Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Texas Instruments is considering the launch of a new calculator, the TI-99, which would have quite a few additional features that they believe students

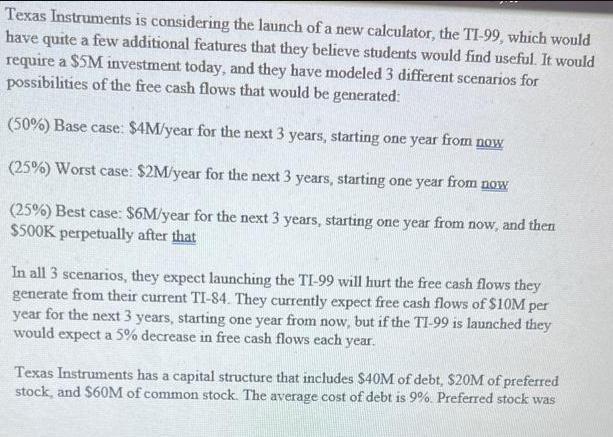

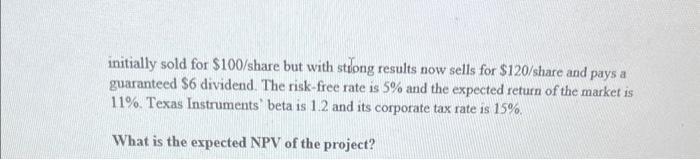

Texas Instruments is considering the launch of a new calculator, the TI-99, which would have quite a few additional features that they believe students would find useful. It would require a $5M investment today, and they have modeled 3 different scenarios for possibilities of the free cash flows that would be generated: (50%) Base case: $4M/year for the next 3 years, starting one year from now (25%) Worst case: $2M/year for the next 3 years, starting one year from now (25%) Best case: $6M/year for the next 3 years, starting one year from now, and then $500K perpetually after that In all 3 scenarios, they expect launching the TI-99 will hurt the free cash flows they generate from their current TI-84. They currently expect free cash flows of $10M per year for the next 3 years, starting one year from now, but if the TI-99 is launched they would expect a 5% decrease in free cash flows each year. Texas Instruments has a capital structure that includes $40M of debt, $20M of preferred stock, and $60M of common stock. The average cost of debt is 9%. Preferred stock was initially sold for $100/share but with strong results now sells for $120/share and pays a guaranteed $6 dividend. The risk-free rate is 5% and the expected return of the market is 11%. Texas Instruments' beta is 1.2 and its corporate tax rate is 15%. What is the expected NPV of the project?

Step by Step Solution

★★★★★

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected NPV of the project we first need to calculate the expected free cash flows of the project in each of the three scenarios and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started