Answered step by step

Verified Expert Solution

Question

1 Approved Answer

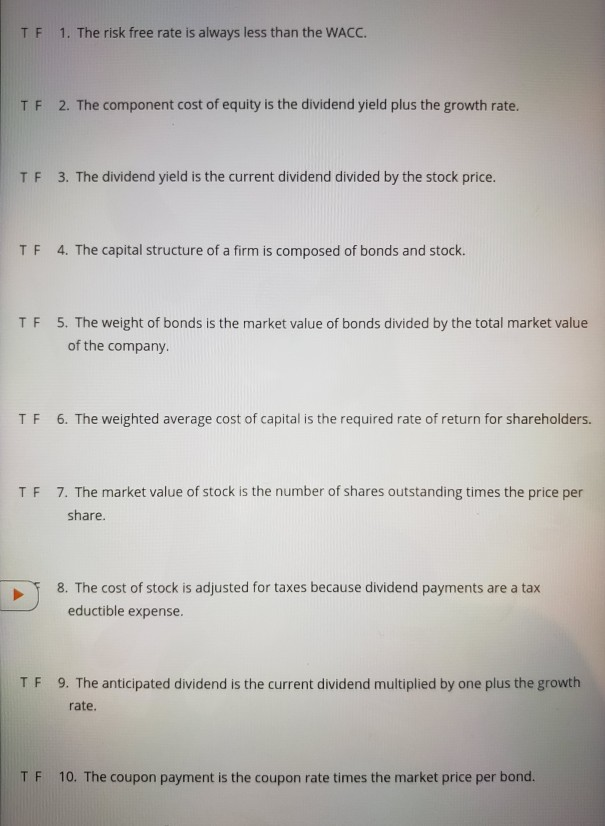

TF 1. The risk free rate is always less than the WACC. TF 2. The component cost of equity is the dividend yield plus the

TF 1. The risk free rate is always less than the WACC. TF 2. The component cost of equity is the dividend yield plus the growth rate. TF 3. The dividend yield is the current dividend divided by the stock price. TF 4. The capital structure of a firm is composed of bonds and stock. TF 5. The weight of bonds is the market value of bonds divided by the total market value of the company. IF 6. The weighted average cost of capital is the required rate of return for shareholders. TF 7. The market value of stock is the number of shares outstanding times the price per share. 8. The cost of stock is adjusted for taxes because dividend payments are a tax eductible expense. TF 9. The anticipated dividend is the current dividend multiplied by one plus the growth rate. TF 10. The coupon payment is the coupon rate times the market price per bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started