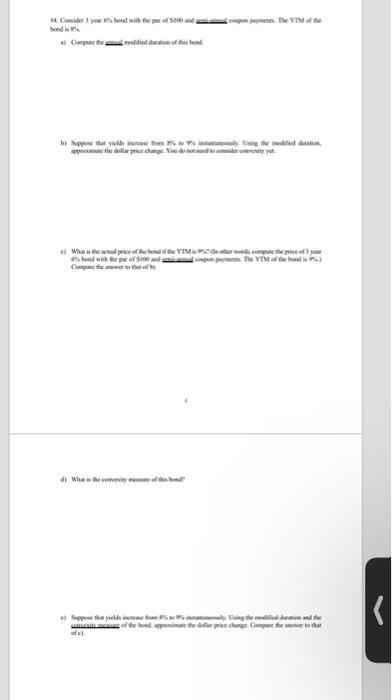

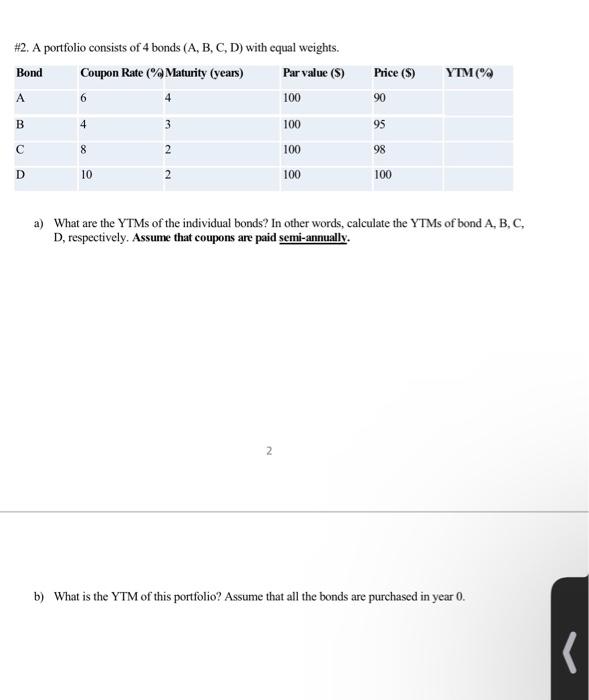

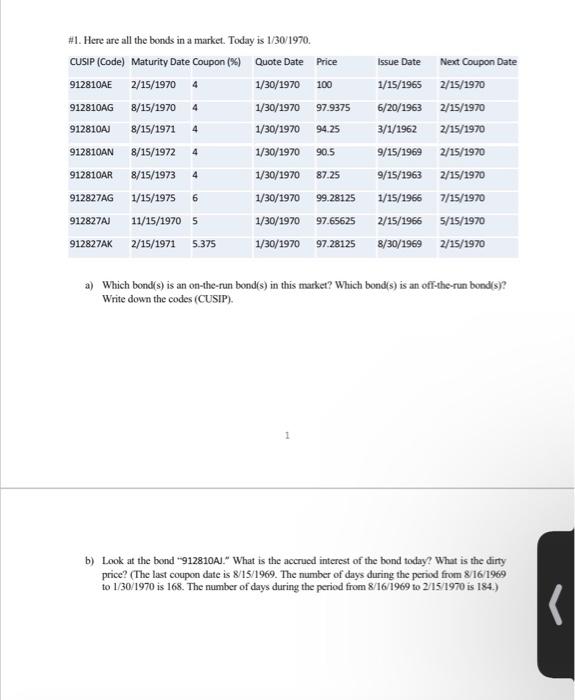

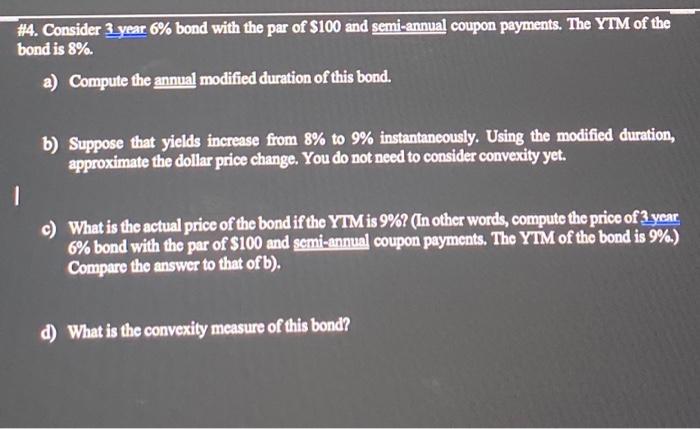

texat is yere 1.)Whatistheastulpreecefelesfort if) Whis it the cinnetily evawet of tast triet? af 4 ! #3. Suppose that we invest in a bond with a 3-year horizon. We consider purchasing a bond with the face value of $1,000, the maturity of 20 years, and the coupon rate of 8%. The bond pays the coupons semiannually. The price of the bond is $907.99 and the YTM is 9%. We expect that we can reinvest the coupon payments at an annual rate of 6%. At the end of the horizon, the 17 -year bond will be selling to offer a YTM of 10%. What is the total return (ROR) of this bond? #2. A portfolio consists of 4 bonds (A, B, C, D) with equal weights. a) What are the YTMs of the individual bonds? In other words, calculate the YTMs of bond A, B, C, D, respectively. Assume that coupons are paid semi-annually. 2 b) What is the YTM of this portfolio? Assume that all the bonds are purchased in year 0 . #1. Here are all the bonds in a market. Today is 1/30/1970. a) Which bond(s) is an on-the-run bond(s) in this market? Which bond(s) is an off-the-run bond(s)? Write down the codes (CUSIP). 1 b) Look at the bond "912810A." What is the accrued interest of the bond today? What is the dirty price? (The last coupon date is 8/15/1969. The number of days during the period from 8/16/1969 to 1/30/1970 is 168 . The number of days during the period from 8/16/1969 to 2/15/1970 is 184 .) H4. Consider 3 year 6% bond with the par of $100 and semi-annual coupon payments. The YTM of the bond is 8%. a) Compute the annual modified duration of this bond. b) Suppose that yields increase from 8% to 9% instantancously. Using the modified duration, approximate the dollar price change. You do not need to consider convexity yet. C) What is the actual price of the bond if the YIM is 9% (In other words, compute the price of 3 year 6% bond with the par of $100 and semieannual coupon payments. The YIM of the bond is 9% ) Compare the answer to that of b). d) What is the convexity measure of this bond? texat is yere 1.)Whatistheastulpreecefelesfort if) Whis it the cinnetily evawet of tast triet? af 4 ! #3. Suppose that we invest in a bond with a 3-year horizon. We consider purchasing a bond with the face value of $1,000, the maturity of 20 years, and the coupon rate of 8%. The bond pays the coupons semiannually. The price of the bond is $907.99 and the YTM is 9%. We expect that we can reinvest the coupon payments at an annual rate of 6%. At the end of the horizon, the 17 -year bond will be selling to offer a YTM of 10%. What is the total return (ROR) of this bond? #2. A portfolio consists of 4 bonds (A, B, C, D) with equal weights. a) What are the YTMs of the individual bonds? In other words, calculate the YTMs of bond A, B, C, D, respectively. Assume that coupons are paid semi-annually. 2 b) What is the YTM of this portfolio? Assume that all the bonds are purchased in year 0 . #1. Here are all the bonds in a market. Today is 1/30/1970. a) Which bond(s) is an on-the-run bond(s) in this market? Which bond(s) is an off-the-run bond(s)? Write down the codes (CUSIP). 1 b) Look at the bond "912810A." What is the accrued interest of the bond today? What is the dirty price? (The last coupon date is 8/15/1969. The number of days during the period from 8/16/1969 to 1/30/1970 is 168 . The number of days during the period from 8/16/1969 to 2/15/1970 is 184 .) H4. Consider 3 year 6% bond with the par of $100 and semi-annual coupon payments. The YTM of the bond is 8%. a) Compute the annual modified duration of this bond. b) Suppose that yields increase from 8% to 9% instantancously. Using the modified duration, approximate the dollar price change. You do not need to consider convexity yet. C) What is the actual price of the bond if the YIM is 9% (In other words, compute the price of 3 year 6% bond with the par of $100 and semieannual coupon payments. The YIM of the bond is 9% ) Compare the answer to that of b). d) What is the convexity measure of this bond