thank u !

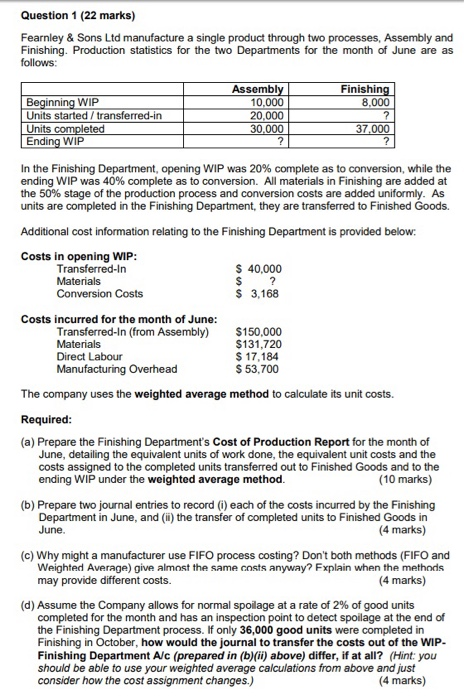

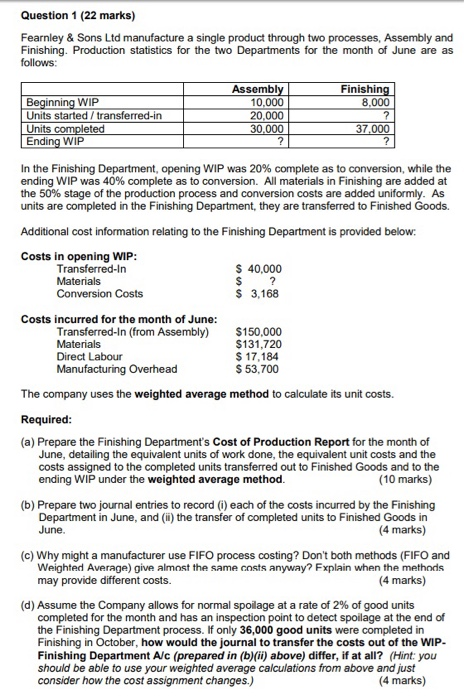

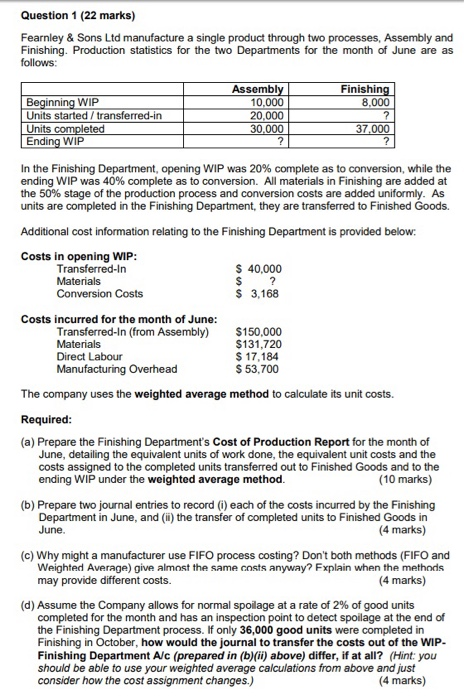

Question 1 (22 marks) Fearnley & Sons Ltd manufacture a single product through two processes, Assembly and Finishing. Production statistics for the two Departments for the month of June are as follows: Assembl Finishin inning WIP 10,000 20,000 30.000 8,000 Units started/ transferred-in ted WIP In the Finishing Department, opening WIP was 20% complete as to conversion, while the ending WIP was 40% complete as to conversion. All materials in Finishing are added at the 50% stage of the production process and conversion costs are added uniformly. As units are completed in the Finishing Department, they are transferred to Finished Goods. Additional cost information relating to the Finishing Department is provided below: Costs in opening WIP S 40,000 Transferred-In Materials Conversion Costs s 3,168 Costs incurred for the month of June: Transferred-In (from Assembly) $150,000 $131,720 S 17,184 S 53.700 Direct Labour The company uses the weighted average method to calculate its unit costs. Required: (a) Prepare the Finishing Department's Cost of Production Report for the month of June, detailing the equivalent units of work done, the equivalent unit costs and the costs assigned to the completed units transferred out to Finished Goods and to the ending WIP under the weighted average method (10 marks) (b) Prepare two journal entries to record (i) each of the costs incurred by the Finishing Department in June, and (i) the transfer of completed units to Finished Goods in June. (4 marks) (c) Why might a manufacturer use FIFO process costing? Don't both methods (FIFO and Weighted Average) give almost the same costs anyway? Fxplain when the methods may provide different costs. (4 marks) (d) Assume the Company allows for normal spoilage at a rate of 2% of good units completed for the month and has an inspection point to detect spoilage at the end of the Finishing Department process. If only 36,000 good units were completed in Finishing in October, how would the journal to transfer the costs out of the WIP- Finishing Department A/c (prepared in (b)(ii) above) differ, if at all? (Hint: you should be able to use your weighted average calculations from above and just consider how the cost assignment changes.) (4 marks)