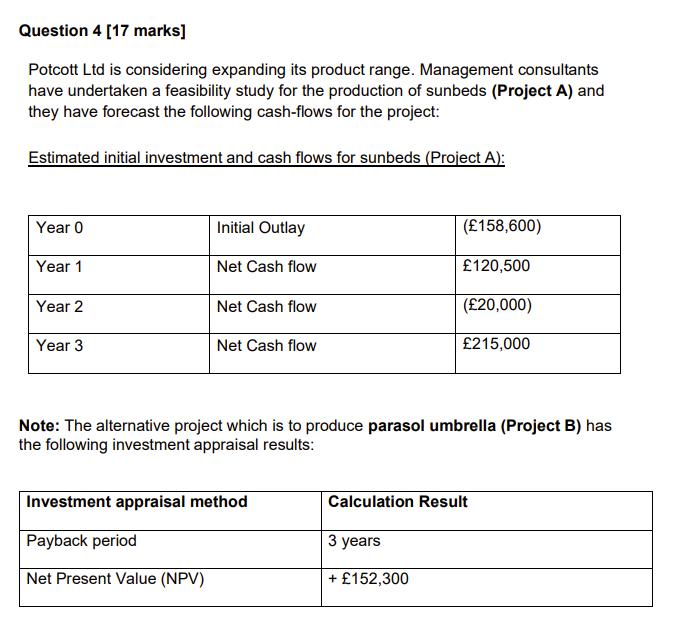

Question 4 [17 marks] Potcott Ltd is considering expanding its product range. Management consultants have undertaken a feasibility study for the production of sunbeds

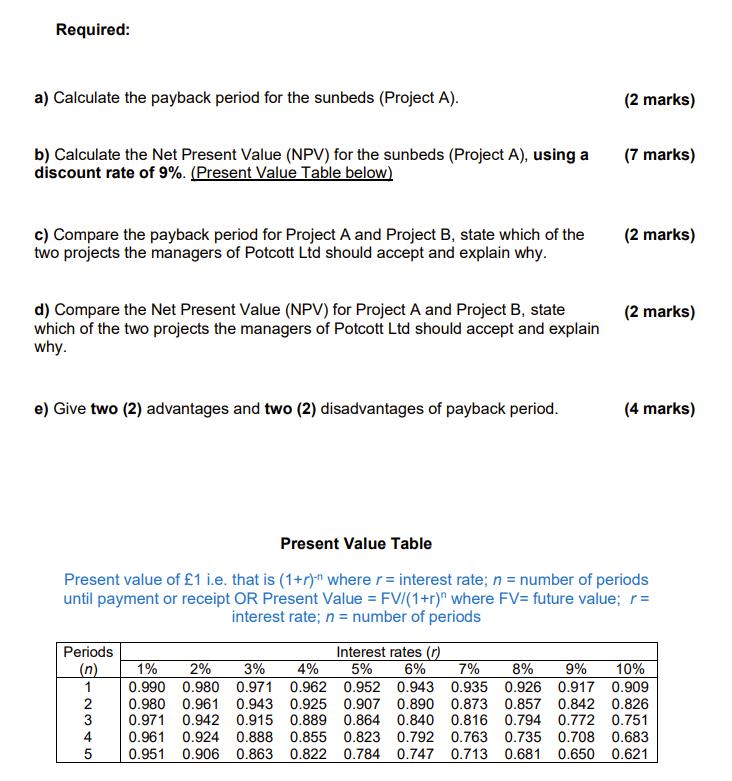

Question 4 [17 marks] Potcott Ltd is considering expanding its product range. Management consultants have undertaken a feasibility study for the production of sunbeds (Project A) and they have forecast the following cash-flows for the project: Estimated initial investment and cash flows for sunbeds (Project A): Year 0 Year 1 Year 2 Year 3 Initial Outlay Net Cash flow Net Cash flow Net Cash flow Note: The alternative project which is to produce parasol umbrella (Project B) has the following investment appraisal results: Investment appraisal method Payback period Net Present Value (NPV) (158,600) 120,500 (20,000) 215,000 Calculation Result 3 years + 152,300 Required: a) Calculate the payback period for the sunbeds (Project A). b) Calculate the Net Present Value (NPV) for the sunbeds (Project A), using a discount rate of 9%. (Present Value Table below) c) Compare the payback period for Project A and Project B, state which of the two projects the managers of Potcott Ltd should accept and explain why. d) Compare the Net Present Value (NPV) for Project A and Project B, state which of the two projects the managers of Potcott Ltd should accept and explain why. e) Give two (2) advantages and two (2) disadvantages of payback period. Periods (n) 1 2 4 5 (2 marks) 1% 2% 3% 4% 0.990 0.980 0.971 0.962 0.980 0.961 0.943 0.925 0.971 0.942 0.915 0.889 0.961 0.924 0.888 0.855 0.951 0.906 0.863 0.822 (7 marks) (2 marks) Present Value Table Present value of 1 i.e. that is (1+r) where r= interest rate; n = number of periods until payment or receipt OR Present Value = FV/(1+r)" where FV= future value; r = interest rate; n = number of periods (2 marks) (4 marks) Interest rates (r) 5% 6% 7% 8% 9% 10% 0.952 0.943 0.935 0.926 0.917 0.909 0.907 0.890 0.873 0.857 0.842 0.826 0.864 0.840 0.816 0.794 0.772 0.751 0.823 0.792 0.763 0.735 0.708 0.683 0.784 0.747 0.713 0.681 0.650 0.621

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Question a Payback period of Project A 227 years Years Cash flow Cumulative cash flow Initial outlay ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started