Question: Thank u guys:) This is the reference pages but the questions are the last 3 pictures . . . . Craft - Mason Wage rate

Thank u guys:)

This is the reference pages but the questions are the last 3 pictures

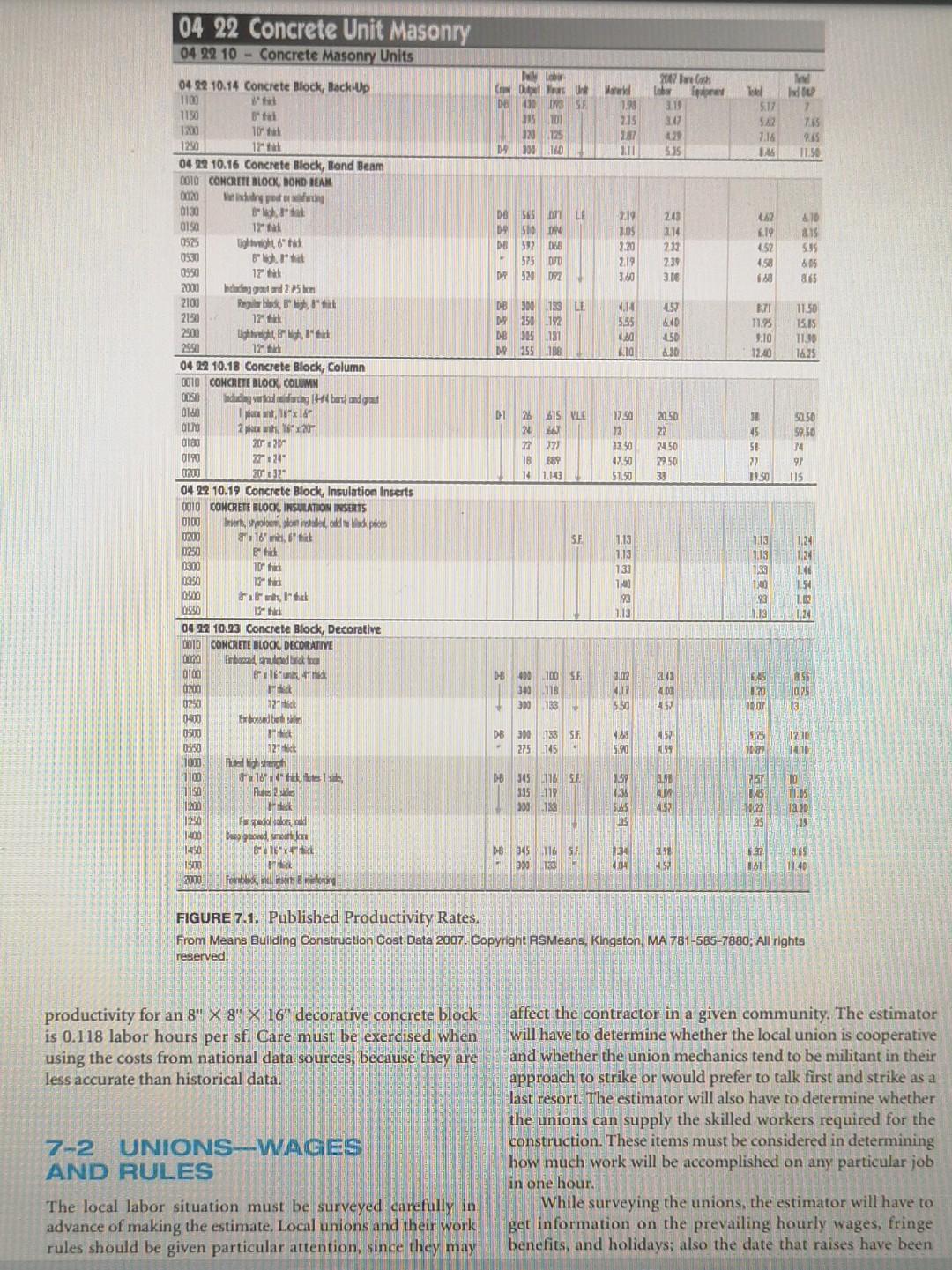

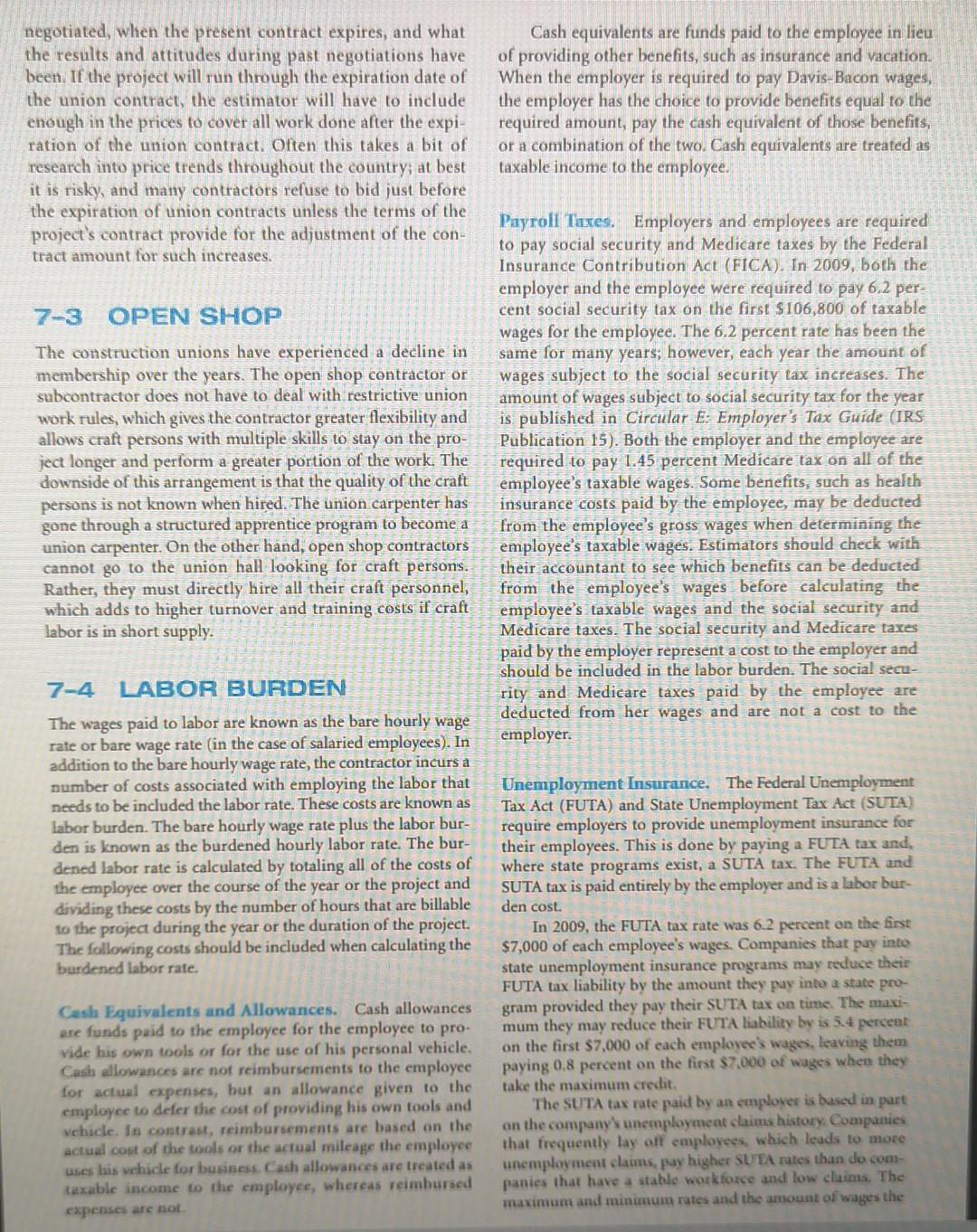

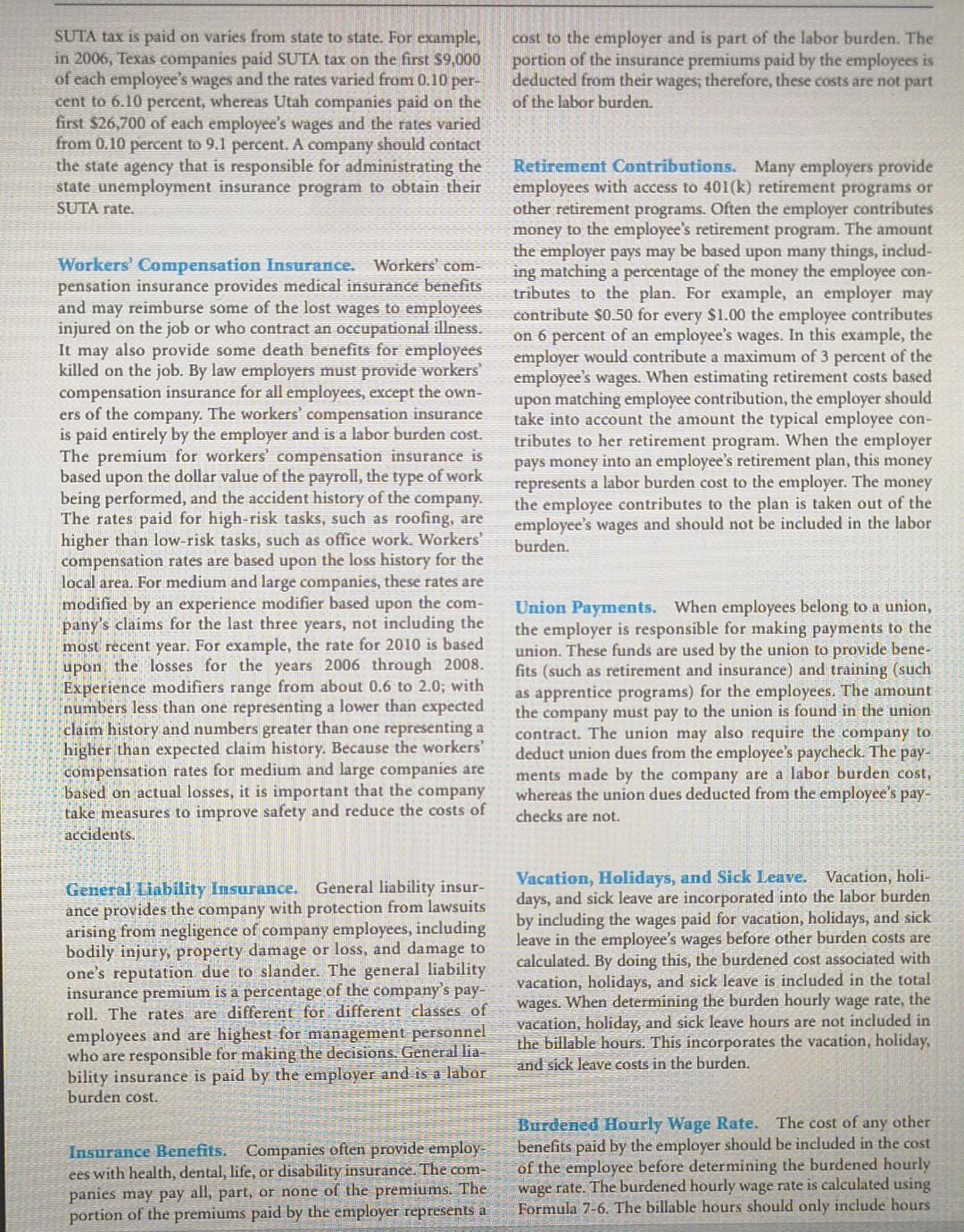

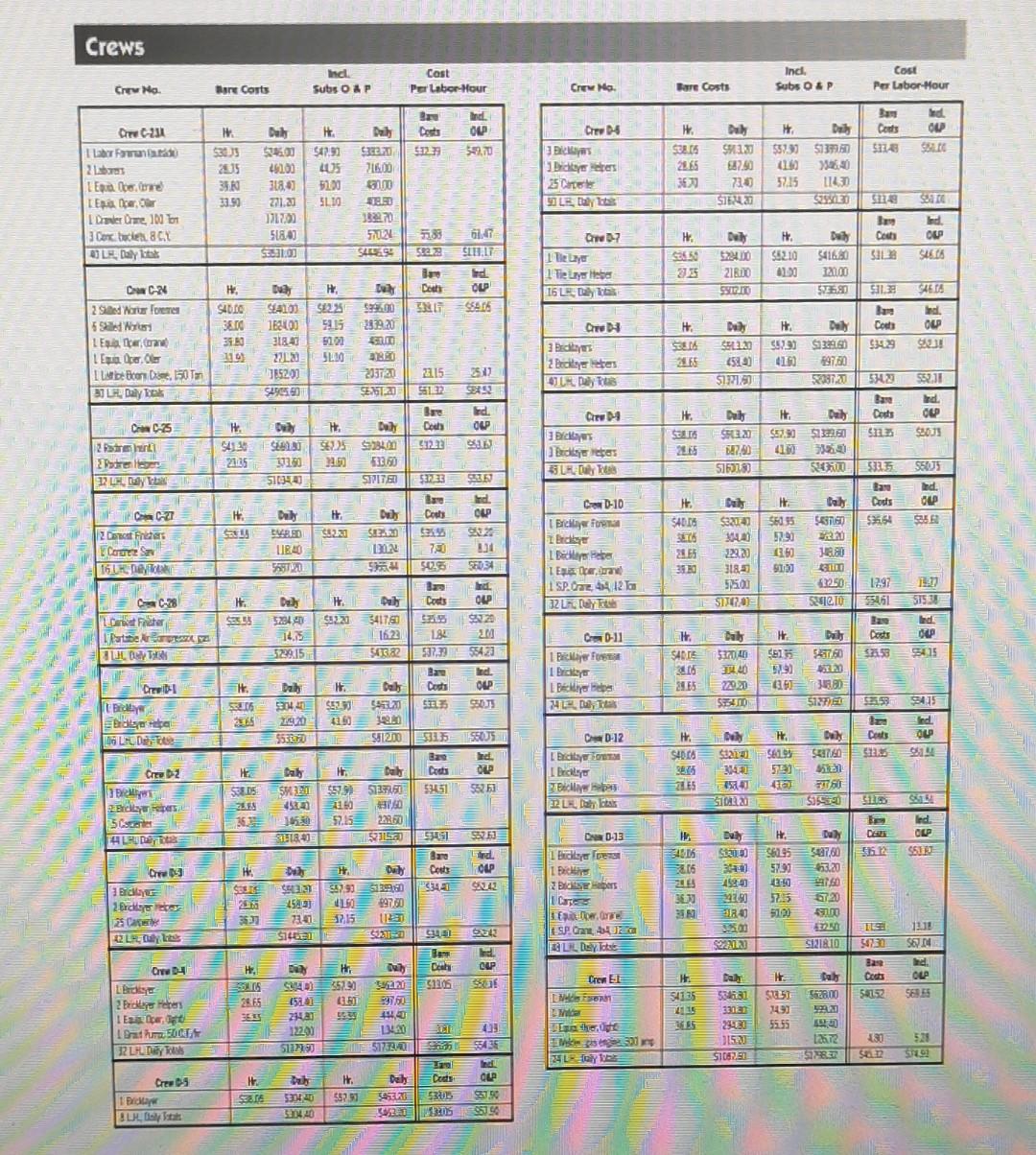

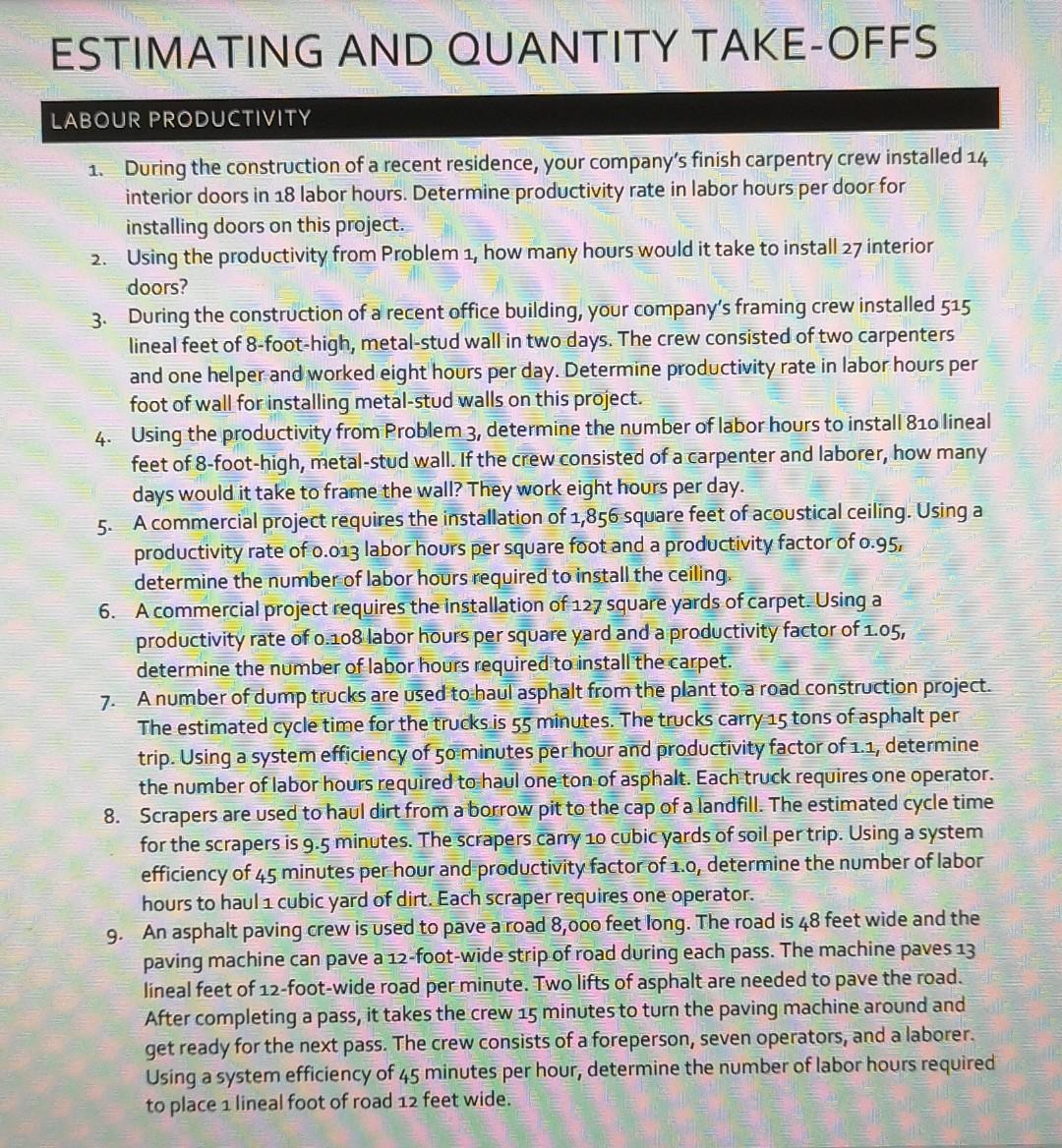

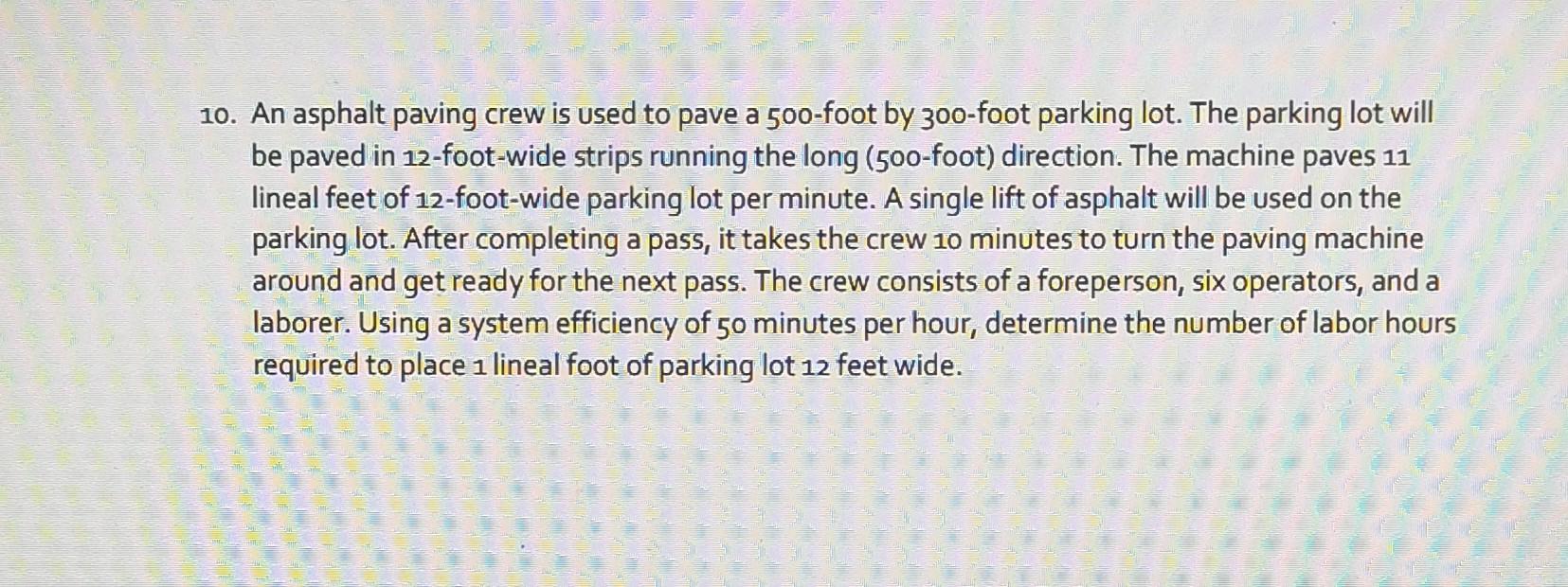

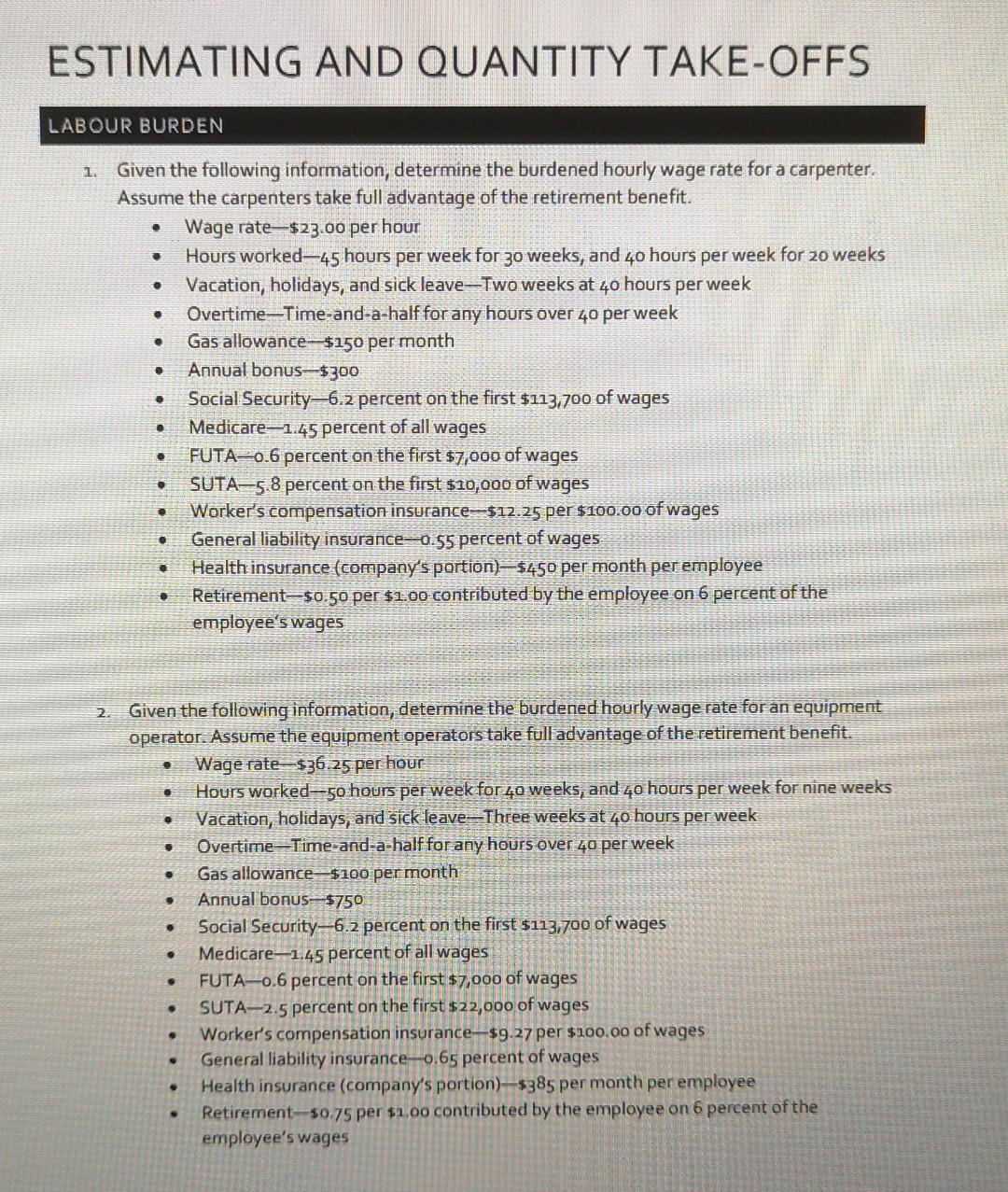

. . . . Craft - Mason Wage rate VET $29.00 Hours worked 50 hours per week for 20 weeks and 40 hours per week for 29 weeks - Paid vacation, holidays, and sick leave Three weeks at 40 hours per week Overtime - Time and a half for any hours over 40 per Gas allowance $100 per month Annual bonus $500 Social security 6.2 percent on the first $106,800 of wages Medicare 1.45 percent of all wages FUTA 0.8 percent on the first $7,000 of wages SUTA = 4.5 percent on the first $18,000 of wages General Liability Insurance - 0.75 percent of wages Health Insurance (company) $300 per month per employee Retirement $0.75 per $1.00 contributed by the employee on 6 percent of the employee's wages - 7-1 LABOR HOURS AND PRODUCTIVITY The basic principles of estimating labor costs are discussed in this chapter; they form a basis for the labor costs, which will be illustrated in each chapter that covers quantity take- off. Estimating labor requires determining the number of labor hours to do a specific task and then applying a wage rate. A labor hour is defined as one worker working for one hour. Determining the labor hours requires knowing the quantity of work to be placed and the productivity rate for the specific crew that will perform the work. The crew is an aggregation of construction trades working on a specific task. The productivity rate is often expressed as a number of labor hours per unit of work, although it may also be expressed as the quantity of work performed by a crew dur- ing a standard eight-hour day. In this book, we will use the number of labor hours per unit of work. The productivity rates can come from a number of sources, but the most reliable source is historical data. The advantage of historical data is that it reflects how a particular company's personnel perform the tasks. The historical pro- ductivity rate is determined by dividing the total number of labor hours to complete a task by the actual quantity of work performed, as shown in Formula 7-1. Productivity rate = Formula 7-1 Labor hours Quantity Productivity Rate For historical data to be useful, the accounting system should not only track the cost to complete a task, but also track the number of labor hours required and the quan- tity of work performed. For example, if a job requires the construction of a concrete slab, it is insufficient to know that the labor to construct the slab cost $5,523. The his- torical data must also tell us that it took 170 labor hours and that 10,000 square feet of slab was constructed. With- out the labor hours or the quantity of work performed, it is impossible to determine a productivity rate from his- torical data. EXAMPLE 7-1 HISTORICAL PRODUCTIVITY RATE Type of work-8" x 8" x 16" Concrete Masonry Units (CMUS) Quantity of work-1,700 square feet Labor cost-$6,987 Labor hours-170 labor hours Productivity rate = 170 labor hours 1,700 sf = 0.1 labor hours per sf Formula 7-2 is used to determine the estimated number of labor hours for a task using the productivity rate. Labor hours = Quantity takeoff X Productivity rate Labor Hours Formula 7-2 The productivity rate that is used, if derived from his- torical data, is for the average or standard conditions for the projects used in calculating the historical production rate. On many occasions, the project that is being bid deviates from these standard conditions. Therefore, the number of labor hours needs to be modified to take into consideration how the project that is being bid deviates from the standard condition. This is done by using a productivity factor. For- mula 7-3 is the mathematical means by which the productiv- ity factor is applied. Adjusted labor hours = Labor hours X Productivity factor Adjusted Labor Hours Formula 7-3 The productivity factor is a combination of several vari- ables or conditions. This is perhaps one of the most compli- cated determinations. There are no hard-and-fast rules concerning productivity factors. The elements of experience 53 54 CHAPTER SEVEN and instinct are perhaps the best quality. When the condi- tions slow the progress of the work, a productivity factor greater than one is used, thus increasing the number of labor hours to complete a unit of work. When the conditions increase the speed at which the work progresses, a produc- tivity factor less than one is used, thus decreasing the num- ber of labor hours to complete a unit of work. Following are some variables that need to be considered when determining the productivity factor. Availability and Productivity of Workers. When there is plenty of work available and workers are scarce, less- trained craft persons are accepted. These less-trained per- sons will require more time or labor hours to complete the required task, and a productivity factor greater than one is used. Conversely, when construction projects are scarce, workers may become motivated, and the contractor can be selective and hire only the most qualified workers. This will result in producing more work per labor hour, and a pro- ductivity factor less than one is used. Climatic Conditions. Cold, hot, winds, rain, snow, and combinations of these all affect the amount of work that can be produced in an hour. Typically, any weather extremes will slow down the work pace and may require additional precautions that add labor hours to the project. The estimator must try to factor in each of these to deter- mine the most cost-effective approach. Can the project be scheduled so that the concrete can be poured before the winter cold sets in? If not, extra time and materials will be necessary to make certain that the concrete does not freeze after it is poured. On the other hand, if the weather is too hot, precautions will need to be taken to ensure that the concrete does not set too quickly, requiring provisions to be in place to keep it damp. Adverse weather conditions, in and of themselves, do not warrant the use of a productiv- ity factor greater than one. The anticipated weather condi- tion must be worse than the average weather condition for the historical data. For example, if the historical data were for concrete poured during the winter months, the histor- ical data already take into account the time it takes to pro- tect concrete against the average winter conditions. However, if the historical data used were for concrete poured during the summer months or all year round, a productivity factor greater than one is used to account for the winter conditions. A productivity factor of less than one would be used when the anticipated weather condi- tions are better than the average weather conditions for the historical data. Working Conditions. The job site working conditions can have a great effect on the rate of work. A project being built in the city with little working space, limited storage space, and difficult delivery situations typically has less 09: work accomplished per labor hour just due to the difficulty of managing the resources. The same may be true of high- rise construction where workers may have to wait for the crane to deliver materials to them, have difficulty moving from floor to floor, and take extra time just to get from where they punch the time clock to where they will be working. Again, a productivity factor of greater than one is used when conditions are worse than average, and a pro- ductivity factor of less than one is used when conditions are better than average. Projects that are far removed from the supply of workers and materials often have similar situations that the estimator must consider. How can material deliveries be made in a timely fashion? Where will the material be stored until needed? Will extra equipment and workers be required to transport the material from the storage area to where it will be installed? Will storage sheds be necessary for material that cannot be left out in the weather? If so, who will be responsible for receiving inventory and mov- ing it to where it will be installed? Worker availability for remote jobs must also be considered. Are workers avail- able, at what costs, and are any special incentives required? Again, a productivity factor of greater than one is used when conditions are worse than average, and a productiv ity factor of less than one is used when conditions are bet- ter than average. Other Considerations. Workers seldom work a full 60 minutes during the hour. Studies of the actual amount of time worked per hour averaged 30 to 50 minutes. This is often referred to as system efficiency. Keep in mind that the time it takes to "start up" in the morning, coffee breaks, trips to the bathroom, a drink of water, discussing the big game or date last night, lunches that start a little early and may end a little late, and clean-up time all tend to shorten the work day. This list of variables is long, but these items must be considered. Again, the productivity factor is based upon the variance from average conditions, not from the ideal. A system efficiency lower than average will require a productivity factor greater than one, and a system efficiency greater than average will require a pro- ductivity factor less than one. Of most importance to the estimator are those items that can be done to make it "con- venient" to work, such as placing restrooms, drinking water, and materials close to the work. This also involves providing adequate, well-maintained equipment; seeing that materials are delivered to the job just before they are needed; answering questions regarding the work to be per- formed in a timely manner; and anything else necessary to ensure that the work can proceed quickly. When keeping historical records for the labor produc- tivity, it is important that a record not only of the produc- tivity rate be kept, but also under what conditions that productivity rate was achieved so that an appropriate pro- ductivity factor can be used. 10 EXAMPLE 7-2 LABOR HOURS Type of work-8" X 8" X 16" Concrete Masonry Units- Decorative Historical productivity rate 0.1 labor hours per sf Productivity factor-1.1 Crew three masons and two helpers Labor hours 1,000 sf x 0.10 labor hours per sf = 100 labor hours Adjusted labor hours = 100 labor hours X 1.1 =110 labor hours Sixty percent (3/5) of the hours will be performed by masons and 40 percent (2/5) will be performed by their helpers. Mason labor hours = 0.60 X 110 labor hours = 66 labor hours: Mason helper labor hours = 0.40 x 110 labor hours = 44 labor hours m Another method of determining the productivity rate is cycle time analysis, which is used when the work is performed in a repeatable cycle. An example of a cycle is a truck hauling earthen materials from the borrow pit to the job site and returning to the borrow pit to make a second trip. Cycle time analysis is used extensively in excavation estimating. Cycle time analysis is performed by timing a number of cycles, ide- ally at least 30. Using the average cycle time (in minutes), the productivity rate is calculated using Formula 7-4. The average cycle time is determined by summing the cycle time and by dividing the sum by the number of observations. The produc- tivity factor is the same as the productivity factor used in Formula 7-3. The crew size is the number of people in the crew and determines the number of labor hours per clock hour. The system efficiency takes into account that workers seldom work a full 60 minutes per hour. Typical system efficiencies range from 30 to 50 minutes per hour. The quantity per cycle is the number of units of work produced by one cycle. Productivity rate Average cycle time X Productivity factor X Crew size System efficiency X Quantity per cycle Productivity Rate Formula 7-4 EXAMPLE 7-3 PRODUCTIVITY RATE USING CYCLE TIME Type of work-Hauling materials from the borrow pit Average cycle time-35 minutes Truck capacity-17 tons Crew-One driver Productivity factor-0.95 System efficiency-45 minutes per hour 35 minutes X 0.95 X 1 Productivity rate= 45 minutes per hour X 17 tons Productivity rate= 0.0435 labor hours per ton When the work is performed linearly (such as paving or striping a road, placing a concrete curb using slip-forming machine, or grading a road), the rate of progress may be used to determine the productivity rate. The productivity rate is calculated using Formula 7-5. The quantity is the quantity of work to be performed; in the case of placing concrete curb, it would be the length (in feet) of the curb to be placed with the slip-forming machine. The rate of progress is the number of units of work that can be performed by the crew each minute when they are performing the work. In the case of placing a concrete curb, the rate of progress would be the number of feet of curb that is placed in one minute. The travel time is the time (in minutes) that the equipment is not working because it is being moved from one section of work to another section of work. In the case of placing the concrete curb, sections of curb will be left out where there is a tight radius or a driveway approach. The travel time would be the time it takes to move the equipment forward through the driveway approaches and sections where the curb is not being placed by the machine. The crew size is the number of people in the crew and determines the number of labor hours per clock hour. The system efficiency takes into account that workers seldom work a full 60 minutes per hour. Typical sys- tem efficiencies range from 30 to 50 minutes per hour. Productivity rate Quantity Rate of progress + Travel time X Crew size System efficiency X Quantity Productivity Rate EXAMPLE 7-4 PRODUCTIVITY RATE USING RATE OF PROGRESS Type of work-Slip forming concrete curb Quantity 2,200 Number of approaches-30 each @ 3 minutes each Number of curves-5 each @5 minutes each Rate of progress-3' per minute Crew One operator and two helpers Productivity factor-0.95 System efficiency 45 minutes per hour Formula 7-50-30 Travel time = 30 X 3 minutes + 5 X 5 minutes = 115 minutes 2,200' + 115 minutes X 3 3 feet per minute Productivity rate= 45 minutes per hour x 2,200" Productivity rate= 0.0257 labor hours per foot When company data are not available, data from published sources can be used. Figure 7.1 shows the productivity and costs for concrete unit masonry from R.S. Means Building Construction Cost Data. From Figure 7.1, we see that the 04 22 Concrete Unit Masonry 04 22 10- Concrete Masonry Units 04 22 10.14 Concrete Block, Back-Up 1100 i' fil 1150 B' fai 1200 10" thick 1290 12 tak 04 22 10.16 Concrete Block, Bond Beam 0010 CONCRETE BLOCK, BOND BEAM 0020 Nid proting 0130 high, 3 2.19 0150 12" f 2.05 0525 lightweight 6 fak 2.20 0530 & ligh. I til 2.19 0550 12 k 3.60 2000 Including grout and 225 bom 2100 4.14 Regular black, Big, 8 12 tk 2150 5.55 2500 Lightweight, B High, B 4.60 2550 12 tick 6.10 04 22 10.18 Concrete Block, Column 0010 CONCRETE BLOCK, COLUMN 0050 educing vertical infarcing 14-44 bars and grat 16x16 0160 17.50 0170 216x20 23 33.50 0180 2020 0190 7224 47.50 0200 20" 32" 51.50 04 22 10.19 Concrete Block, Insulation Inserts 0010 CONCRETE BLOCK, INSULATION INSERTS 0100 Inserts, styrolom, plom installed odd te black pices 0200 16","ick 1.13 1,24 02:50 6 thick 1.13 1.24 0300 10 tick 1.33 1.46 03:50 12 fick 1.40 1.54 0500 th, that 93 1.02 12" thick 1.13 124 04 22 10.23 Concrete Block, Decorative 0010 CONCRETE BLOCK, DECORATIVE 0020 Embedded back fo 0100 616 4 400 100 SF 3.02 341 8.55 0200 343 118 4.17 403 10.75 0250 did 12ck Embossed both sides 300 133 5.50 4.57 13 0400 0500 DB 300 133 S.F. 4.09 457 12.10 hick 12 Mick 0550 275 145 5.90 4.59 14.10 1000 1100 D-B 345 116 SE 3.59 KLAB 101 1150 8164"ticktes 1 se Flusses thick 4.36 AM 11.05 335 119 300 133 1200 SUAS 4.57 13.20 19 1290 Far spadol sales, d las 1400 Deo graoned, uncar 1450 DB 345 116 134 3.98 8.65 816x4ck k 1500 1300 133 4.04 11.40 20.00 Foble, and wing FIGURE 7.1. Published Productivity Rates. From Means Building Construction Cost Data 2007. Copyright RSMeans, Kingston, MA 781-585-7880; All rights reserved. Fluted high strength productivity for an 8" X 8" X 16" decorative concrete block is 0.118 labor hours per sf. Care must be exercised when using the costs from national data sources, because they are less accurate than historical data. 7-2 UNIONS-WAGES AND RULES The local labor situation must be surveyed carefully in advance of making the estimate. Local unions and their work rules should be given particular attention, since they may Daile Lobin Crow Dupe Fears Unt 430 13 SF 35 101 320 125 300 1140 565 001 LE 18 232 & 2*** D-P 500 194 592 068 575 070 520 DRZ 300 133 LE 250 192 D-B 305 131 D-9 255 188 DI 26 615 VLE 663 77 371 18 189 14 1.143 D-B S.E. S.F. Mari 1.99 2.15 2.87 3.11 2007 Bare Cocks 3.19 3.47 4.29 5.35 2.43 3.14 2.32 2.39 3.06 4.57 6.40 4.50 6.30 20.50 22 24.50 28.50 33 Lober Tote 5.17 5.62 7.16 1.46 4.62 6.19 4.52 4.58 6.68 8.71 11.95 9.10 12.40 38 45 58 77 119.50 1.13 1.13 1,33 1340 93 1.13 385 98 58 3 8.20 757 6.37 Tvtal Indep 7 9.65 11.50 610 ais 5.35 605 8.65 11.50 15.85 11.30 16.25 50.50 59.50 34 97 115 affect the contractor in a given community. The estimator will have to determine whether the local union is cooperative and whether the union mechanics tend to be militant in their approach to strike or would prefer to talk first and strike as a last resort. The estimator will also have to determine whether the unions can supply the skilled workers required for the construction. These items must be considered in determining how much work will be accomplished on any particular job in one hour. While surveying the unions, the estimator will have to get information on the prevailing hourly wages, fringe benefits, and holidays; also the date that raises have been negotiated, when the present contract expires, and what the results and attitudes during past negotiations have been. If the project will run through the expiration date of the union contract, the estimator will have to include enough in the prices to cover all work done after the expi- ration of the union contract. Often this takes a bit of research into price trends throughout the country; at best it is risky, and many contractors refuse to bid just before the expiration of union contracts unless the terms of the project's contract provide for the adjustment of the con- tract amount for such increases. 7-3 OPEN SHOP The construction unions have experienced a decline in membership over the years. The open shop contractor or subcontractor does not have to deal with restrictive union work rules, which gives the contractor greater flexibility and allows craft persons with multiple skills to stay on the pro- ject longer and perform a greater portion of the work. The downside of this arrangement is that the quality of the craft persons is not known when hired. The union carpenter has gone through a structured apprentice program to become a union carpenter. On the other hand, open shop contractors cannot go to the union hall looking for craft persons. Rather, they must directly hire all their craft personnel, which adds to higher turnover and training costs if craft labor is in short supply. 7-4 LABOR BURDEN The wages paid to labor are known as the bare hourly wage rate or bare wage rate (in the case of salaried employees). In addition to the bare hourly wage rate, the contractor incurs a number of costs associated with employing the labor that needs to be included the labor rate. These costs are known as labor burden. The bare hourly wage rate plus the labor bur- den is known as the burdened hourly labor rate. The bur- dened labor rate is calculated by totaling all of the costs of the employee over the course of the year or the project and dividing these costs by the number of hours that are billable to the project during the year or the duration of the project. The following costs should be included when calculating the burdened labor rate. Cash Equivalents and Allowances. Cash allowances are funds paid to the employee for the employee to pro- vide his own tools or for the use of his personal vehicle. Cash allowances are not reimbursements to the employee for actual expenses, but an allowance given to the employee to defer the cost of providing his own tools and vehicle. In contrast, reimbursements are based on the actual cost of the tools or the actual mileage the employee uses his vehicle for business. Cash allowances are treated as taxable income to the employee, whereas reimbursed expenses are not. Cash equivalents are funds paid to the employee in lieu of providing other benefits, such as insurance and vacation. When the employer is required to pay Davis-Bacon wages, the employer has the choice to provide benefits equal to the required amount, pay the cash equivalent of those benefits, or a combination of the two. Cash equivalents are treated as taxable income to the employee. Payroll Taxes. Employers and employees are required to pay social security and Medicare taxes by the Federal Insurance Contribution Act (FICA). In 2009, both the employer and the employee were required to pay 6.2 per- cent social security tax on the first $106,800 of taxable wages for the employee. The 6.2 percent rate has been the same for many years; however, each year the amount of wages subject to the social security tax increases. The amount of wages subject to social security tax for the year is published in Circular E mployer's Tax Guide (IRS Publication 15). Both the employer and the employee are required to pay 1.45 percent Medicare tax on all of the employee's taxable wages. Some benefits, such as health insurance costs paid by the employee, may be deducted from the employee's gross wages when determining the employee's taxable wages. Estimators should check with their accountant to see which benefits can be deducted from the employee's wages before calculating the employee's taxable wages and the social security and Medicare taxes. The social security and Medicare taxes paid by the employer represent a cost to the employer and should be included in the labor burden. The social secu- rity and Medicare taxes paid by the employee are deducted from her wages and are not a cost to the employer. Unemployment Insurance. The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) require employers to provide unemployment insurance for their employees. This is done by paying a FUTA tax and, where state programs exist, a SUTA tax. The FUTA and SUTA tax is paid entirely by the employer and is a labor bur- den cost. In 2009, the FUTA tax rate was 6.2 percent on the first $7,000 of each employee's wages. Companies that pay into state unemployment insurance programs may reduce their FUTA tax liability by the amount they pay into a state pro- gram provided they pay their SUTA tax on time. The maxi- mum they may reduce their FUTA liability by is 5.4 percent on the first $7,000 of each employee's wages, leaving them paying 0.8 percent on the first $7,000 of wages when they take the maximum credit. The SUTA tax rate paid by an employer is based in part on the company's unemployment claims history. Companies that frequently lay off employees, which leads to more unemployment claims, pay higher SUTA rates than do com- panies that have a stable workforce and low claims. The maximum and minimum rates and the amount of wages the SUTA tax is paid on varies from state to state. For example, in 2006, Texas companies paid SUTA tax on the first $9,000 of each employee's wages and the rates varied from 0.10 per- cent to 6.10 percent, whereas Utah companies paid on the first $26,700 of each employee's wages and the rates varied from 0.10 percent to 9.1 percent. A company should contact the state agency that is responsible for administrating the state unemployment insurance program to obtain their SUTA rate. Workers' Compensation Insurance. Workers' com- pensation insurance provides medical insurance benefits and may reimburse some of the lost wages to employees injured on the job or who contract an occupational illness. It may also provide some death benefits for employees killed on the job. By law employers must provide workers' compensation insurance for all employees, except the own- ers of the company. The workers' compensation insurance is paid entirely by the employer and is a labor burden cost. The premium for workers' compensation insurance is based upon the dollar value of the payroll, the type of work being performed, and the accident history of the company. The rates paid for high-risk tasks, such as roofing, are higher than low-risk tasks, such as office work. Workers' compensation rates are based upon the loss history for the local area. For medium and large companies, these rates are modified by an experience modifier based upon the com- pany's claims for the last three years, not including the most recent year. For example, the rate for 2010 is based upon the losses for the years 2006 through 2008. Experience modifiers range from about 0.6 to 2.0; with numbers less than one representing a lower than expected claim history and numbers greater than one representing a higher than expected claim history. Because the workers' compensation rates for medium and large companies are based on actual losses, it is important that the company take measures to improve safety and reduce the costs of accidents. General Liability Insurance. General liability insur- ance provides the company with protection from lawsuits arising from negligence of company employees, including bodily injury, property damage or loss, and damage to one's reputation due to slander. The general liability insurance premium is a percentage of the company's pay- roll. The rates are different for different classes of employees and are highest for management personnel who are responsible for making the decisions. General lia- bility insurance is paid by the employer and is a labor burden cost. Insurance Benefits. Companies often provide employ- ees with health, dental, life, or disability insurance. The com- panies may pay all, part, or none of the premiums. The portion of the premiums paid by the employer represents a cost to the employer and is part of the labor burden. The portion of the insurance premiums paid by the employees is deducted from their wages; therefore, these costs are not part of the labor burden. Retirement Contributions. Many employers provide employees with access to 401(k) retirement programs or other retirement programs. Often the employer contributes money to the employee's retirement program. The amount the employer pays may be based upon many things, includ- ing matching a percentage of the money the employee con- tributes to the plan. For example, an employer may contribute $0.50 for every $1.00 the employee contributes on 6 percent of an employee's wages. In this example, the employer would contribute a maximum of 3 percent of the employee's wages. When estimating retirement costs based upon matching employee contribution, the employer should take into account the amount the typical employee con- tributes to her retirement program. When the employer pays money into an employee's retirement plan, this money represents a labor burden cost to the employer. The money the employee contributes to the plan is taken out of the employee's wages and should not be included in the labor burden. Union Payments. When employees belong to a union, the employer is responsible for making payments to the union. These funds are used by the union to provide bene- fits (such as retirement and insurance) and training (such as apprentice programs) for the employees. The amount the company must pay to the union is found in the union contract. The union may also require the company to deduct union dues from the employee's paycheck. The pay- ments made by the company are a labor burden cost, whereas the union dues deducted from the employee's pay- checks are not. Vacation, Holidays, and Sick Leave. Vacation, holi- days, and sick leave are incorporated into the labor burden by including the wages paid for vacation, holidays, and sick leave in the employee's wages before other burden costs are calculated. By doing this, the burdened cost associated with vacation, holidays, and sick leave is included in the total wages. When determining the burden hourly wage rate, the vacation, holiday, and sick leave hours are not included in the billable hours. This incorporates the vacation, holiday, and sick leave costs in the burden. Burdened Hourly Wage Rate. The cost of any other benefits paid by the employer should be included in the cost of the employee before determining the burdened hourly wage rate. The burdened hourly wage rate is calculated using Formula 7-6. The billable hours should only include hours Quantity 3 Craft Mason Helpers 5 FIGURE 7.2. Weighted Average Burdened Wage Rate. 2 Bare Hourly Labor Burdened Hourly Wage Rate Wage Rate Burden 29.00 12.41 41.41 18.00 8.84 26.84 Total Weighted Average Burdened Wage Rate that are billable to a project and should not include vacation, holiday, and sick leave hours. Burdened hourly wage rate= Wages+ Benefits Billable hours Burdened Hourly Wage Rate EXAMPLE 7-5 BURDENED HOURLY WAGE RATE Craft Mason Wage rate-$29.00 per hour Hours worked-50 hours per week for 20 weeks and 40 hours per week for 29 weeks Paid vacation, holidays, and sick leave-Three weeks at 40 hours per week Overtime Time-and-a-half for any hours over 40 per week Gas allowance $100 per month Annual bonus $500 Social security 6.2 percent on the first $106,800 of wages Medicare-1.45 percent of all wages FUTA 0.8 percent on the first $7,000 of wages SUTA 4.5 percent on the first $18,000 of wages Worker's compensation insurance $7.25 per $100.00 of wages General liability insurance 0.75 percent of wages Health insurance (company's portion) $300 per month per employee Retirement $0.75 per $1.00 contributed by the employee on 6 percent of the employee's wages Wages= (40 hours per week X 52 weeks X $29.00/hour) + (10 hour per week X 20 weeks X $29.00/hour X 1.5) + $100 per month X 12 months + $500 Wages = $70,720 Social security = $70,720 X 0.062 = $4,385 Medicare = $70,720 X 0.0145 = $1,025 FUTA $7,000 X 0.008 = $56 SUTA= $18,000 X 0.045 = $810 $7.25 $100 Workers' compensation insurance = $70,720 X General liability insurance Health insurance Formula 7-6 = $5,127 $70,720 X 0,0075 $530 $300/month X 12 months = $3,600 Total Labor Cost/Hour 124.23 53.68 177.91 35.58 The company contributes up to 4.5 percent (75 percent of 6 per- cent) of the employee's wages to the employee's retirement account. Assume that the employees take full advantage of this benefit. Retirement = $70,720 X 0.045 = $3,182 Benefits $4,385+ $1,025 + $56 + $810 + $5,127 + $530 + $3,600 +$3,182 Benefits $18,715 Billable hours 50 hours per week X 20 weeks +40 hours per week X 29 weeks Billable hours = 2,160 hours Burdened hourly wage rate= $70,720+ $18,715 2,160 hours Burdened hourly wage rate= $41.41 per hour 7-5 PRICING LABOR To price labor, first the estimator must estimate the labor hours required to do the work. These labor hours can then be multi- plied by the burdened wage rate to develop the labor costs. However, when the crew is made up of different crafts being paid different wage rates, a weighted average burdened wage rate must be determined. This is done by determining the total cost for the crew for an hour and by dividing that amount by the number of persons on the crew, as shown in Figure 7.2. In Figure 7.1, a D-8 crew was used in the placement of the decora- tive block. Figure 7.3 shows the makeup of the crew, which includes three bricklayers and two bricklayer helpers. Once the average crew wage rate has been found, it can be multiplied by the number of labor hours to deter- mine the labor costs. Formula 7-7 is used to determine the labor costs. Labor cost Adjusted labor hours x Weighted average burdened wage rate Labor Cost Formula 7-7 EXAMPLE 7-6 DETERMINING LABOR COST From Example 7-2, there were 110 labor hours. The labor costs would be the following: Labor cost 110 labor hours x $35.58/hour $3,913.80 Crews Crew No. Crew C-23A 1 Labor Formand 2 Laborers LEqua Oper, Grane L Equia, Oper, Oler 1 Crawler Crane, 100 Ton 3 Conc buckets, 8C.Y 43 LH. Dally Totak Crow C-24 2 Shed Worker Foremen 5 Skilled Worker 1 Equip, per, tran 1 Equin Oper, Oller L Libe Boary Dame, 150 Tan 83 LH, Daly Total 2 Fastra Jenk 2 Rodrien He 32 LH, Day Tela 29 Cren C-27 2 Damont Finishers E Comorene Sarv 16TH DAYTON Crea C-28 Law Fecher 1 Partibie Ar Compres LL DAY TH Bricklayer repe LIF Dabase E Crew D-2 ExicMyers Bricklayer Helpers 5 Cocenter 44 LHUDAYTAXTO Crew 0:3 3 BricMay G 2 Bricklayer rece 25 Carpenter 42 LIFE, Cully Bottic Crew D-4 L. Bricksyer 2 Bricklayer Helpers 1 Emi Oper, Og Brat Pum500/ 32 LH Duity Tos Crew 0-5 1 Brickay BLH, Doly Tatab Crew C-25 LIVE Crew-1 Bare Costs H. 530.35 28.35 39.80 33.50 H $40.00 38.00 39.80 119 M H. 541.30 21:35 H Incl. Cost Subs O & P Per Labor-Hour Bau Ind. Daily OLP Daily Hr. 5346.00 547.91 $382330 537.39 $49,70 46100 4435 716.00 318.40 $1.00 430.00 271.21 51.10 TELED 1717,00 518.40 $3531.00 1832.70 570.24 54846.94 55.83 503. 29 SLEV.17 Ind... Hr. Costs OLP 5296.00 53417 554.15 SE410) 582 25 1624.00 53.15 318.40 2339.20 450.00 271 20 51.00 3820 SITE 23.15 2547 3852.00 $4905.60 233720 SE351.20 551132 584.53 Barve d. Dully Costs OLP 41232 953.63 Hr, $181.80 567.25 $3284.00 373.50 633.50 5103440 $717,60 537.33 CALEJ Bave Daily Costs CAP Hr $82.33 S83520 Dully SACRED 118:40 5687-20 750 130.24 5955 44 54295 560.34 hdl. Daly Hr. Conts 0&P Daily $52.20 3417,60 $35.95 $53.20 16.23 1.84 200 5433.82 537.39 554.23 Bave Incl. Daily Costs CAP Hr. $53.90 5463.20 SEEL35 550.35 41.60 302.20 E $812.00 $33.35 55035 Costs CLP $34,51 55263 Daily 557.90 51339.60 41.60 160 57.15 229.60 $211530 53451 TRUTH Bard Lind Daly Costs CAP $52.42 $57.93 5139960 $34-41 897.60 41.50 57,15 11330 $LATER 53441 69242 Bom Incl. Daily Centy Hr. CUP 357.90 $64120 $1305 5501 29750 454,40 134.30 4.39 E 51734-0 554 36 3-201 Indi Coats C&P 530015 11305963.50 H. CEK BA Hr. 538.06 23365 HE $38.05 2548 36.3 HE SORDE 20665 36:37 Hr 28.65 BERS Hr. $38.06 051825 14.75 529915 Daily 5304 40 779.20 5533 FD SM 391 45340 $141840 Dah $51331 45843 73.47 $144 DWY SMALL) 4581 43.81 234,83 1224) SPE Daily Hr. 557.93 5304 40 53104.40 Daily 53.20 $52.63 FOTO Crew No. Crew D-6 3 Ei Mays 1 Bricklayer Helpers 25 Carperler 50 LB, Dally Tobi Cree D-7 1 Be Layer 1 Tie Layer Helper 16 LH, Daly Totalk Cree D-B 3 Bricklayers 2 Bricklayer Helpers 41 LH, Daly Tas Crew D-9 3 BlicMayes 3 Bricklayer repers 43 LHL Daly Totals CD-10 1 Bricklayer Foreman 1 Bricklayer 1 Bricklayer Helper 1. Equas Oper, Obrane) 1 S.P. Crane, 44, 12 Ton 32 Lin Daly Tits CD-11 1 BicMayer Foreman 1 Bricklayer Bicklayer Helper 24TLEH, DADY TOAMN CD-12 L Bricklayer Foren Bricklayer PT BicMayer Helpers 32 LHL, Daily Ictsis O 0-13 1 Bricklayer Forens 1 Brickliver 2 1 Carpetter 3. Equi: Oper, Grae S.P. Crane, 44, 12 h Brickaer Halpers AG LFL., Dely Totst Crew E-1 Moldes Fe Welder Laun tiver, Orphe Me pas en 300 ap 24 LB Toily Tomis Cost Incl. Subs O & P Bare Costs Per Labor-Hour Inc. CUP Hr. 538.05 28.65 Cents 533-48 $50.00 Daily Hr. Daily $90.3.30 $57.90 $1399.60 687.40 41.60 1346.40 7340 57.15 114.30 $1634.30 $13.49 588.CO Baye Ind. CEP 546.06 Hr. Daily Hr. Duilly Costs 536.50 5204.000 552.10 5416.80 53138 27.25 218.00 41:00 120.00 5502.00 5735.80 $31.39 $46.18 Bave Inc. Costs OLP Hr. $38.06 $34.29 $52.38 Hr. Daily $11.20 557.90 $1399.60 45840 4160 697.50 $1371.60 52087.20 534.23 552.3 Ind. Daily Costs CEP Hr. $38.16 Hr. $57.90 $1399.60 $1135 $80.35 $64.3.20 647,40 51630.80 5343500 533.35 550075 Bare Ind. Hr. Daily Costs CAP Hr. $330-43 563.95 SASTUGO $40.05 $35.64 535.60 3806 28.65 57.90 22.20 348.80 3100 39.80 222.20 43.60 31847 91:00 575.00 $1747,00 432.50 12.97 51210 515.38 Ind Daily Costs LOOP Hr. 58135 $35.58 554.35 Hr. Daly $40.05 $32040 1316 334.40 29.65 5451760 463.20 348.80 $1277.60 229.20 43.60 535400 $35.53 $34.15 find. OLP Hr. $40.06 551.54 Daily Hr. Daily Cests $32140 561.95 5437/60 $11.35 MAXI 57130 415 STDR 20 4151 7377.60 $35590 alm $51.54 led. $17.65 be DERF 415 12 OMP H 4006 16 Dvily 5330140 Hr. $60.95 57.90 Dully 5487,60 $5137 53.20 20165 458:40 43:50 36.33 242090 57.35 57.20 35.83 91:00 450.00 18.40 35.00 63250 51218.10 198 13.38 547.30 S6704 $2230 33 Base Daly Hr. Cah Coots 534581 $31.50 5628.00 54152 Ind OLP 568.65 Hr. 541 35 74135 330.20 1491 36 85 55.55 29520 454,40 125.02 430 $1087.50 $1798.37 541.32 $14.92 ESTIMATING AND QUANTITY TAKE-OFFS LABOUR PRODUCTIVITY 1. During the construction of a recent residence, your company's finish carpentry crew installed 14 interior doors in 18 labor hours. Determine productivity rate in labor hours per door for installing doors on this project. 2. Using the productivity from Problem 1, how many hours would it take to install 27 interior doors? 3. During the construction of a recent office building, your company's framing crew installed 515 lineal feet of 8-foot-high, metal-stud wall in two days. The crew consisted of two carpenters and one helper and worked eight hours per day. Determine productivity rate in labor hours per foot of wall for installing metal-stud walls on this project. 4. Using the productivity from Problem 3, determine the number of labor hours to install 810 lineal laborer, how many feet of 8-foot-high, metal-stud wall. If the crew consisted of a carpenter days would it take to frame the wall? They work eight hours per day. 5. A commercial project requires the installation of 1,856 square feet of acoustical ceiling. Using a productivity rate of 0.013 labor hours per square foot and a productivity factor of 0.95, determine the number of labor hours required to install the ceiling. 6. A commercial project requires the installation of 127 square yards of carpet. Using a productivity rate of 0.108 labor hours per square yard and a productivity factor of 1.05, determine the number of labor hours required to install the carpet. 7. A number of dump trucks are used to haul asphalt from the plant to a road construction project. The estimated cycle time for the trucks is 55 minutes. The trucks carry 15 tons of asphalt per trip. Using a system efficiency of 50 minutes per hour and productivity factor of 1.1, determine the number of labor hours required to haul one ton of asphalt. Each truck requires one operator. 8. Scrapers are used to haul dirt from a borrow pit to the cap of a landfill. The estimated cycle time for the scrapers is 9.5 minutes. The scrapers carry 10 cubic yards of soil per trip. Using a system efficiency of 45 minutes per hour and productivity factor of 1.0, determine the number of labor hours to haul 1 cubic yard of dirt. Each scraper requires one operator. 9. An asphalt paving crew is used to pave a road 8,000 feet long. The road is 48 feet wide and the paving machine can pave a 12-foot-wide strip of road during each pass. The machine paves 13 lineal feet of 12-foot-wide road per minute. Two lifts of asphalt are needed to pave the road. After completing a pass, it takes the crew 15 minutes to turn the paving machine around and get ready for the next pass. The crew consists of a foreperson, seven operators, and a laborer. Using a system efficiency of 45 minutes per hour, determine the number of labor hours required to place 1 lineal foot of road 12 feet wide. 10. An asphalt paving crew is used to pave a 500-foot by 300-foot parking lot. The parking lot will be paved in 12-foot-wide strips running the long (500-foot) direction. The machine paves 11 lineal feet of 12-foot-wide parking lot per minute. A single lift of asphalt will be used on the parking lot. After completing a pass, it takes the crew 10 minutes to turn the paving machine around and get ready for the next pass. The crew consists of a foreperson, six operators, and a laborer. Using a system efficiency of 50 minutes per hour, determine the number of labor hours required to place 1 lineal foot of parking lot 12 feet wide. ESTIMATING AND QUANTITY TAKE-OFFS LABOUR BURDEN 1. Given the following information, determine the burdened hourly wage rate for a carpenter. Assume the carpenters take full advantage of the retirement benefit. Wage rate $23.00 per hour Hours worked-45 hours per week for 30 weeks, and 40 hours per week for 20 weeks Vacation, holidays, and sick leave-Two weeks at 40 hours per week Overtime Time-and-a-half for any hours over 40 per week Gas allowance $150 per month O Annual bonus-$300 C Social Security 6.2 percent on the first $113,700 of wages Medicare-1.45 percent of all wages a FUTA 0.6 percent on the first $7,000 of wages SUTA 5.8 percent on the first $10,000 of wages Worker's compensation insurance $12.25 per $100.00 of wages General liability insurance-0.55 percent of wages Health insurance (company's portion)-$450 per month per employee Retirement $0.50 per $1.00 contributed by the employee on 6 percent of the employee's wages 2. Given the following information, determine the burdened hourly wage rate for an equipment operator. Assume the equipment operators take full advantage of the retirement benefit. Wage rate $36.25 per hour Hours worked-50 hours per week for 40 weeks, and 40 hours per week for nine weeks 9 Vacation, holidays, and sick leave-Three weeks at 40 hours per week Overtime Time-and-a-half for any hours over 40 per week Gas allowance $100 per month Annual bonus $750 Social Security-6.2 percent on the first $113,700 of wages Medicare-1.45 percent of all wages FUTA-0.6 percent on the first $7,000 of wages SUTA-2.5 percent on the first $22,000 of wages Worker's compensation insurance-$9.27 per $100.00 of wages General liability insurance-0.65 percent of wages Health insurance (company's portion)-$385 per month per employee Retirement-$0.75 per $1.00 contributed by the employee on 6 percent of the employee's wages . . . . Craft - Mason Wage rate VET $29.00 Hours worked 50 hours per week for 20 weeks and 40 hours per week for 29 weeks - Paid vacation, holidays, and sick leave Three weeks at 40 hours per week Overtime - Time and a half for any hours over 40 per Gas allowance $100 per month Annual bonus $500 Social security 6.2 percent on the first $106,800 of wages Medicare 1.45 percent of all wages FUTA 0.8 percent on the first $7,000 of wages SUTA = 4.5 percent on the first $18,000 of wages General Liability Insurance - 0.75 percent of wages Health Insurance (company) $300 per month per employee Retirement $0.75 per $1.00 contributed by the employee on 6 percent of the employee's wages - 7-1 LABOR HOURS AND PRODUCTIVITY The basic principles of estimating labor costs are discussed in this chapter; they form a basis for the labor costs, which will be illustrated in each chapter that covers quantity take- off. Estimating labor requires determining the number of labor hours to do a specific task and then applying a wage rate. A labor hour is defined as one worker working for one hour. Determining the labor hours requires knowing the quantity of work to be placed and the productivity rate for the specific crew that will perform the work. The crew is an aggregation of construction trades working on a specific task. The productivity rate is often expressed as a number of labor hours per unit of work, although it may also be expressed as the quantity of work performed by a crew dur- ing a standard eight-hour day. In this book, we will use the number of labor hours per unit of work. The productivity rates can come from a number of sources, but the most reliable source is historical data. The advantage of historical data is that it reflects how a particular company's personnel perform the tasks. The historical pro- ductivity rate is determined by dividing the total number of labor hours to complete a task by the actual quantity of work performed, as shown in Formula 7-1. Productivity rate = Formula 7-1 Labor hours Quantity Productivity Rate For historical data to be useful, the accounting system should not only track the cost to complete a task, but also track the number of labor hours required and the quan- tity of work performed. For example, if a job requires the construction of a concrete slab, it is insufficient to know that the labor to construct the slab cost $5,523. The his- torical data must also tell us that it took 170 labor hours and that 10,000 square feet of slab was constructed. With- out the labor hours or the quantity of work performed, it is impossible to determine a productivity rate from his- torical data. EXAMPLE 7-1 HISTORICAL PRODUCTIVITY RATE Type of work-8" x 8" x 16" Concrete Masonry Units (CMUS) Quantity of work-1,700 square feet Labor cost-$6,987 Labor hours-170 labor hours Productivity rate = 170 labor hours 1,700 sf = 0.1 labor hours per sf Formula 7-2 is used to determine the estimated number of labor hours for a task using the productivity rate. Labor hours = Quantity takeoff X Productivity rate Labor Hours Formula 7-2 The productivity rate that is used, if derived from his- torical data, is for the average or standard conditions for the projects used in calculating the historical production rate. On many occasions, the project that is being bid deviates from these standard conditions. Therefore, the number of labor hours needs to be modified to take into consideration how the project that is being bid deviates from the standard condition. This is done by using a productivity factor. For- mula 7-3 is the mathematical means by which the productiv- ity factor is applied. Adjusted labor hours = Labor hours X Productivity factor Adjusted Labor Hours Formula 7-3 The productivity factor is a combination of several vari- ables or conditions. This is perhaps one of the most compli- cated determinations. There are no hard-and-fast rules concerning productivity factors. The elements of experience 53 54 CHAPTER SEVEN and instinct are perhaps the best quality. When the condi- tions slow the progress of the work, a productivity factor greater than one is used, thus increasing the number of labor hours to complete a unit of work. When the conditions increase the speed at which the work progresses, a produc- tivity factor less than one is used, thus decreasing the num- ber of labor hours to complete a unit of work. Following are some variables that need to be considered when determining the productivity factor. Availability and Productivity of Workers. When there is plenty of work available and workers are scarce, less- trained craft persons are accepted. These less-trained per- sons will require more time or labor hours to complete the required task, and a productivity factor greater than one is used. Conversely, when construction projects are scarce, workers may become motivated, and the contractor can be selective and hire only the most qualified workers. This will result in producing more work per labor hour, and a pro- ductivity factor less than one is used. Climatic Conditions. Cold, hot, winds, rain, snow, and combinations of these all affect the amount of work that can be produced in an hour. Typically, any weather extremes will slow down the work pace and may require additional precautions that add labor hours to the project. The estimator must try to factor in each of these to deter- mine the most cost-effective approach. Can the project be scheduled so that the concrete can be poured before the winter cold sets in? If not, extra time and materials will be necessary to make certain that the concrete does not freeze after it is poured. On the other hand, if the weather is too hot, precautions will need to be taken to ensure that the concrete does not set too quickly, requiring provisions to be in place to keep it damp. Adverse weather conditions, in and of themselves, do not warrant the use of a productiv- ity factor greater than one. The anticipated weather condi- tion must be worse than the average weather condition for the historical data. For example, if the historical data were for concrete poured during the winter months, the histor- ical data already take into account the time it takes to pro- tect concrete against the average winter conditions. However, if the historical data used were for concrete poured during the summer months or all year round, a productivity factor greater than one is used to account for the winter conditions. A productivity factor of less than one would be used when the anticipated weather condi- tions are better than the average weather conditions for the historical data. Working Conditions. The job site working conditions can have a great effect on the rate of work. A project being built in the city with little working space, limited storage space, and difficult delivery situations typically has less 09: work accomplished per labor hour just due to the difficulty of managing the resources. The same may be true of high- rise construction where workers may have to wait for the crane to deliver materials to them, have difficulty moving from floor to floor, and take extra time just to get from where they punch the time clock to where they will be working. Again, a productivity factor of greater than one is used when conditions are worse than average, and a pro- ductivity factor of less than one is used when conditions are better than average. Projects that are far removed from the supply of workers and materials often have similar situations that the estimator must consider. How can material deliveries be made in a timely fashion? Where will the material be stored until needed? Will extra equipment and workers be required to transport the material from the storage area to where it will be installed? Will storage sheds be necessary for material that cannot be left out in the weather? If so, who will be responsible for receiving inventory and mov- ing it to where it will be installed? Worker availability for remote jobs must also be considered. Are workers avail- able, at what costs, and are any special incentives required? Again, a productivity factor of greater than one is used when conditions are worse than average, and a productiv ity factor of less than one is used when conditions are bet- ter than average. Other Considerations. Workers seldom work a full 60 minutes during the hour. Studies of the actual amount of time worked per hour averaged 30 to 50 minutes. This is often referred to as system efficiency. Keep in mind that the time it takes to "start up" in the morning, coffee breaks, trips to the bathroom, a drink of water, discussing the big game or date last night, lunches that start a little early and may end a little late, and clean-up time all tend to shorten the work day. This list of variables is long, but these items must be considered. Again, the productivity factor is based upon the variance from average conditions, not from the ideal. A system efficiency lower than average will require a productivity factor greater than one, and a system efficiency greater than average will require a pro- ductivity factor less than one. Of most importance to the estimator are those items that can be done to make it "con- venient" to work, such as placing restrooms, drinking water, and materials close to the work. This also involves providing adequate, well-maintained equipment; seeing that materials are delivered to the job just before they are needed; answering questions regarding the work to be per- formed in a timely manner; and anything else necessary to ensure that the work can proceed quickly. When keeping historical records for the labor produc- tivity, it is important that a record not only of the produc- tivity rate be kept, but also under what conditions that productivity rate was achieved so that an appropriate pro- ductivity factor can be used. 10 EXAMPLE 7-2 LABOR HOURS Type of work-8" X 8" X 16" Concrete Masonry Units- Decorative Historical productivity rate 0.1 labor hours per sf Productivity factor-1.1 Crew three masons and two helpers Labor hours 1,000 sf x 0.10 labor hours per sf = 100 labor hours Adjusted labor hours = 100 labor hours X 1.1 =110 labor hours Sixty percent (3/5) of the hours will be performed by masons and 40 percent (2/5) will be performed by their helpers. Mason labor hours = 0.60 X 110 labor hours = 66 labor hours: Mason helper labor hours = 0.40 x 110 labor hours = 44 labor hours m Another method of determining the productivity rate is cycle time analysis, which is used when the work is performed in a repeatable cycle. An example of a cycle is a truck hauling earthen materials from the borrow pit to the job site and returning to the borrow pit to make a second trip. Cycle time analysis is used extensively in excavation estimating. Cycle time analysis is performed by timing a number of cycles, ide- ally at least 30. Using the average cycle time (in minutes), the productivity rate is calculated using Formula 7-4. The average cycle time is determined by summing the cycle time and by dividing the sum by the number of observations. The produc- tivity factor is the same as the productivity factor used in Formula 7-3. The crew size is the number of people in the crew and determines the number of labor hours per clock hour. The system efficiency takes into account that workers seldom work a full 60 minutes per hour. Typical system efficiencies range from 30 to 50 minutes per hour. The quantity per cycle is the number of units of work produced by one cycle. Productivity rate Average cycle time X Productivity factor X Crew size System efficiency X Quantity per cycle Productivity Rate Formula 7-4 EXAMPLE 7-3 PRODUCTIVITY RATE USING CYCLE TIME Type of work-Hauling materials from the borrow pit Average cycle time-35 minutes Truck capacity-17 tons Crew-One driver Productivity factor-0.95 System efficiency-45 minutes per hour 35 minutes X 0.95 X 1 Productivity rate= 45 minutes per hour X 17 tons Productivity rate= 0.0435 labor hours per ton When the work is performed linearly (such as paving or striping a road, placing a concrete curb using slip-forming machine, or grading a road), the rate of progress may be used to determine the productivity rate. The productivity rate is calculated using Formula 7-5. The quantity is the quantity of work to be performed; in the case of placing concrete curb, it would be the length (in feet) of the curb to be placed with the slip-forming machine. The rate of progress is the number of units of work that can be performed by the crew each minute when they are performing the work. In the case of placing a concrete curb, the rate of progress would be the number of feet of curb that is placed in one minute. The travel time is the time (in minutes) that the equipment is not working because it is being moved from one section of work to another section of work. In the case of placing the concrete curb, sections of curb will be left out where there is a tight radius or a driveway approach. The travel time would be the time it takes to move the equipment forward through the driveway approaches and sections where the curb is not being placed by the machine. The crew size is the number of people in the crew and determines the number of labor hours per clock hour. The system efficiency takes into account that workers seldom work a full 60 minutes per hour. Typical sys- tem efficiencies range from 30 to 50 minutes per hour. Productivity rate Quantity Rate of progress + Travel time X Crew size System efficiency X Quantity Productivity Rate EXAMPLE 7-4 PRODUCTIVITY RATE USING RATE OF PROGRESS Type of work-Slip forming concrete curb Quantity 2,200 Number of approaches-30 each @ 3 minutes each Number of curves-5 each @5 minutes each Rate of progress-3' per minute Crew One operator and two helpers Productivity factor-0.95 System efficiency 45 minutes per hour Formula 7-50-30 Travel time = 30 X 3 minutes + 5 X 5 minutes = 115 minutes 2,200' + 115 minutes X 3 3 feet per minute Productivity rate= 45 minutes per hour x 2,200" Productivity rate= 0.0257 labor hours per foot When company data are not available, data from published sources can be used. Figure 7.1 shows the productivity and costs for concrete unit masonry from R.S. Means Building Construction Cost Data. From Figure 7.1, we see that the 04 22 Concrete Unit Masonry 04 22 10- Concrete Masonry Units 04 22 10.14 Concrete Block, Back-Up 1100 i' fil 1150 B' fai 1200 10" thick 1290 12 tak 04 22 10.16 Concrete Block, Bond Beam 0010 CONCRETE BLOCK, BOND BEAM 0020 Nid proting 0130 high, 3 2.19 0150 12" f 2.05 0525 lightweight 6 fak 2.20 0530 & ligh. I til 2.19 0550 12 k 3.60 2000 Including grout and 225 bom 2100 4.14 Regular black, Big, 8 12 tk 2150 5.55 2500 Lightweight, B High, B 4.60 2550 12 tick 6.10 04 22 10.18 Concrete Block, Column 0010 CONCRETE BLOCK, COLUMN 0050 educing vertical infarcing 14-44 bars and grat 16x16 0160 17.50 0170 216x20 23 33.50 0180 2020 0190 7224 47.50 0200 20" 32" 51.50 04 22 10.19 Concrete Block, Insulation Inserts 0010 CONCRETE BLOCK, INSULATION INSERTS 0100 Inserts, styrolom, plom installed odd te black pices 0200 16","ick 1.13 1,24 02:50 6 thick 1.13 1.24 0300 10 tick 1.33 1.46 03:50 12 fick 1.40 1.54 0500 th, that 93 1.02 12" thick 1.13 124 04 22 10.23 Concrete Block, Decorative 0010 CONCRETE BLOCK, DECORATIVE 0020 Embedded back fo 0100 616 4 400 100 SF 3.02 341 8.55 0200 343 118 4.17 403 10.75 0250 did 12ck Embossed both sides 300 133 5.50 4.57 13 0400 0500 DB 300 133 S.F. 4.09 457 12.10 hick 12 Mick 0550 275 145 5.90 4.59 14.10 1000 1100 D-B 345 116 SE 3.59 KLAB 101 1150 8164"ticktes 1 se Flusses thick 4.36 AM 11.05 335 119 300 133 1200 SUAS 4.57 13.20 19 1290 Far spadol sales, d las 1400 Deo graoned, uncar 1450 DB 345 116 134 3.98 8.65 816x4ck k 1500 1300 133 4.04 11.40 20.00 Foble, and wing FIGURE 7.1. Published Productivity Rates. From Means Building Construction Cost Data 2007. Copyright RSMeans, Kingston, MA 781-585-7880; All rights reserved. Fluted high strength productivity for an 8" X 8" X 16" decorative concrete block is 0.118 labor hours per sf. Care must be exercised when using the costs from national data sources, because they are less accurate than historical data. 7-2 UNIONS-WAGES AND RULES The local labor situation must be surveyed carefully in advance of making the estimate. Local unions and their work rules should be given particular attention, since they may Daile Lobin Crow Dupe Fears Unt 430 13 SF 35 101 320 125 300 1140 565 001 LE 18 232 & 2*** D-P 500 194 592 068 575 070 520 DRZ 300 133 LE 250 192 D-B 305 131 D-9 255 188 DI 26 615 VLE 663 77 371 18 189 14 1.143 D-B S.E. S.F. Mari 1.99 2.15 2.87 3.11 2007 Bare Cocks 3.19 3.47 4.29 5.35 2.43 3.14 2.32 2.39 3.06 4.57 6.40 4.50 6.30 20.50 22 24.50 28.50 33 Lober Tote 5.17 5.62 7.16 1.46 4.62 6.19 4.52 4.58 6.68 8.71 11.95 9.10 12.40 38 45 58 77 119.50 1.13 1.13 1,33 1340 93 1.13 385 98 58 3 8.20 757 6.37 Tvtal Indep 7 9.65 11.50 610 ais 5.35 605 8.65 11.50 15.85 11.30 16.25 50.50 59.50 34 97 115 affect the contractor in a given community. The estimator will have to determine whether the local union is cooperative and whether the union mechanics tend to be militant in their approach to strike or would prefer to talk first and strike as a last resort. The estimator will also have to determine whether the unions can supply the skilled workers required for the construction. These items must be considered in determining how much work will be accomplished on any particular job in one hour. While surveying the unions, the estimator will have to get information on the prevailing hourly wages, fringe benefits, and holidays; also the date that raises have been negotiated, when the present contract expires, and what the results and attitudes during past negotiations have been. If the project will run through the expiration date of the union contract, the estimator will have to include enough in the prices to cover all work done after the expi- ration of the union contract. Often this takes a bit of research into price trends throughout the country; at best it is risky, and many contractors refuse to bid just before the expiration of union contracts unless the terms of the project's contract provide for the adjustment of the con- tract amount for such increases. 7-3 OPEN SHOP The construction unions have experienced a decline in membership over the years. The open shop contractor or subcontractor does not have to deal with restrictive union work rules, which gives the contractor greater flexibility and allows craft persons with multiple skills to stay on the pro- ject longer and perform a greater portion of the work. The downside of this arrangement is that the quality of the craft persons is not known when hired. The union carpenter has gone through a structured apprentice program to become a union carpenter. On the other hand, open shop contractors cannot go to the union hall looking for craft persons. Rather, they must directly hire all their craft personnel, which adds to higher turnover and training costs if craft labor is in short supply. 7-4 LABOR BURDEN The wages paid to labor are known as the bare hourly wage rate or bare wage rate (in the case of salaried employees). In addition to the bare hourly wage rate, the contractor incurs a number of costs associated with employing the labor that needs to be included the labor rate. These costs are known as labor burden. The bare hourly wage rate plus the labor bur- den is known as the burdened hourly labor rate. The bur- dened labor rate is calculated by totaling all of the costs of the employee over the course of the year or the project and dividing these costs by the number of hours that are billable to the project during the year or the duration of the project. The following costs should be included when calculating the burdened labor rate. Cash Equivalents and Allowances. Cash allowances are funds paid to the employee for the employee to pro- vide his own tools or for the use of his personal vehicle. Cash allowances are not reimbursements to the employee for actual expenses, but an allowance given to the employee to defer the cost of providing his own tools and vehicle. In contrast, reimbursements are based on the actual cost of the tools or the actual mileage the employee uses his vehicle for business. Cash allowances are treated as taxable income to the employee, whereas reimbursed expenses are not. Cash equivalents are funds paid to the employee in lieu of providing other benefits, such as insurance and vacation. When the employer is required to pay Davis-Bacon wages, the employer has the choice to provide benefits equal to the required amount, pay the cash equivalent of those benefits, or a combination of the two. Cash equivalents are treated as taxable income to the employee. Payroll Taxes. Employers and employees are required to pay social security and Medicare tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts