Answered step by step

Verified Expert Solution

Question

1 Approved Answer

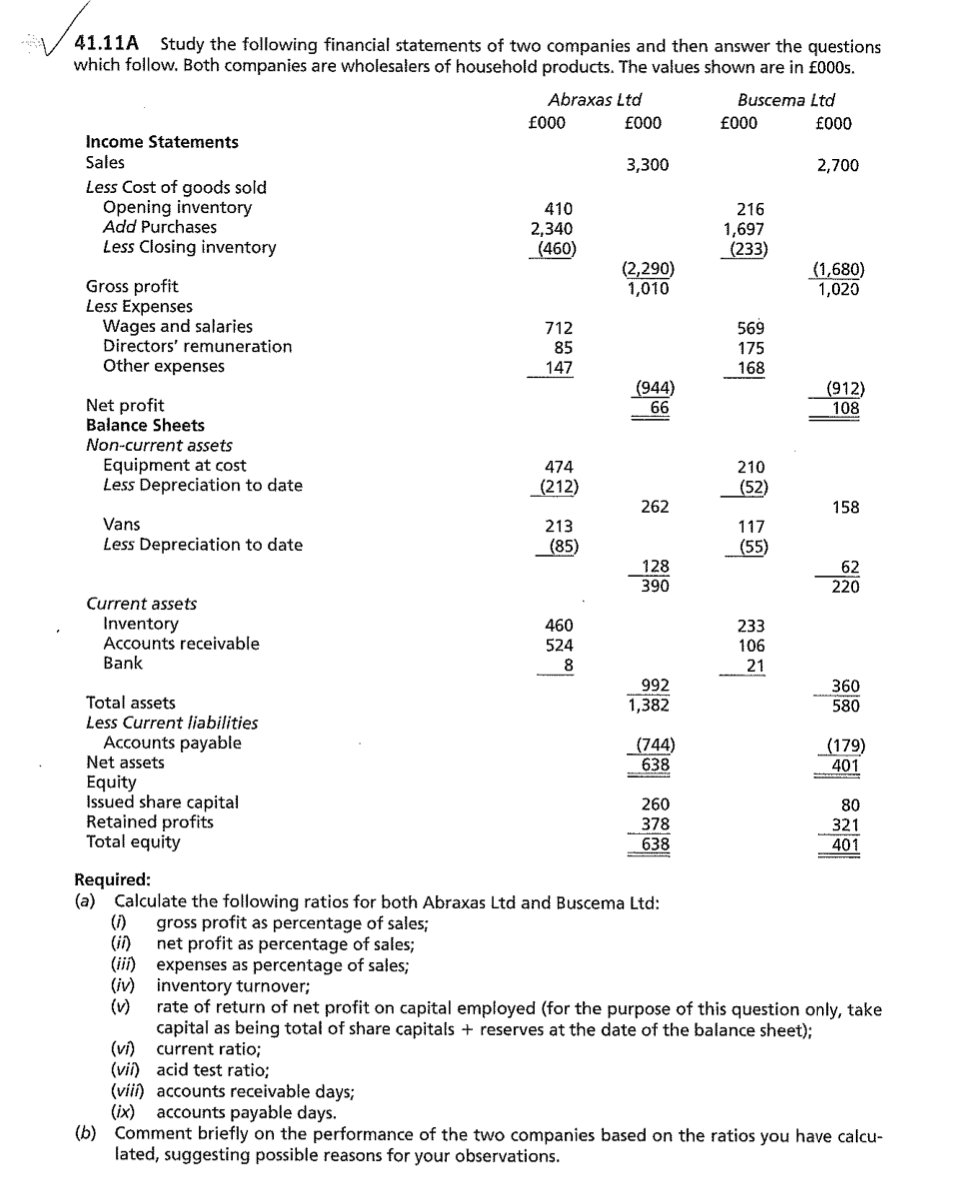

Thank you. 41.11A Study the following financial statements of two companies and then answer the questions which follow. Both companies are wholesalers of household products.

Thank you.

41.11A Study the following financial statements of two companies and then answer the questions which follow. Both companies are wholesalers of household products. The values shown are in 000s. Abraxas Ltd 000 E000 Buscema Ltd 000 000 3,300 2,700 Income Statements Sales Less Cost of goods sold Opening inventory Add Purchases Less Closing inventory 216 410 2,340 (460) 1,697 (233) (2,290) 1,010 (1,680) 1,025 Gross profit Less Expenses Wages and salaries Directors' remuneration Other expenses 569 712 85 147 175 168 (944) 66 (912) 108 Net profit Balance Sheets Non-current assets Equipment at cost Less Depreciation to date 474 (212) 210 (52) 262 158 Vans Less Depreciation to date 213 (85) 117 (55) 128 390 62 220 Current assets Inventory Accounts receivable Bank 460 524 8 233 106 21 992 1,382 360 580 Total assets Less Current liabilities Accounts payable Net assets Equity Issued share capital Retained profits Total equity (744) 638 (179) 401 260 378 638 80 321 401 Required: (a) Calculate the following ratios for both Abraxas Ltd and Buscema Ltd: (1) gross profit as percentage of sales; (ii) net profit as percentage of sales; (iii) expenses as percentage of sales; (iv) inventory turnover; (v) rate of return of net profit on capital employed (for the purpose of this question only, take capital as being total of share capitals + reserves at the date of the balance sheet); (vi) current ratio; (vii) acid test ratio; (viii) accounts receivable days; (ix) accounts payable days. (b) Comment briefly on the performance of the two companies based on the ratios you have calcu- lated, suggesting possible reasons for your observationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started