Question

TF 1. The book value of a machine, as shown on the balance sheet, is relevant in a decision concerning the replacement of that machine

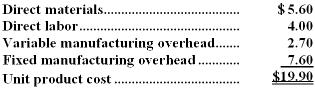

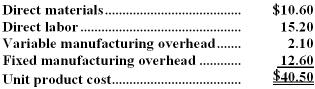

TF 1. The book value of a machine, as shown on the balance sheet, is relevant in a decision concerning the replacement of that machine by another machine. A) True B) False 2. Generally, a product line should be dropped when the fixed costs that can be avoided by dropping the product line are less than the contribution margin that will be lost. A) True B) False MC 3. TB 44 A customer has requested that Inga Corporation fill a special order for 2,000 units of product K81 for $25.00 a unit. While the product would be modified slightly for the special order, product K81's normal unit product cost is $19.90:uploaded imageDirect labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by: A) $13,000 B) $(9,700) C) $10,200 D) $(2,200) 4. TB 81 Ahsan Company makes 60,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:uploaded image An outside supplier has offered to sell the company all of these parts it needs for $45.70 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $318,000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $3.50 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

A) $13,000 B) $(9,700) C) $10,200 D) $(2,200) 4. TB 81 Ahsan Company makes 60,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:uploaded image An outside supplier has offered to sell the company all of these parts it needs for $45.70 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $318,000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $3.50 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products. How much of the unit product cost of $40.50 is relevant in the decision of whether to make or buy the part? A) $40.50 B) $15.20 C) $27.90 D) $37.00 5. TB 64 The Tingey Company has 500 obsolete microcomputers that are carried in inventory at a total cost of $720,000. If these microcomputers are upgraded at a total cost of $100,000, they can be sold for a total of $160,000. As an alternative, the microcomputers can be sold in their present condition for $50,000. The sunk cost in this situation is: A) $720,000 B) $160,000 C) $50,000 D) $100,000 6. TB 120 Resendes Refiners, Inc., processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs $48 to buy from farmers and $16 to crush in the company's plant. Two intermediate products, cane fiber and cane juice, emerge from the crushing process. The cane fiber can be sold as is for $24 or processed further for $17 to make the end product industrial fiber that is sold for $38. The cane juice can be sold as is for $34 or processed further for $23 to make the end product molasses that is sold for $76. How much profit (loss) does the company make by processing the intermediate product cane juice into molasses rather than selling it as is? A) $3 B) $19 C) $(45) D) $(13) 7. TB 53 Coakley Beet Processors, Inc., processes sugar beets in batches. A batch of sugar beets costs $48 to buy from farmers and $10 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $24 or processed further for $16 to make the end product industrial fiber that is sold for $36. The beet juice can be sold as is for $44 or processed further for $28 to make the end product refined sugar that is sold for $70. How much profit (loss) does the company make by processing the intermediate product beet juice into refined sugar rather than selling it as is? A) $(31) B) $(60) C) $(2) D) $(12) 8. TB 35 Product R19N has been considered a drag on profits at Buzzeo Corporation for some time and management is considering discontinuing the product altogether. Data from the company's accounting system appear below:uploaded image

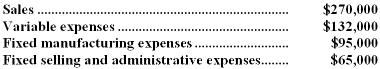

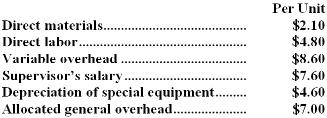

How much of the unit product cost of $40.50 is relevant in the decision of whether to make or buy the part? A) $40.50 B) $15.20 C) $27.90 D) $37.00 5. TB 64 The Tingey Company has 500 obsolete microcomputers that are carried in inventory at a total cost of $720,000. If these microcomputers are upgraded at a total cost of $100,000, they can be sold for a total of $160,000. As an alternative, the microcomputers can be sold in their present condition for $50,000. The sunk cost in this situation is: A) $720,000 B) $160,000 C) $50,000 D) $100,000 6. TB 120 Resendes Refiners, Inc., processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs $48 to buy from farmers and $16 to crush in the company's plant. Two intermediate products, cane fiber and cane juice, emerge from the crushing process. The cane fiber can be sold as is for $24 or processed further for $17 to make the end product industrial fiber that is sold for $38. The cane juice can be sold as is for $34 or processed further for $23 to make the end product molasses that is sold for $76. How much profit (loss) does the company make by processing the intermediate product cane juice into molasses rather than selling it as is? A) $3 B) $19 C) $(45) D) $(13) 7. TB 53 Coakley Beet Processors, Inc., processes sugar beets in batches. A batch of sugar beets costs $48 to buy from farmers and $10 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $24 or processed further for $16 to make the end product industrial fiber that is sold for $36. The beet juice can be sold as is for $44 or processed further for $28 to make the end product refined sugar that is sold for $70. How much profit (loss) does the company make by processing the intermediate product beet juice into refined sugar rather than selling it as is? A) $(31) B) $(60) C) $(2) D) $(12) 8. TB 35 Product R19N has been considered a drag on profits at Buzzeo Corporation for some time and management is considering discontinuing the product altogether. Data from the company's accounting system appear below:uploaded image In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $49,000 of the fixed manufacturing expenses and $30,000 of the fixed selling and administrative expenses are avoidable if product R19N is discontinued. What would be the effect on the company's overall net operating income if product R19N were dropped? A) Overall net operating income would decrease by $59,000. B) Overall net operating income would decrease by $22,000. C) Overall net operating income would increase by $59,000. D) Overall net operating income would increase by $22,000. 9. TB 79 Meltzer Corporation is presently making part O13 that is used in one of its products. A total of 3,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:uploaded image An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $49,000 of the fixed manufacturing expenses and $30,000 of the fixed selling and administrative expenses are avoidable if product R19N is discontinued. What would be the effect on the company's overall net operating income if product R19N were dropped? A) Overall net operating income would decrease by $59,000. B) Overall net operating income would decrease by $22,000. C) Overall net operating income would increase by $59,000. D) Overall net operating income would increase by $22,000. 9. TB 79 Meltzer Corporation is presently making part O13 that is used in one of its products. A total of 3,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:uploaded image An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

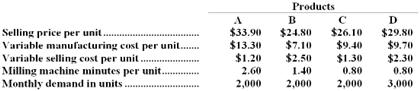

If management decides to buy part O13 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income? A) Net operating income would decline by $23,100 per year. B) Net operating income would decline by $26,100 per year. C) Net operating income would decline by $20,100 per year. D) Net operating income would decline by $8,700 per year. 10. TB 106 Cress Company makes four products in a single facility. Data concerning these products appear below:uploaded image The milling machines are potentially the constraint in the production facility. A total of 11,500 minutes are available per month on these machines. How many minutes of milling machine time would be required to satisfy demand for all four products? A) 12,000 B) 10,800 C) 9,000

The milling machines are potentially the constraint in the production facility. A total of 11,500 minutes are available per month on these machines. How many minutes of milling machine time would be required to satisfy demand for all four products? A) 12,000 B) 10,800 C) 9,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started