Question

TF 1. In the selling and administrative budget, the non-cash charges (such as depreciation) are added to the total budgeted selling and administrative expenses to

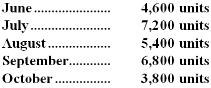

TF 1. In the selling and administrative budget, the non-cash charges (such as depreciation) are added to the total budgeted selling and administrative expenses to determine the expected cash disbursements for selling and administrative expenses. A) True B) False 2. One benefit of budgeting is that it coordinates the activities of the entire organization. One benefit of budgeting is that it coordinates the activities of the entire organization. A) True B) False MC 3. The Gomez Company, a merchandising firm, has budgeted its activity for December according to the following information: Sales at $500,000, all for cash. Merchandise Inventory on November 30 was $250,000. The cash balance at Dece TB 84 The Gomez Company, a merchandising firm, has budgeted its activity for December according to the following information: Sales at $500,000, all for cash. Merchandise Inventory on November 30 was $250,000. The cash balance at December 1 was $20,000. Selling and administrative expenses are budgeted at $50,000 for December and are paid for in cash. Budgeted depreciation for December is $30,000. The planned merchandise inventory on December 31 is $260,000. The cost of goods sold represents 75% of the selling price. All purchases are paid for in cash. The budgeted cash receipts for December are: A) $125,000 B) $375,000 C) $530,000 D) $500,000 4. TB 72 The Yost Company makes and sells a single product, Product A. Each unit of Product A requires 1.2 hours of labor at a labor rate of $8.40 per hour. Yost Company needs to prepare a Direct Labor Budget for the second quarter. The budgeted direct labor cost per unit of Product A is: A) $8.40 B) $7.00 C) $10.08 D) $9.60 5. TB 87 Dengel Inc. is working on its cash budget for November. The budgeted beginning cash balance is $24,000. Budgeted cash receipts total $177,000 and budgeted cash disbursements total $167,000. The desired ending cash balance is $50,000. The excess (deficiency) of cash available over disbursements for November will be: A) $34,000 B) $201,000 C) $10,000 D) $14,000 6. TB 74 Davol Corporation is preparing its Manufacturing Overhead Budget for the fourth quarter of the year. The budgeted variable manufacturing overhead rate is $6.80 per direct labor-hour; the budgeted fixed manufacturing overhead is $72,000 per month, of which $20,000 is factory depreciation. If the budgeted direct labor time for October is 5,000 hours, then the total budgeted manufacturing overhead for October is: A) $52,000 B) $106,000 C) $54,000 D) $86,000 7. TB 63 Young Enterprises has budgeted sales in units for the next five months as follows:  Past experience has shown that the ending inventory for each month should be equal to 10% of the next month's sales in units. The inventory on May 31 fell short of this goal since it contained only 400 units. The company needs to prepare a Production Budget for the next five months. The beginning inventory in units for September should be: A) 460 units B) 6,800 units C) 540 units D) 680 units 8. TB 77 The manufacturing overhead budget at Mahapatra Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 7,900 direct labor-hours will be required in May. The variable overhead rate is $9.50 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $112,970 per month, which includes depreciation of $18,170. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for May should be: A) $14.30 B) $21.50 C) $9.50 D) $23.80 9. TB 89 Deshaies Corporation is preparing its cash budget for November. The budgeted beginning cash balance is $10,000. Budgeted cash receipts total $100,000 and budgeted cash disbursements total $104,000. The desired ending cash balance is $30,000. The excess (deficiency) of cash available over disbursements for November is: A) $110,000 B) $6,000 C) ($4,000) D) $14,000 10. TB 79 Salge Inc. bases its manufacturing overhead budget on budgeted direct labor- hours. The variable overhead rate is $8.10 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. All other fixed manufacturing overhead costs represent current cash flows. The direct labor budget indicates that 5,300 direct labor-hours will be required in September. The September cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: A) $42,930 B) $54,060 C) $96,990 D) $117,660

Past experience has shown that the ending inventory for each month should be equal to 10% of the next month's sales in units. The inventory on May 31 fell short of this goal since it contained only 400 units. The company needs to prepare a Production Budget for the next five months. The beginning inventory in units for September should be: A) 460 units B) 6,800 units C) 540 units D) 680 units 8. TB 77 The manufacturing overhead budget at Mahapatra Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 7,900 direct labor-hours will be required in May. The variable overhead rate is $9.50 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $112,970 per month, which includes depreciation of $18,170. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for May should be: A) $14.30 B) $21.50 C) $9.50 D) $23.80 9. TB 89 Deshaies Corporation is preparing its cash budget for November. The budgeted beginning cash balance is $10,000. Budgeted cash receipts total $100,000 and budgeted cash disbursements total $104,000. The desired ending cash balance is $30,000. The excess (deficiency) of cash available over disbursements for November is: A) $110,000 B) $6,000 C) ($4,000) D) $14,000 10. TB 79 Salge Inc. bases its manufacturing overhead budget on budgeted direct labor- hours. The variable overhead rate is $8.10 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. All other fixed manufacturing overhead costs represent current cash flows. The direct labor budget indicates that 5,300 direct labor-hours will be required in September. The September cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: A) $42,930 B) $54,060 C) $96,990 D) $117,660

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started