Question

Textflix is a new idea to help reduce college student cost of textbooks. Textflix is a new project to be undertaken by the Netflix Corporation.

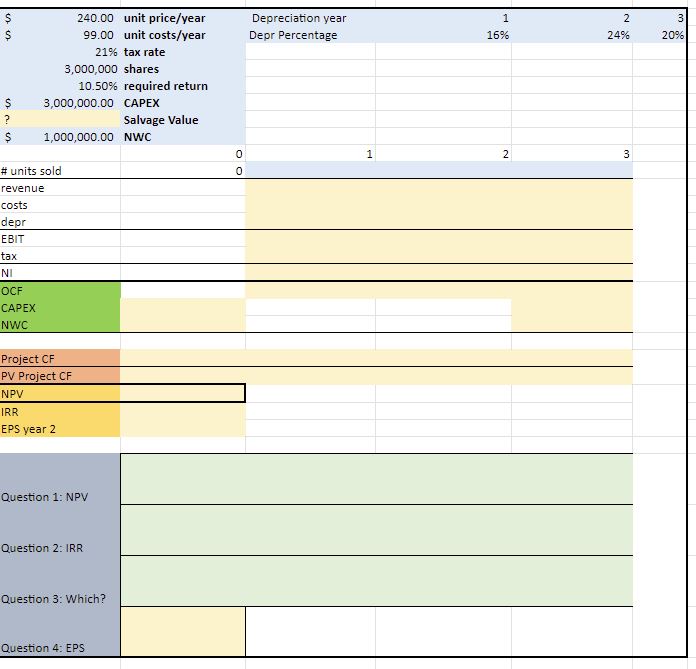

Textflix is a new idea to help reduce college student cost of textbooks. Textflix is a new project to be undertaken by the Netflix Corporation. Textflix will charge $20 per month to have access to a large library of textbooks. It expects to have 8,000 users in first year, 20,000 in second and 150,000 in third. To build out this new project, new infrastructure for space and new tech equipment will cost $3,000,000. The costs of each sale will be approximately $99 per year in licensing fees, maintenance, app space, and all the other good things we should consider. Depreciation will be 16% year 1, 24% year 2 and 20% year 3 and the building and equipment will be sold for 60% of original purchase price in year 3. Tax rate is 21%. Since this is a new project by an existing firm, we will assume this new project matches the overall risk of the current firm, thus we can use the firm's cost of capital directly, which is 10.5% (required rate of return). Net working capital invested for the project will be 1,000,000 today and will be recovered in full at the end of the project. The company has 3,000,000 shares outstanding. 1. Calculate the NPV of the project. Accept or Reject? 2. Calculate the IRR of the project. Accept or reject? 3. If you had to choose one of the two approaches above, which would you choose and why? 4. Utilizing our pro-forma income statements, what is the expected EPS for the firm in year 2 for this scenario.

SS $ 240.00 unit price/year 99.00 unit costs/year 21% tax rate 3,000,000 shares 10.50% required return 3,000,000.00 CAPEX $ ? Salvage Value $ 1,000,000.00 NWC # units sold revenue costs depr EBIT tax NI OCF CAPEX NWC Project CF PV Project CF NPV IRR EPS year 2 Question 1: NPV Question 2: IRR Question 3: Which? Question 4: EPS Depreciation year Depr Percentage 1 2 16% 24% 3 20% 0 1 2 3 0

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV and IRR of the Textflix project and determine whether to accept or reject it well follow these steps 1 Calculate the cash flows for each year of the project 2 Discount the cash fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started