Answered step by step

Verified Expert Solution

Question

1 Approved Answer

th benefit of its employees. The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices. Budgeted and actual

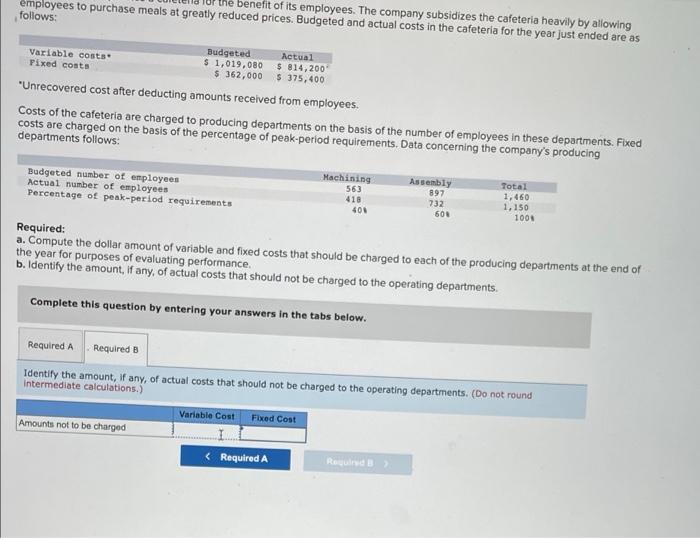

th benefit of its employees. The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices. Budgeted and actual costs in the cafeteria for the year just ended are as follows: Budgeted $ 1,019,080 S 814, 200 $ 362,000 Actual Variable costs Fixed costn $ 375,400 "Unrecovered cost after deducting amounts received from employees. Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows: Budgeted number of enployees Actual number of employees Percentage of peak-period requirements Machining 563 Assembly 897 Total 1,460 1,150 418 732 60 40 100 Required: a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance. b. Identify the amount, if any, of actual costs that should not be charged to the operating departments. Complete this question by entering your answers in the tabs below. Required A Required B Identify the amount, if any, of actual costs that should not be charged to the operating departments. (Do not round Intermediate calculations.) Variable Cost Fixed Cost Amounts not to be charged < Required A Regulred B

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Requirement a Amount to be charged Machining Assembly Variable cost charges Machin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started