Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you 8. Understanding term life insurance Alyssa is a 60-year-old female who has recently become the legal guardian and sole caretaker of her three-year-old

thank you

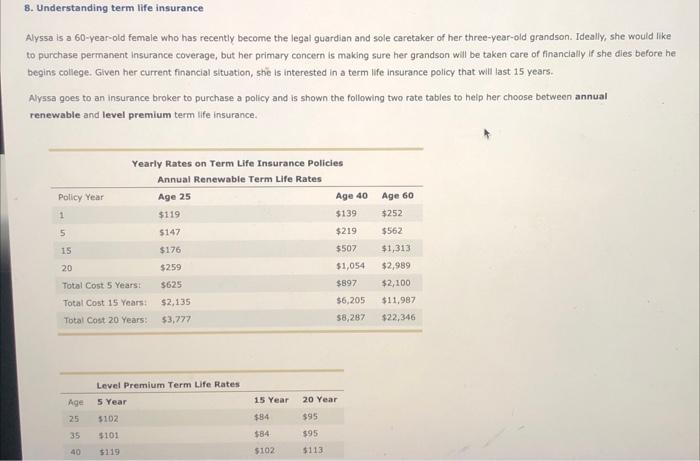

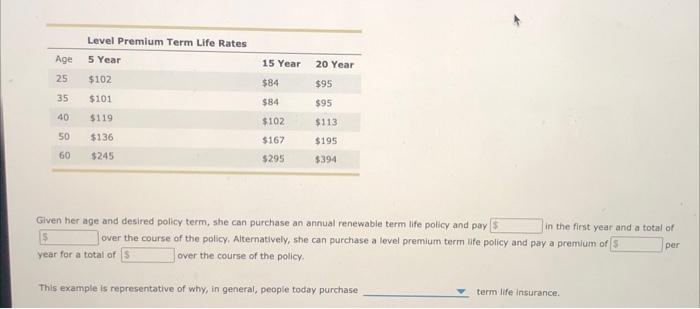

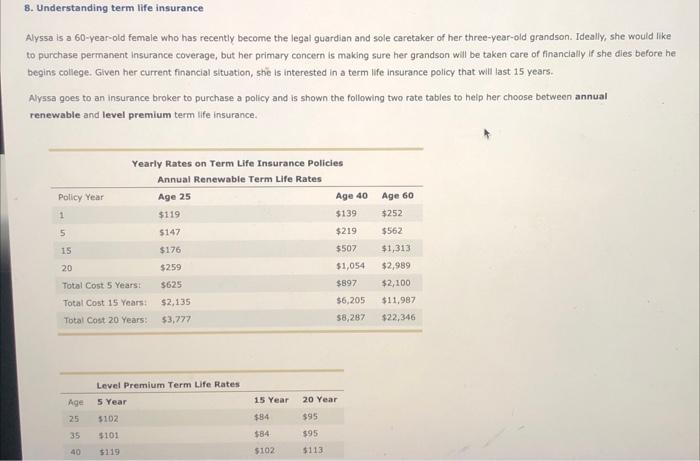

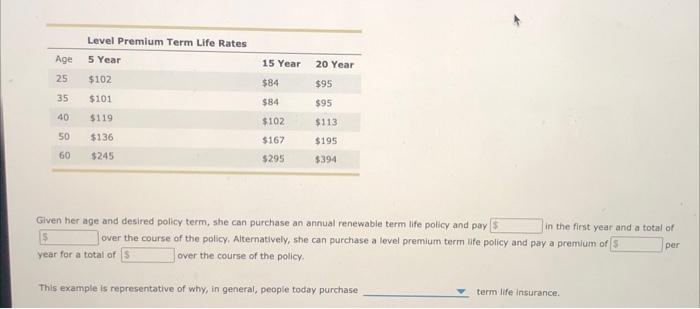

8. Understanding term life insurance Alyssa is a 60-year-old female who has recently become the legal guardian and sole caretaker of her three-year-old grandson. Ideally, she would like to purchase permanent Insurance coverage, but her primary concern is making sure her grandson will be taken care of financially if she dies before he begins college. Given her current financial situation, she is interested in a term life insurance policy that will last 15 years. Alyssa goes to an insurance broker to purchase a policy and is shown the following two rate tables to help her choose between annual renewable and level premium term life insurance. Age 60 Yearly Rates on Term Life Insurance Policies Annual Renewable Term Life Rates Policy Year Age 25 Age 40 1 $119 $139 5 $147 $219 15 $176 $507 20 $259 $1,054 Total Cost 5 Years $625 $897 Total Cost 15 Years: $2,135 $6,205 Total Cost 20 years: $3,777 58,287 $252 $562 $1,313 $2,989 $2,100 $11.987 $22,346 Level Premium Term Life Rates 5 Year 15 Year Age 25 20 Year $95 5102 $84 35 $101 384 $95 40 $119 $102 $113 Level Premium Term Life Rates Age 5 Year 15 Year 20 Year 25 $102 $84 35 $101 $95 $95 $84 40 $119 $102 $113 50 $136 $167 $295 60 $195 $394 $245 Given her age and desired policy term, she can purchase an annual renewable term life policy and pay 5 in the first year and a total of over the course of the policy, Alternatively, she can purchase a level premium term die policy and pay a premium of year for a total of 5 over the course of the policy. per This example is representative of why, in general, people today purchase term life insurance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started