Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Test please open to see everything and answer in full please 4. Which of the following is a deduction for adjusted gross income in 2023

Test please open to see everything and answer in full please

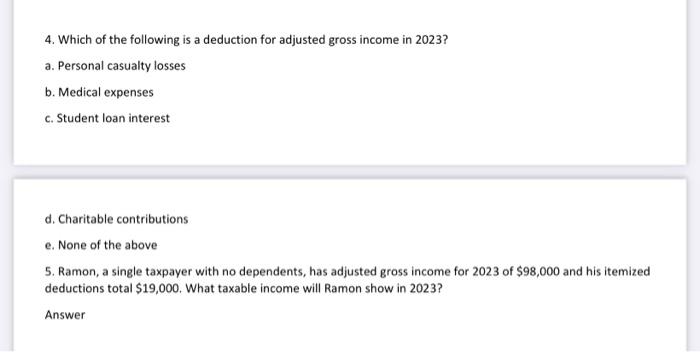

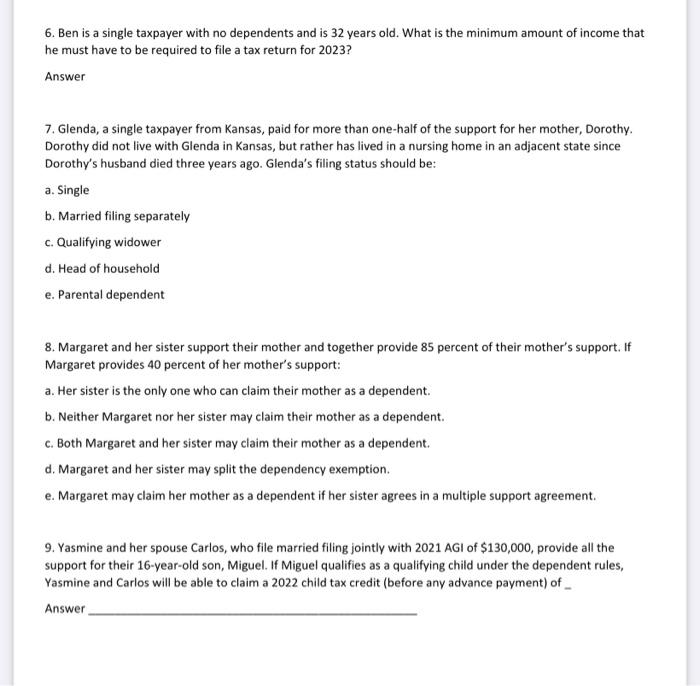

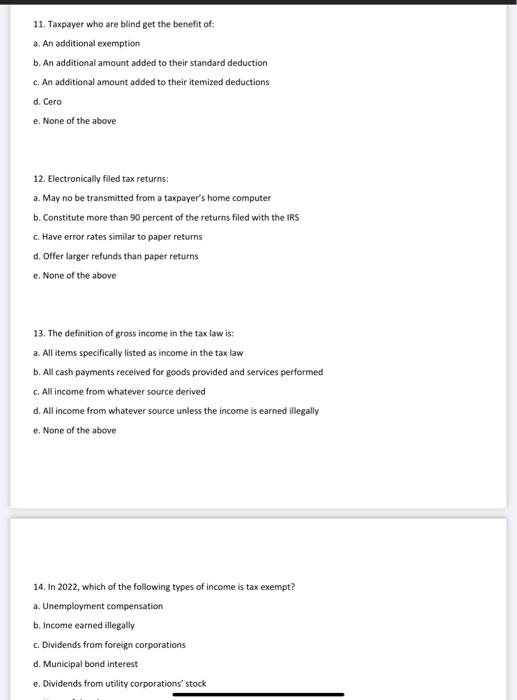

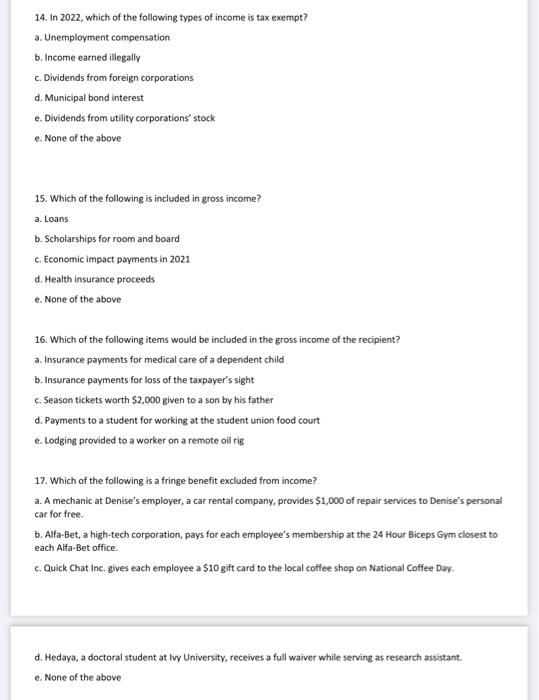

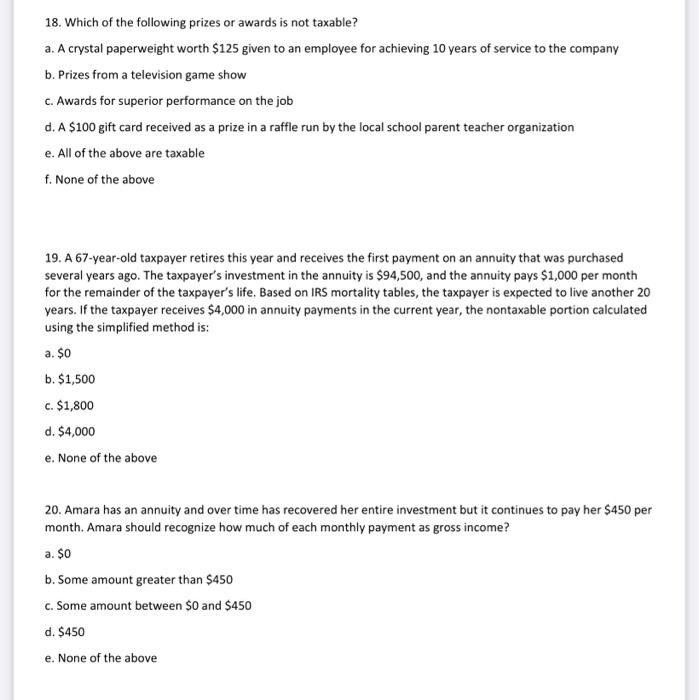

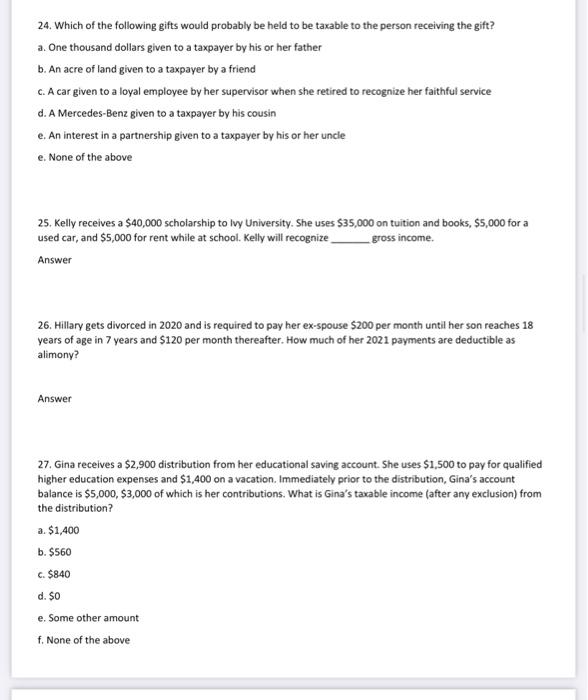

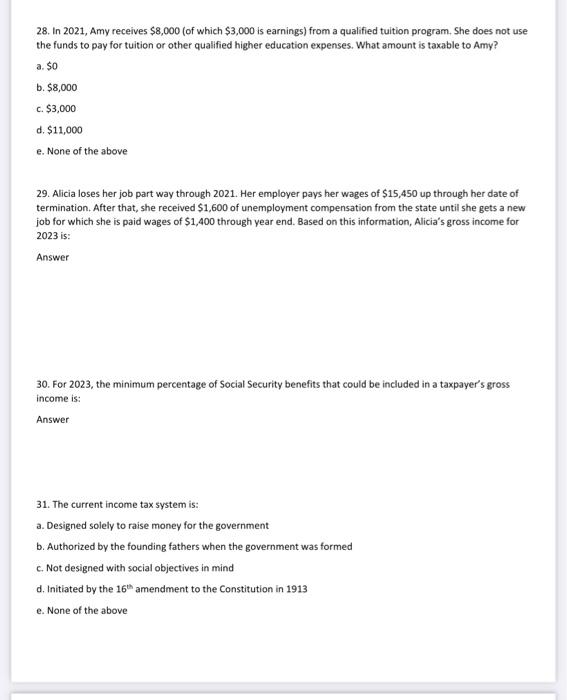

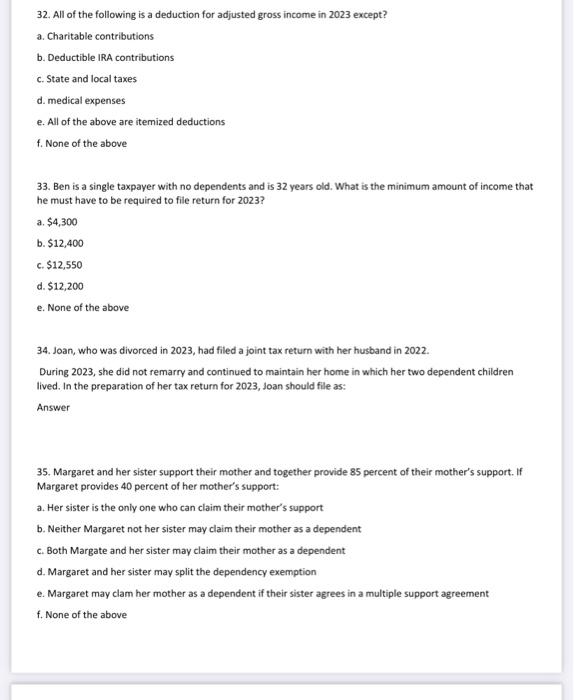

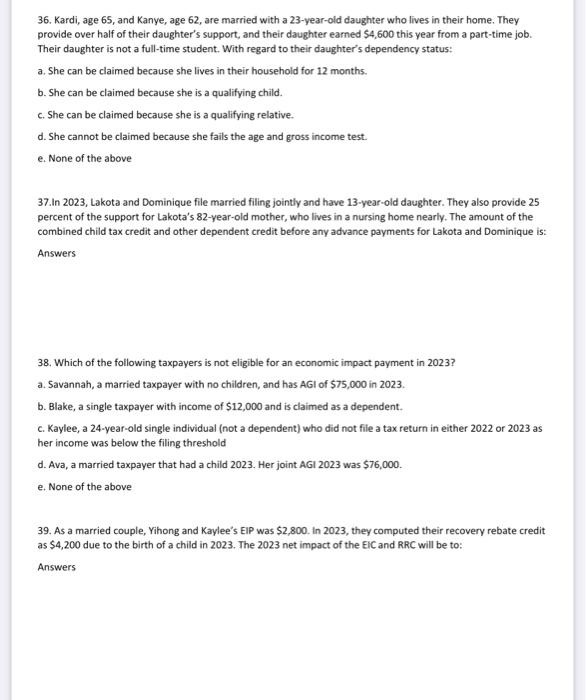

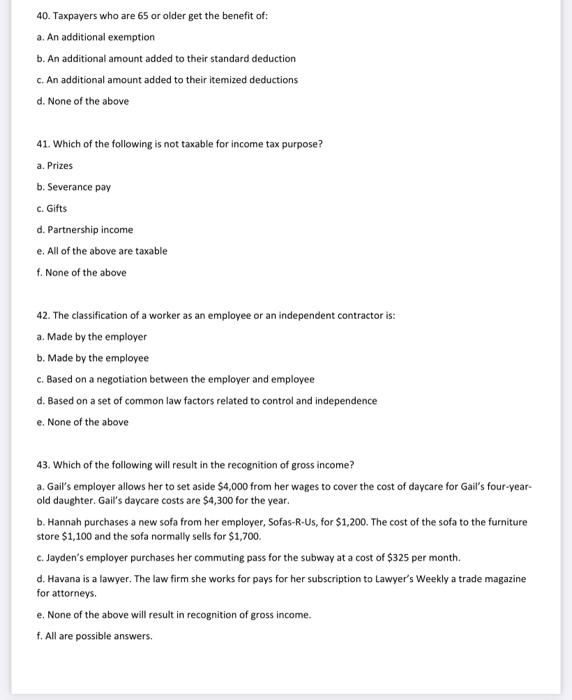

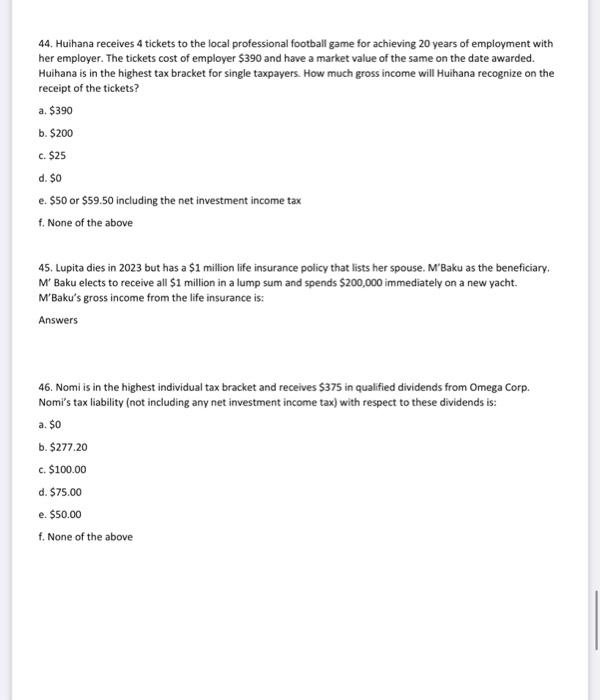

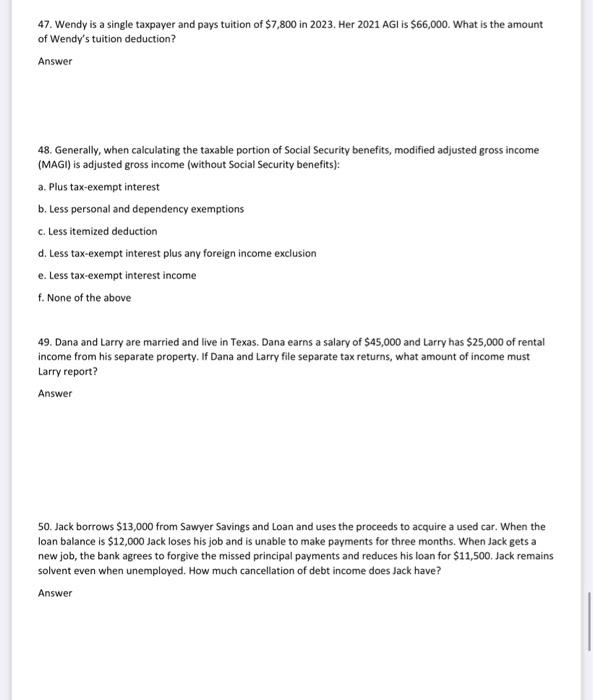

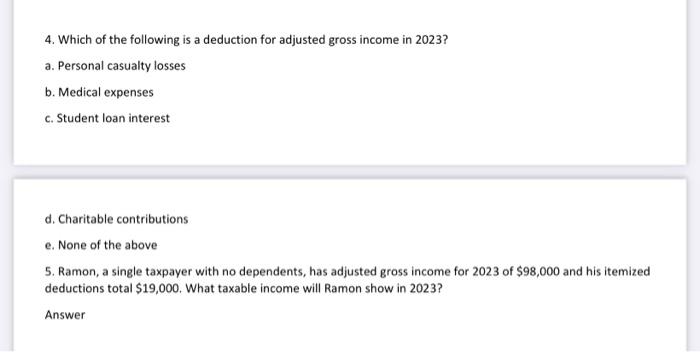

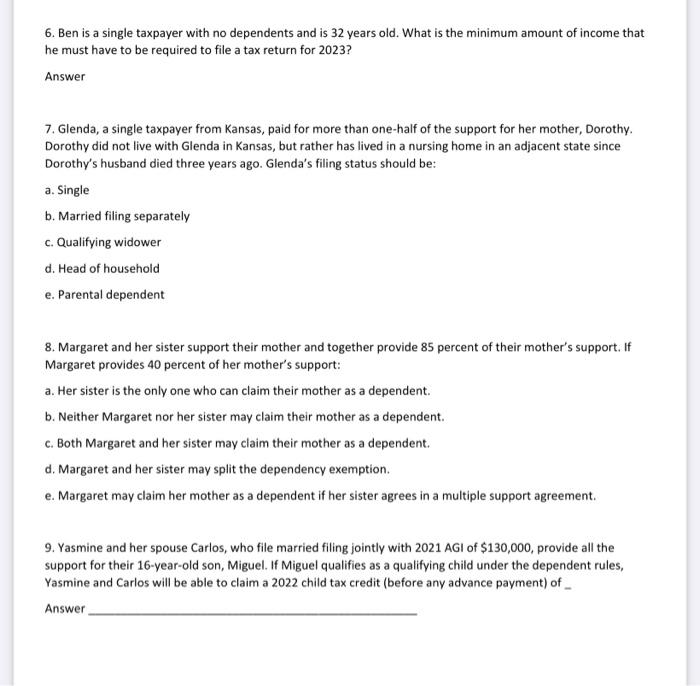

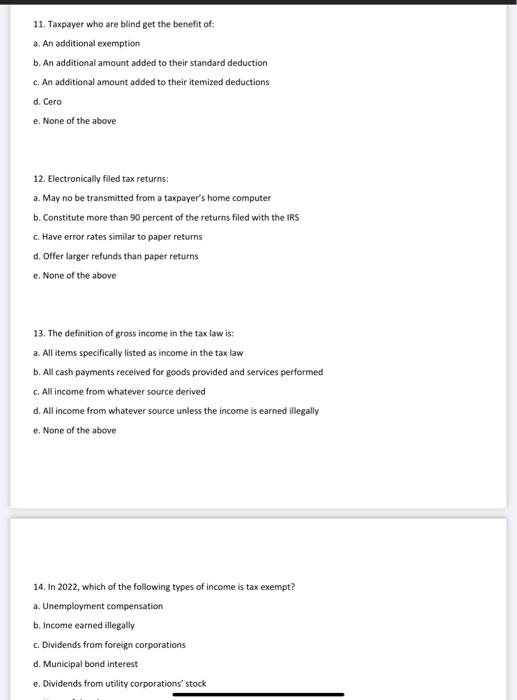

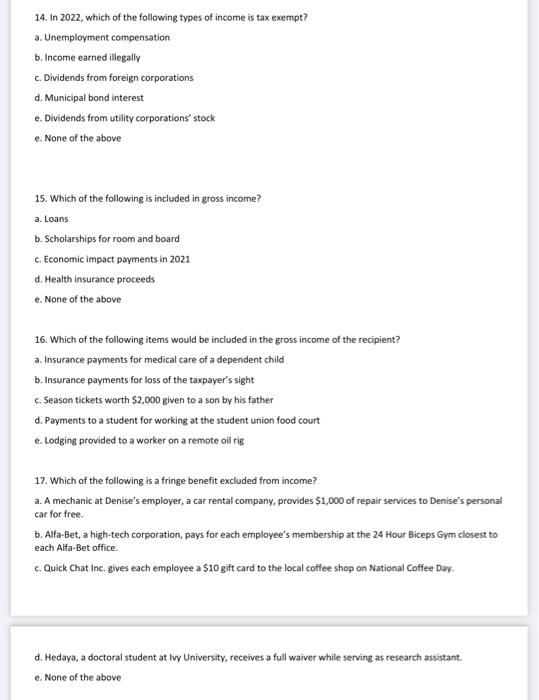

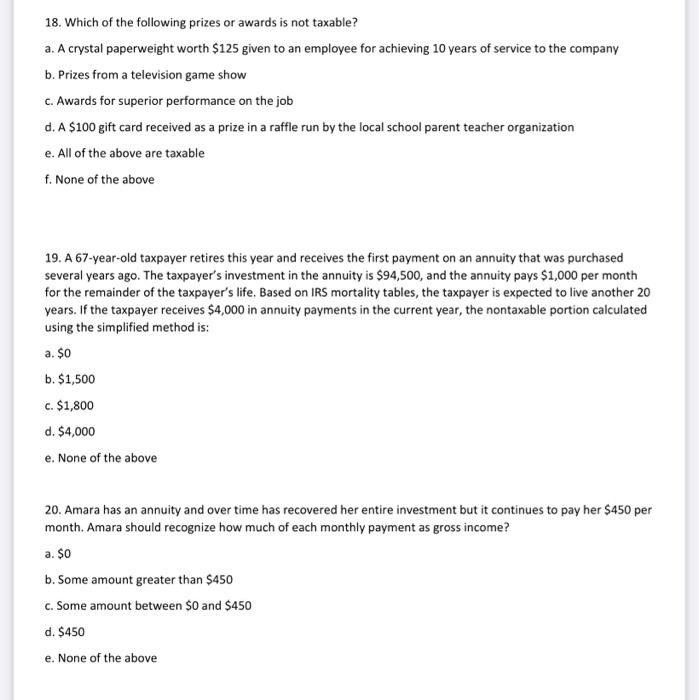

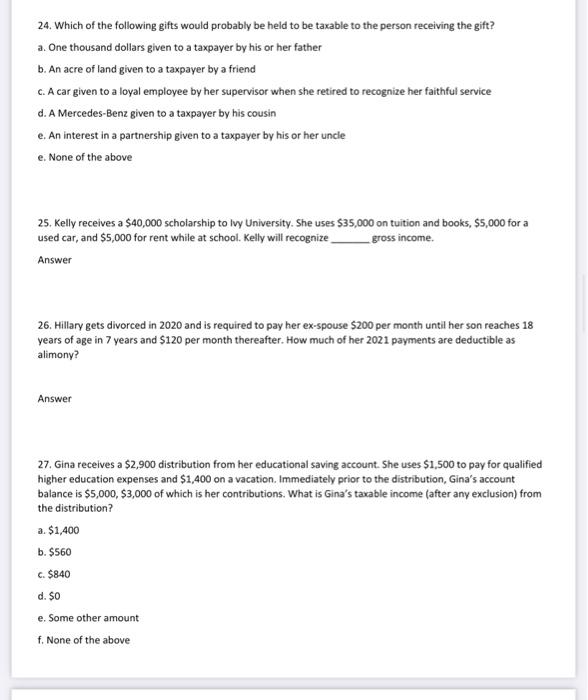

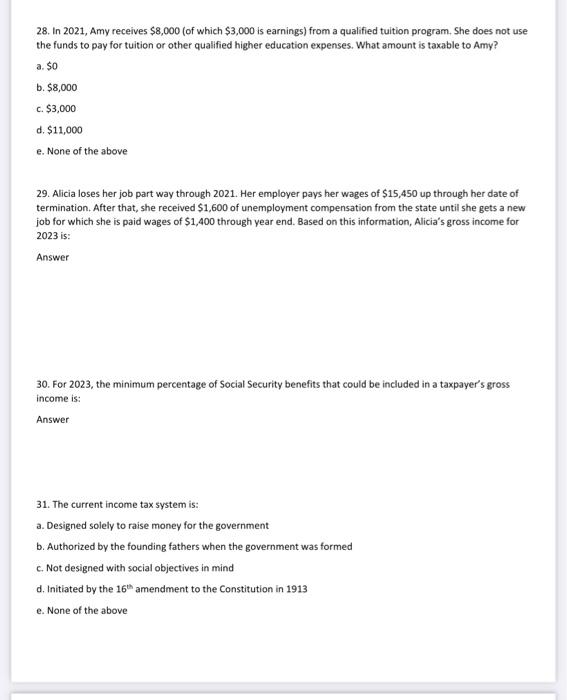

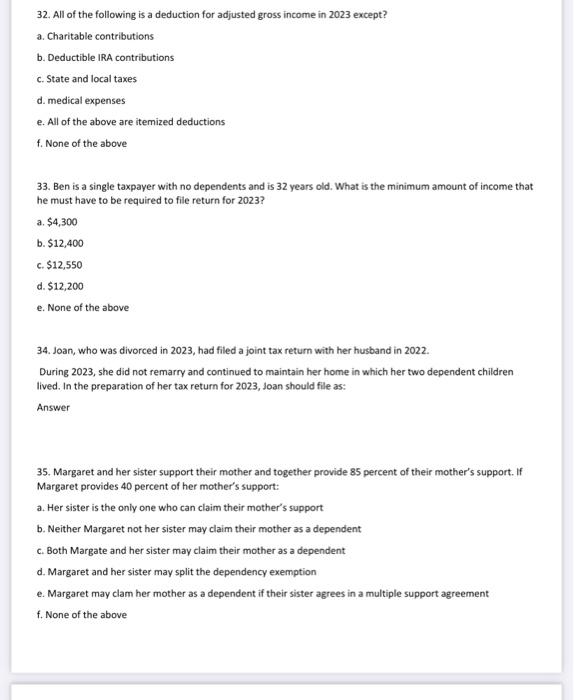

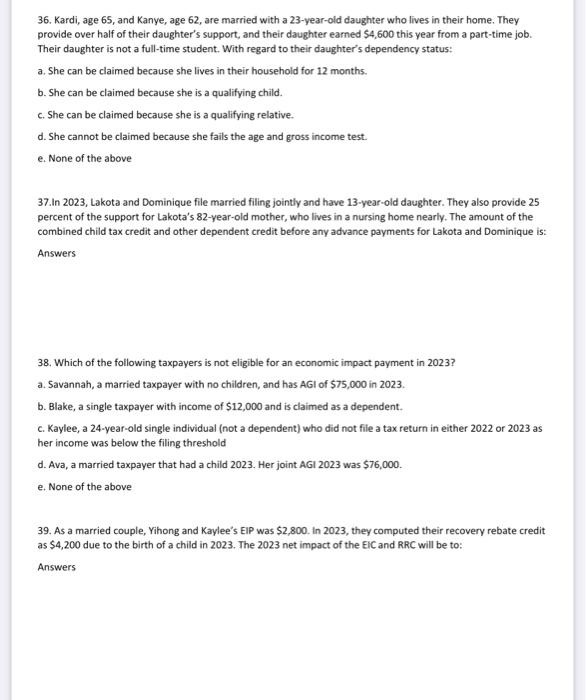

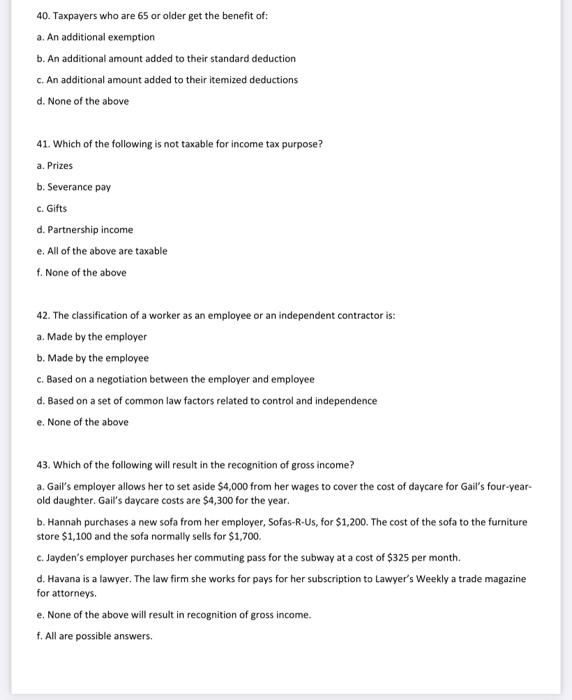

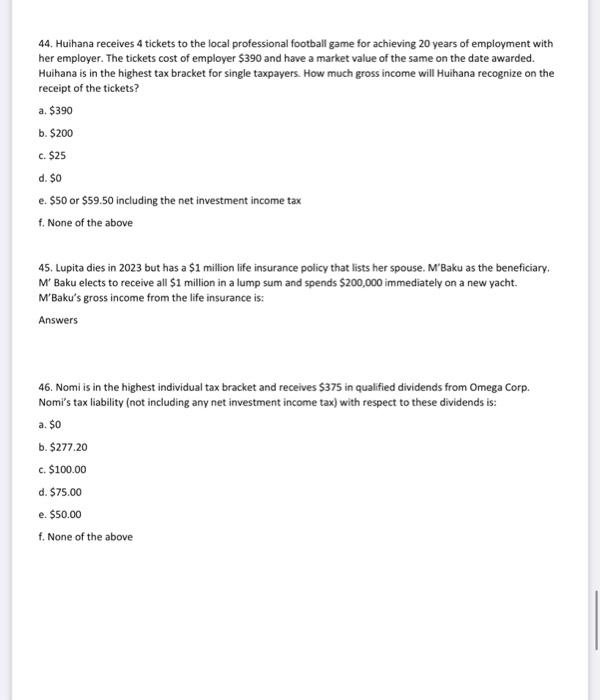

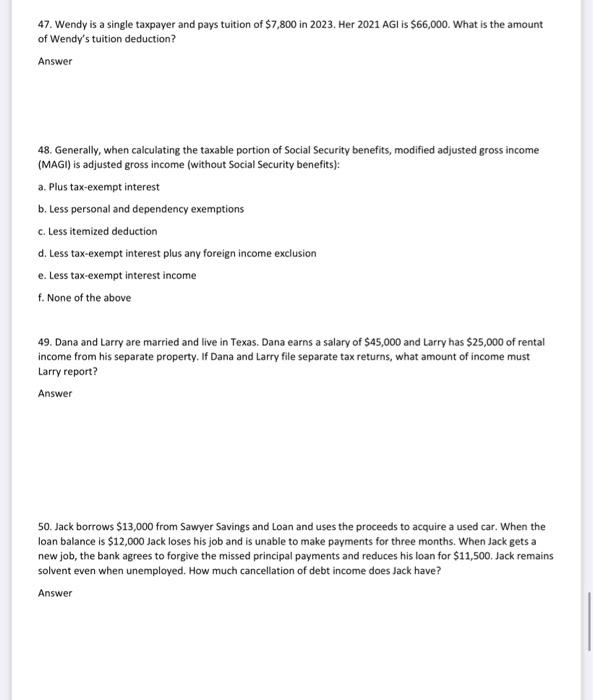

4. Which of the following is a deduction for adjusted gross income in 2023 ? a. Personal casualty losses b. Medical expenses c. Student loan interest d. Charitable contributions e. None of the above 5. Ramon, a single taxpayer with no dependents, has adjusted gross income for 2023 of $98,000 and his itemized deductions total $19,000. What taxable income will Ramon show in 2023 ? Answer 6. Ben is a single taxpayer with no dependents and is 32 years old. What is the minimum amount of income that he must have to be required to file a tax return for 2023 ? Answer 7. Glenda, a single taxpayer from Kansas, paid for more than one-half of the support for her mother, Dorothy. Dorothy did not live with Glenda in Kansas, but rather has lived in a nursing home in an adjacent state since Dorothy's husband died three years ago. Glenda's filing status should be: a. Single b. Married filing separately c. Qualifying widower d. Head of household e. Parental dependent 8. Margaret and her sister support their mother and together provide 85 percent of their mother's support. If Margaret provides 40 percent of her mother's support: a. Her sister is the only one who can claim their mother as a dependent. b. Neither Margaret nor her sister may claim their mother as a dependent. c. Both Margaret and her sister may claim their mother as a dependent. d. Margaret and her sister may split the dependency exemption. e. Margaret may claim her mother as a dependent if her sister agrees in a multiple support agreement. 9. Yasmine and her spouse Carlos, who file married filing jointly with 2021AGI of $130,000, provide all the support for their 16-year-old son, Miguel. If Miguel qualifies as a qualifying child under the dependent rules, Yasmine and Carlos will be able to claim a 2022 child tax credit (before any advance payment) of _ Answi 11. Taxpayer who are blind get the benefit of: a. An additional exemption b. An additional amount added to their standard deduction c. An additional amount added to their itemized deductions d. Cero e. None of the above 12. Electronically filed tax returns: a. May no be transmitted from a taxpayer's home computer b. Constitute more than 90 percent of the returns filed with the IRS c. Have error rates similar to paper returns d. Offer larger refunds than paper returns e. None of the above 13. The definition of gross income in the tax law is: a. All items specifically listed as income in the tax law b. All cash payments received for goods provided and services performed c. All income from whatever source derived d. All income from whatever source unless the income is earned illegally e. None of the above 14. In 2022, which of the following types of income is tax exempt? a. Unemployment compensation b. Income earned illegally c. Dividends from foreign corporations d. Municipal bond interest e. Dividends from utility corporations' stock 14. In 2022, which of the following types of income is tax exempt? a. Unemployment compensation b. Income earned illegally c. Dividends from foreign corporations d. Municipal bond interest e. Dividends from utility corporations' stock e. None of the above 15. Which of the following is included in gross income? a. Loans b. Scholarships for room and board c. Economic impact payments in 2021 d. Heath insurance proceeds e. None of the above 16. Which of the following items would be included in the gross income of the recipient? a. Insurance payments for medical care of a dependent child b. Insurance payments for loss of the taxpayer's sight c. Season tickets worth $2,000 given to a son by his father d. Payments to a student for working at the student union food court e. Lodging provided to a worker on a remote oil rig 17. Which of the following is a fringe benefit excluded from income? a. A mechanic at Denise's employer, a car rental company, provides $1,000 of repair services to Denise's personal car for free. b. Alfa-Bet, a high-tech corporation, pays for each employee's membership at the 24 Hour Biceps Gym closest to each Alfa-Bet office. c. Quick Chat Inc. gives each employee a $10 gift card to the local coffee shop on National Coffee Day. d. Hedaya, a doctoral student at tvy University, receives a full waiver while serving as research assistant. e. None of the above 18. Which of the following prizes or awards is not taxable? a. A crystal paperweight worth $125 given to an employee for achieving 10 years of service to the company b. Prizes from a television game show c. Awards for superior performance on the job d. A $100 gift card received as a prize in a raffle run by the local school parent teacher organization e. All of the above are taxable f. None of the above 19. A 67-year-old taxpayer retires this year and receives the first payment on an annuity that was purchased several years ago. The taxpayer's investment in the annuity is $94,500, and the annuity pays $1,000 per month for the remainder of the taxpayer's life. Based on IRS mortality tables, the taxpayer is expected to live another 20 years. If the taxpayer receives $4,000 in annuity payments in the current year, the nontaxable portion calculated using the simplified method is: a. $0 b. $1,500 c. $1,800 d. $4,000 e. None of the above 20. Amara has an annuity and over time has recovered her entire investment but it continues to pay her $450 per month. Amara should recognize how much of each monthly payment as gross income? a. $0 b. Some amount greater than $450 c. Some amount between $0 and $450 d. $450 e. None of the above 21. Which of the following might result in life insurance proceeds that are taxable to the recipient? a. A life insurance policy in which the insured is the son of the taxpayer and the beneficiary is the taxpayer. b. A life insurance policy transferred by a partner to the partnership c. A life insurance policy transferred to a creditor in payment of the debt d. A life insurance policy purchased by a taxpayer insuring his or her spouse e. A life insurance policy purchased by a corporation insuring an officer e. None of the above 22. Rebecca, a single taxpayer, owns a Series I U.S. Saving Bond that increased in value by $46 during the year. She makes no special election. How much income must Rebecca recognize this year? a. $0 b. $46 c. $23 d. $0 if in first 5 years or $46 thereafter e. None of the above 23. Interest from which of the following types of bonds is included in federal taxable income? a. State of California bond b. City of New Orleans bond c. Bond of the Commonwealth of Puerto Rico d. U.S. Treasury Bond e. All of the above are excluded from income e. None of the above 24. Which of the following gifts would probably be held to be taxable to the person receiving the gift? a. One thousand dollars given to a taxpayer by his or her father b. An acre of land given to a taxpayer by a friend c. A car given to a loyal employee by her supervisor when she retired to recognize her faithful service d. A Mercedes-Benz given to a taxpayer by his cousin e. An interest in a partnership given to a taxpayer by his or her uncle e. None of the above 25. Kelly receives a $40,000 scholarship to Ivy University. She uses $35,000 on tuition and books, $5,000 for a used car, and $5,000 for rent while at school. Kelly will recognize gross income. Answer 26. Hillary gets divorced in 2020 and is required to pay her ex-spouse $200 per month until her son reaches 18 years of age in 7 years and $120 per month thereafter. How much of her 2021 payments are deductible as alimony? Answer 27. Gina receives a $2,900 distribution from her educational saving account. She uses $1,500 to pay for qualified higher education expenses and $1,400 on a vacation. Immediately prior to the distribution, Gina's account balance is $5,000,$3,000 of which is her contributions. What is Gina's taxable income (after any exclusion) from the distribution? a. $1,400 b. $560 c. $840 d. $0 e. Some other amount f. None of the above 28. In 2021, Amy receives $8,000 (of which $3,000 is earnings) from a qualified tuition program, She does not use the funds to pay for tuition or other qualified higher education expenses. What amount is taxable to Amy? a. $0 b. $8,000 c. $3,000 d. $11,000 e. None of the above 29. Alicia loses her job part way through 2021. Her employer pays her wages of $15,450 up through her date of termination. After that, she received $1,600 of unemployment compensation from the state until she gets a new job for which she is paid wages of $1,400 through year end. Based on this information, Alicia's gross income for 2023 is: Answer 30. For 2023, the minimum percentage of Social Security benefits that could be included in a taxpayer's gross income is: Answer 31. The current income tax system is: a. Designed solely to raise money for the government b. Authorized by the founding fathers when the government was formed c. Not designed with social objectives in mind d. Initiated by the 16th amendment to the Constitution in 1913 e. None of the above 32. All of the following is a deduction for adjusted gross income in 2023 except? a. Charitable contributions b. Deductible IRA contributions c. State and local taxes d. medical expenses e. All of the above are itemized deductions f. None of the above 33. Ben is a single taxpayer with no dependents and is 32 years old. What is the minimum amount of income that he must have to be required to file return for 2023 ? a. $4,300 b. $12,400 c. $12,550 d. $12,200 e. None of the above 34. Joan, who was divorced in 2023 , had filed a joint tax return with her husband in 2022. During 2023, she did not remarry and continued to maintain her home in which her two dependent children lived. In the preparation of her tax return for 2023 , Joan should file as: Answer 35. Margaret and her sister support their mother and together provide 85 percent of their mother's support. If Margaret provides 40 percent of her mother's support: a. Her sister is the only one who can claim their mother's support b. Neither Margaret not her sister may claim their mother as a dependent c. Both Margate and her sister may claim their mother as a dependent d. Margaret and her sister may split the dependency exemption e. Margaret may clam her mother as a dependent if their sister agrees in a multiple support agreement f. None of the above 36. Kardi, age 65, and Kanye, age 62 , are married with a 23 -year-old daughter who lives in their home. They provide over half of their daughter's support, and their daughter eamed $4,600 this year from a part-time job. Their daughter is not a full-time student. With regard to their daughter's dependency status: a. She can be claimed because she lives in their household for 12 months. b. She can be claimed because she is a qualifying child. c. She can be claimed because she is a qualifying relative. d. She cannot be claimed because she fails the age and gross income test. e. None of the above 37. In 2023, Lakota and Dominique file married filing jointly and have 13-year-old daughter. They also provide 25 percent of the support for Lakota's 82 -year-old mother, who lives in a nursing home nearly. The amount of the combined child tax credit and other dependent credit before any advance payments for Lakota and Dominique is: Answers 38. Which of the following taxpayers is not eligible for an economic impact payment in 2023 ? a. Savannah, a married taxpayer with no children, and has AGI of \$75,000 in 2023. b. Blake, a single taxpayer with income of $12,000 and is claimed as a dependent. c. Kaylee, a 24-year-old single individual (not a dependent) who did not file a tax return in either 2022 or 2023 as her income was below the filing threshold d. Ava, a married taxpayer that had a child 2023. Her joint AG1 2023 was $76,000. e. None of the above 40. Taxpayers who are 65 or older get the benefit of: a. An additional exemption b. An additional amount added to their standard deduction c. An additional amount added to their itemized deductions d. None of the above 41. Which of the following is not taxable for income tax purpose? a. Prizes b. Severance pay c. Gifts d. Partnership income e. All of the above are taxable f. None of the above 42. The classification of a worker as an employee or an independent contractor is: a. Made by the employer b. Made by the employee c. Based on a negotiation between the employer and employee d. Based on a set of common law factors related to control and independence e. None of the above 43. Which of the following will result in the recognition of gross income? a. Gail's employer allows her to set aside $4,000 from her wages to cover the cost of daycare for Gail's four-yearold daughter. Gail's daycare costs are $4,300 for the year. b. Hannah purchases a new sofa from her employer, Sofas-R-Us, for $1,200. The cost of the sofa to the furniture store $1,100 and the sofa normally sells for $1,700. c. Jayden's employer purchases her commuting pass for the subway at a cost of \$325 per month. d. Havana is a lawyer. The law firm she works for pays for her subscription to Lawyer's Weekly a trade magazine for attorneys. e. None of the above will result in recognition of gross income. f. All are possible answers. 44. Huihana receives 4 tickets to the local professional football game for achieving 20 years of employment with her employer. The tickets cost of employer $390 and have a market value of the same on the date awarded. Huihana is in the highest tax bracket for single taxpayers. How much gross income will Huihana recognize on the receipt of the tickets? a. $390 b. $200 c. $25 d. $0 e. $50 or $59.50 including the net investment income tax f. None of the above 45. Lupita dies in 2023 but has a $1 million life insurance policy that lists her spouse. M Baku as the beneficiary. M Baku elects to receive all $1 million in a lump sum and spends $200,000 immediately on a new yacht. M 'Baku's gross income from the life insurance is: Answers 46. Nomi is in the highest individual tax bracket and receives $375 in qualified dividends from Omega Corp. Nomi's tax liability (not including any net investment income tax) with respect to these dividends is: a. $0 b. $277.20 c. $100.00 d. $75.00 e. $50.00 f. None of the above 47. Wendy is a single taxpayer and pays tuition of $7,800 in 2023. Her 2021AGl is $66,000. What is the amount of Wendy's tuition deduction? Answer 48. Generally, when calculating the taxable portion of Social Security benefits, modified adjusted gross income (MAGI) is adjusted gross income (without Social Security benefits): a. Plus tax-exempt interest b. Less personal and dependency exemptions c. Less itemized deduction d. Less tax-exempt interest plus any foreign income exclusion e. Less tax-exempt interest income f. None of the above 49. Dana and Larry are married and live in Texas. Dana earns a salary of $45,000 and Larry has $25,000 of rental income from his separate property. If Dana and Larry file separate tax returns, what amount of income must Larry report? Answer 50. Jack borrows $13,000 from Sawyer Savings and Loan and uses the proceeds to acquire a used car. When the loan balance is $12,000 Jack loses his job and is unable to make payments for three months. When Jack gets a new job, the bank agrees to forgive the missed principal payments and reduces his loan for $11,500. Jack remains solvent even when unemployed. How much cancellation of debt income does Jack have

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started