Question

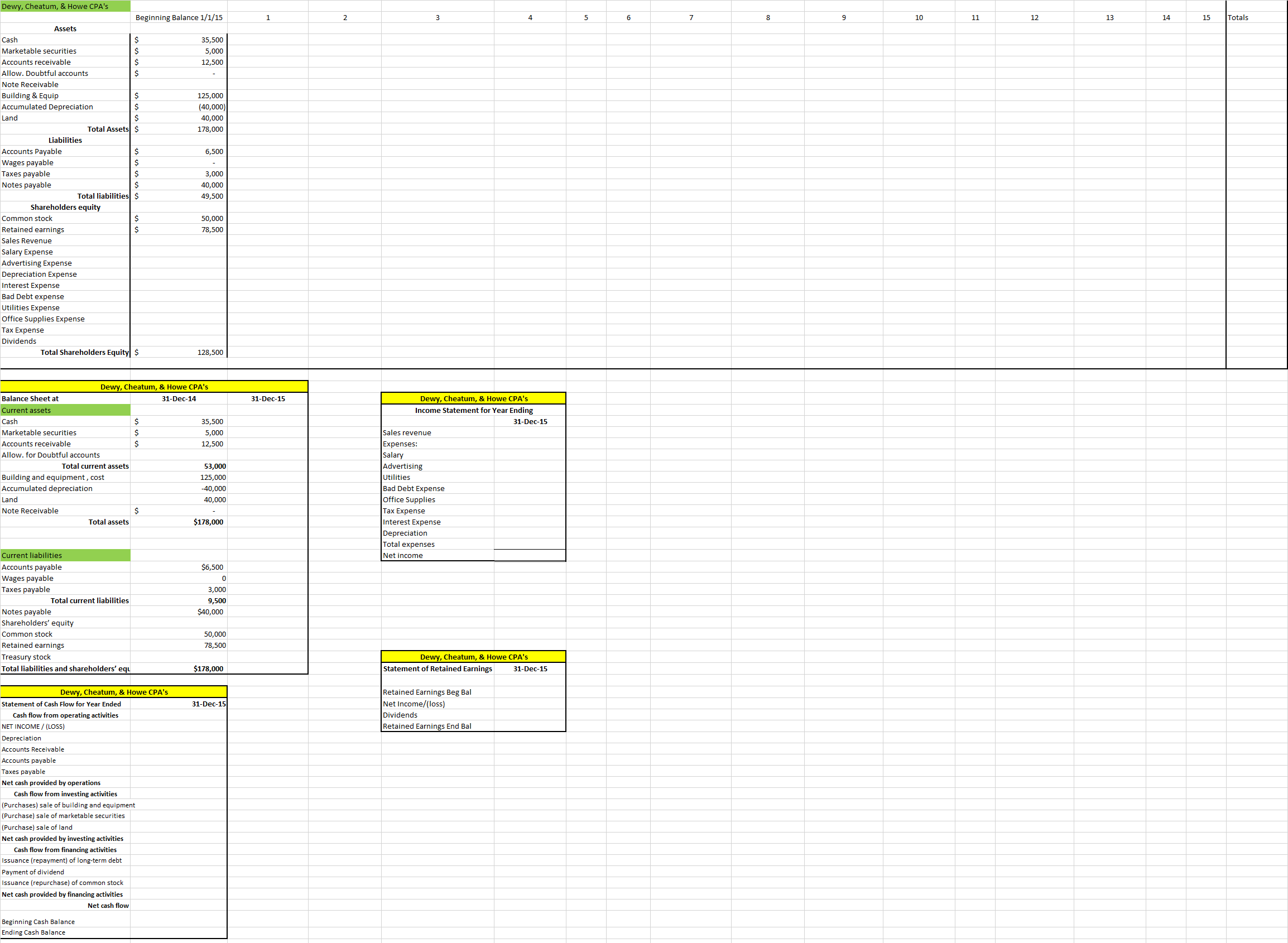

TEST TWO Dewy, Cheatum, & Howe (DC&H) is a CPA firm that had the following business transactions for the year of 2015. Using the provided

TEST TWO Dewy, Cheatum, & Howe (DC&H) is a CPA firm that had the following business transactions for the year of 2015.

Using the provided spreadsheet and Financial Statements, please post the business transactions and then create the four (4) required financial statements for year ending 2015

1.) DC&H borrowed $30,000 from the bank to buy a new building

2.) DC&H billed $140,000 in sales revenue, $40,000 in cash and the balance on account

3.) DC&H bought office supplies for $3,000 on account. (due to immaterial amount the supplies were expensed)

4.) DC&H sold the old building for $25,000 - which equaled the salvage value of the building. The original cost of the building was $40,000

5.) DC&H bought $5,000 in marketable securities

6.) DC&H paid $75,000 for salaries

7.) DC&H paid $20,000 towards the Note Payable, of which $18,000 was applied to the principal and the rest interest.

8.) DC&H collected $105,000 on accounts receivable

9.) DC&H paid $12,000 for advertising

10.) DC&H paid $13,000 in utilities

11.) It was determined that an allowance for doubtful accounts needed to be established and DC&H calculated the first year amount to be $5,000

12.) DC&H sold land for $40,000, receiving $20,000 in cash and a $20,000 promissory note

13.) DC&H received and paid in full a tax bill for $5,000, of which $3,000 was from a prior year.

14.) DC&H recognized and expensed the first year depreciation on the new building using the straight line method. The Building salvage value is $5,000 and depreciates over 5 years. The building was purchased on May 1st

15.) DC&H paid $10,000 in dividends

15.) DC&H paid $10,000 in dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started