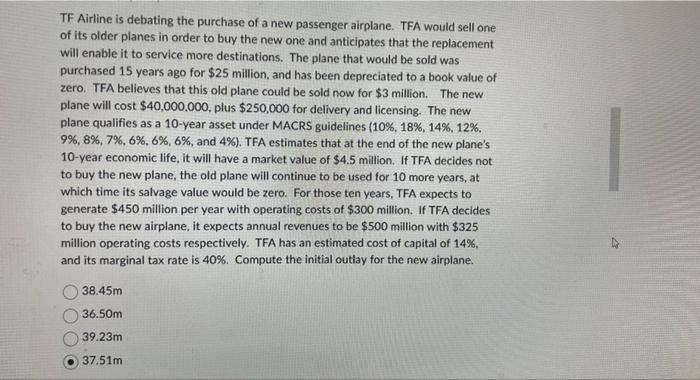

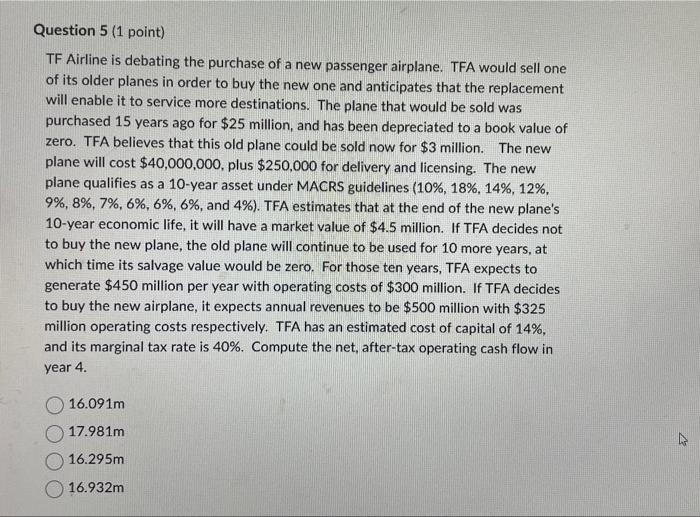

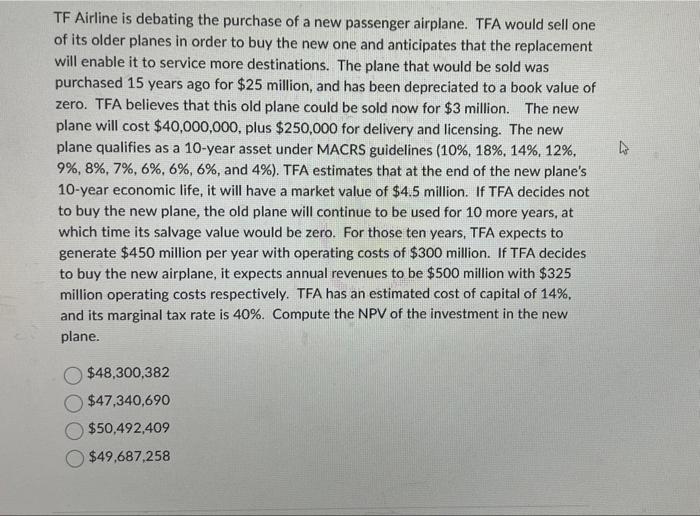

TF Airline is debating the purchase of a new passenger airplane. TFA would sell one of its older planes in order to buy the new one and anticipates that the replacement will enable it to service more destinations. The plane that would be sold was purchased 15 years ago for $25 million, and has been depreciated to a book value of zero. TFA believes that this old plane could be sold now for $3 million. The new plane will cost $40,000,000, plus $250,000 for delivery and licensing. The new plane qualifies as a 10-year asset under MACRS guidelines (10%,18%,14%,12%, 9%,8%,7%,6%,6%,6%, and 4%). TFA estimates that at the end of the new plane's 10 -year economic life, it will have a market value of $4.5 million. If TFA decides not to buy the new plane, the old plane will continue to be used for 10 more years, at which time its salvage value would be zero. For those ten years, TFA expects to generate $450 million per year with operating costs of $300 million. If TFA decides to buy the new airplane, it expects annual revenues to be $500 million with $325 million operating costs respectively. TFA has an estimated cost of capital of 14%. and its marginal tax rate is 40%. Compute the initial outlay for the new airplane. 38.45m 36.50m 39.23m 37.51m TF Airline is debating the purchase of a new passenger airplane. TFA would sell one of its older planes in order to buy the new one and anticipates that the replacement will enable it to service more destinations. The plane that would be sold was purchased 15 years ago for $25 million, and has been depreciated to a book value of zero. TFA believes that this old plane could be sold now for $3 million. The new plane will cost $40,000,000, plus $250,000 for delivery and licensing. The new plane qualifies as a 10-year asset under MACRS guidelines (10%,18%,14%,12%, 9%,8%,7%,6%,6%,6%, and 4%). TFA estimates that at the end of the new plane's 10 -year economic life, it will have a market value of $4.5 million. If TFA decides not to buy the new plane, the old plane will continue to be used for 10 more years, at which time its salvage value would be zero. For those ten years, TFA expects to generate $450 million per year with operating costs of $300 million. If TFA decides to buy the new airplane, it expects annual revenues to be $500 million with $325 million operating costs respectively. TFA has an estimated cost of capital of 14%, and its marginal tax rate is 40%. Compute the net, after-tax operating cash flow in year 4. 16.091m 17.981m 16.295m 16.932m TF Airline is debating the purchase of a new passenger airplane. TFA would sell one of its older planes in order to buy the new one and anticipates that the replacement will enable it to service more destinations. The plane that would be sold was purchased 15 years ago for $25 million, and has been depreciated to a book value of zero. TFA believes that this old plane could be sold now for $3 million. The new plane will cost $40,000,000, plus $250,000 for delivery and licensing. The new plane qualifies as a 10 -year asset under MACRS guidelines (10%,18%,14%,12%, 9%,8%,7%,6%,6%,6%, and 4% ). TFA estimates that at the end of the new plane's 10 -year economic life, it will have a market value of $4.5 million. If TFA decides not to buy the new plane, the old plane will continue to be used for 10 more years, at which time its salvage value would be zero. For those ten years, TFA expects to generate $450 million per year with operating costs of $300 million. If TFA decides to buy the new airplane, it expects annual revenues to be $500 million with $325 million operating costs respectively. TFA has an estimated cost of capital of 14%, and its marginal tax rate is 40%. Compute the NPV of the investment in the new plane. $48,300,382 $47,340,690 $50,492,409 $49,687,258