Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you! 9. Selling, general, and administrative expenses were expected to be $7 million per year. 10. Kirani James would be paid $2 million per

thank you!

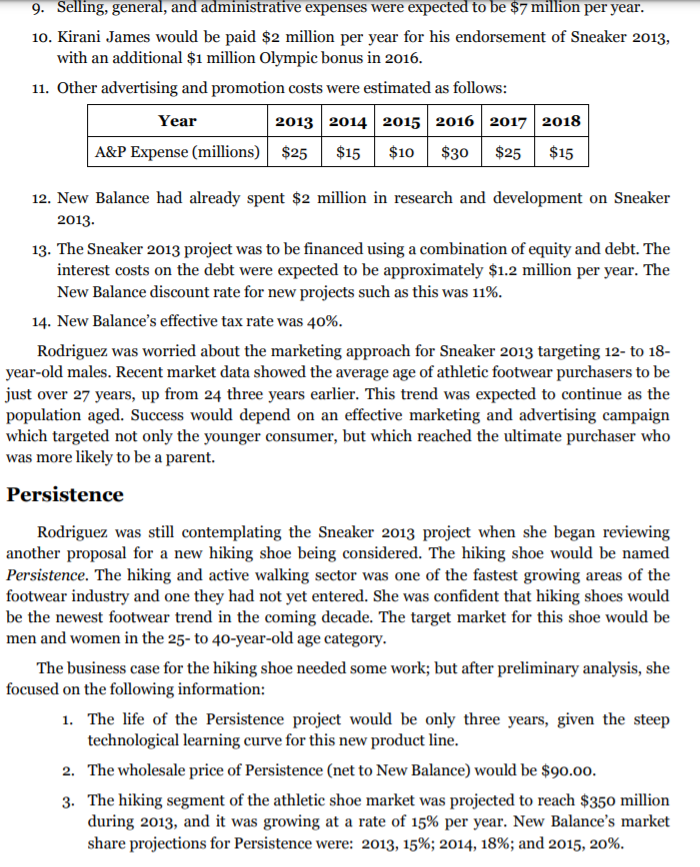

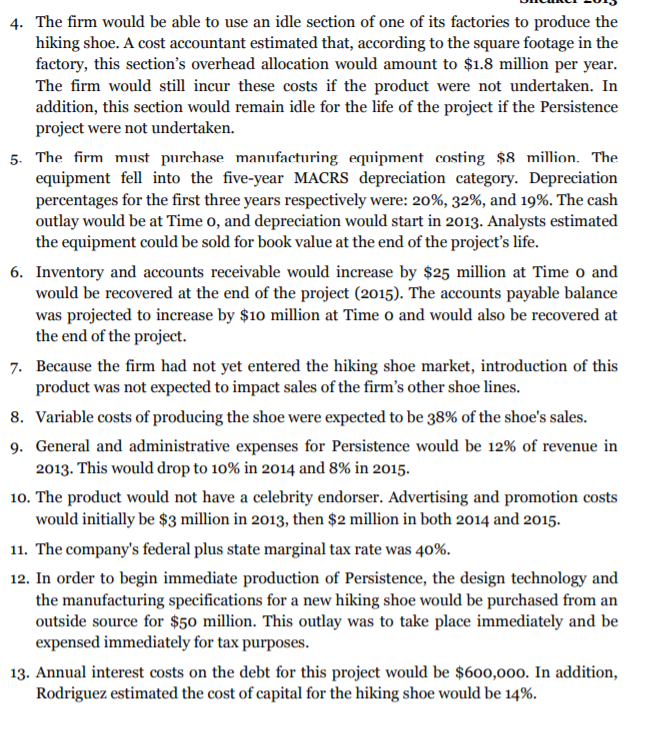

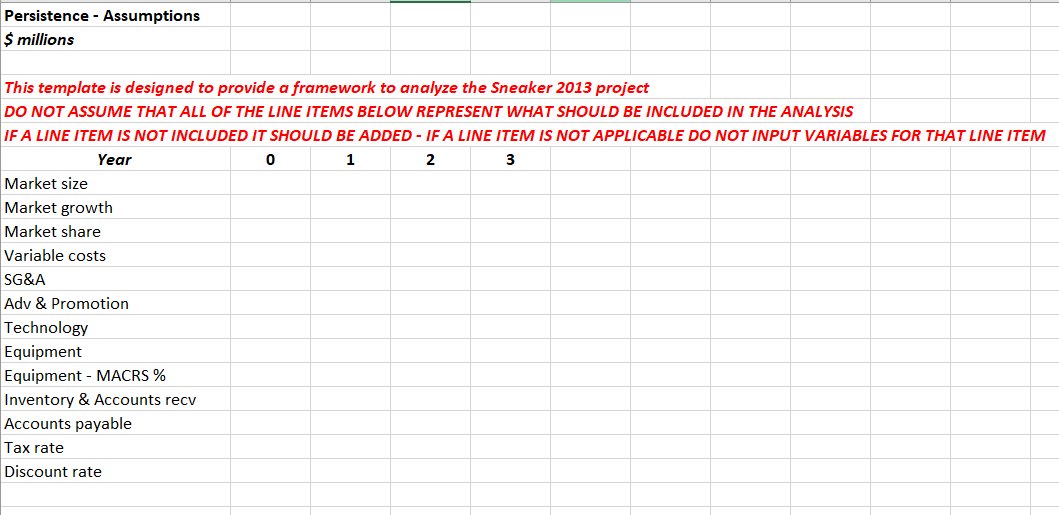

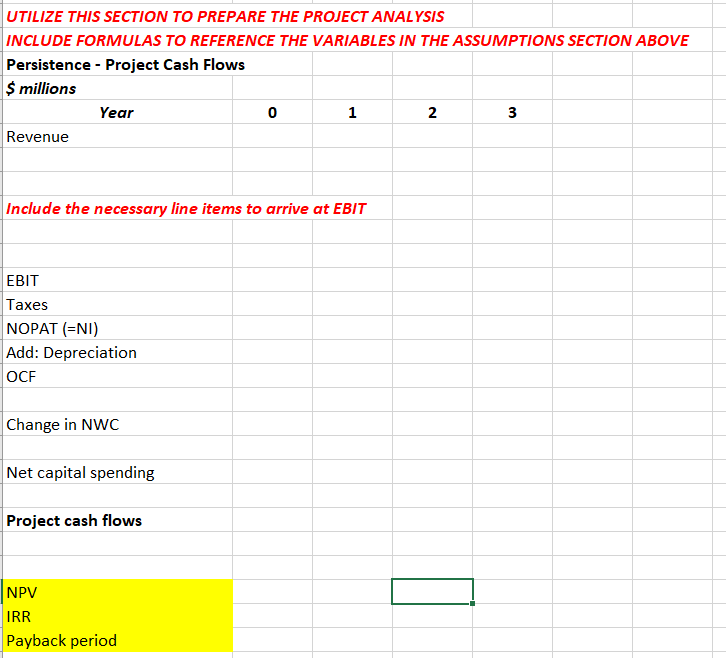

9. Selling, general, and administrative expenses were expected to be $7 million per year. 10. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013, with an additional $1 million Olympic bonus in 2016. 11. Other advertising and promotion costs were estimated as follows: Year 2013 2014 2015 2016 2017 2018 A&P Expense (millions) $25 $15 $10 $30 $25 $15 12. New Balance had already spent $2 million in research and development on Sneaker 2013 13. The Sneaker 2013 project was to be financed using a combination of equity and debt. The interest costs on the debt were expected to be approximately $1.2 million per year. The New Balance discount rate for new projects such as this was 11%. 14. New Balance's effective tax rate was 40%. Rodriguez was worried about the marketing approach for Sneaker 2013 targeting 12- to 18- year-old males. Recent market data showed the average age of athletic footwear purchasers to be just over 27 years, up from 24 three years earlier. This trend was expected to continue as the population aged. Success would depend on an effective marketing and advertising campaign which targeted not only the younger consumer, but which reached the ultimate purchaser who was more likely to be a parent. Persistence Rodriguez was still contemplating the Sneaker 2013 project when she began reviewing another proposal for a new hiking shoe being considered. The hiking shoe would be named Persistence. The hiking and active walking sector was one of the fastest growing areas of the footwear industry and one they had not yet entered. She was confident that hiking shoes would be the newest footwear trend in the coming decade. The target market for this shoe would be men and women in the 25- to 40-year-old age category. The business case for the hiking shoe needed some work; but after preliminary analysis, she focused on the following information: 1. The life of the Persistence project would be only three years, given the steep technological learning curve for this new product line. 2. The wholesale price of Persistence (net to New Balance) would be $90.00. 3. The hiking segment of the athletic shoe market was projected to reach $350 million during 2013, and it was growing at a rate of 15% per year. New Balance's market share projections for Persistence were: 2013, 15%; 2014, 18%; and 2015, 20%. 4. The firm would be able to use an idle section of one of its factories to produce the hiking shoe. A cost accountant estimated that, according to the square footage in the factory, this section's overhead allocation would amount to $1.8 million per year. The firm would still incur these costs if the product were not undertaken. In addition, this section would remain idle for the life of the project if the Persistence project were not undertaken. 5. The firm must purchase manufacturing equipment costing $8 million. The equipment fell into the five-year MACRS depreciation category. Depreciation percentages for the first three years respectively were: 20%, 32%, and 19%. The cash outlay would be at Time o, and depreciation would start in 2013. Analysts estimated the equipment could be sold for book value at the end of the project's life. 6. Inventory and accounts receivable would increase by $25 million at Time o and would be recovered at the end of the project (2015). The accounts payable balance was projected to increase by $10 million at Time o and would also be recovered at the end of the project. 7. Because the firm had not yet entered the hiking shoe market, introduction of this product was not expected to impact sales of the firm's other shoe lines. 8. Variable costs of producing the shoe were expected to be 38% of the shoe's sales. 9. General and administrative expenses for Persistence would be 12% of revenue in 2013. This would drop to 10% in 2014 and 8% in 2015. 10. The product would not have a celebrity endorser. Advertising and promotion costs would initially be $3 million in 2013, then $2 million in both 2014 and 2015. 11. The company's federal plus state marginal tax rate was 40%. 12. In order to begin immediate production of Persistence, the design technology and the manufacturing specifications for a new hiking shoe would be purchased from an outside source for $50 million. This outlay was to take place immediately and be expensed immediately for tax purposes. 13. Annual interest costs on the debt for this project would be $600,000. In addition, Rodriguez estimated the cost of capital for the hiking shoe would be 14%. Persistence - Assumptions $ millions This template is designed to provide a framework to analyze the Sneaker 2013 project DO NOT ASSUME THAT ALL OF THE LINE ITEMS BELOW REPRESENT WHAT SHOULD BE INCLUDED IN THE ANALYSIS IF A LINE ITEM IS NOT INCLUDED IT SHOULD BE ADDED - IF A LINE ITEM IS NOT APPLICABLE DO NOT INPUT VARIABLES FOR THAT LINE ITEM Year 0 1 2 3 Market size Market growth Market share Variable costs SG&A Adv & Promotion Technology Equipment Equipment - MACRS % Inventory & Accounts recv Accounts payable Tax rate Discount rate UTILIZE THIS SECTION TO PREPARE THE PROJECT ANALYSIS INCLUDE FORMULAS TO REFERENCE THE VARIABLES IN THE ASSUMPTIONS SECTION ABOVE Persistence - Project Cash Flows $ millions Year 0 1 2 3 Revenue Include the necessary line items to arrive at EBIT EBIT Taxes NOPAT (=NI) Add: Depreciation OCF Change in NWC Net capital spending Project cash flows NPV IRR Payback period 9. Selling, general, and administrative expenses were expected to be $7 million per year. 10. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013, with an additional $1 million Olympic bonus in 2016. 11. Other advertising and promotion costs were estimated as follows: Year 2013 2014 2015 2016 2017 2018 A&P Expense (millions) $25 $15 $10 $30 $25 $15 12. New Balance had already spent $2 million in research and development on Sneaker 2013 13. The Sneaker 2013 project was to be financed using a combination of equity and debt. The interest costs on the debt were expected to be approximately $1.2 million per year. The New Balance discount rate for new projects such as this was 11%. 14. New Balance's effective tax rate was 40%. Rodriguez was worried about the marketing approach for Sneaker 2013 targeting 12- to 18- year-old males. Recent market data showed the average age of athletic footwear purchasers to be just over 27 years, up from 24 three years earlier. This trend was expected to continue as the population aged. Success would depend on an effective marketing and advertising campaign which targeted not only the younger consumer, but which reached the ultimate purchaser who was more likely to be a parent. Persistence Rodriguez was still contemplating the Sneaker 2013 project when she began reviewing another proposal for a new hiking shoe being considered. The hiking shoe would be named Persistence. The hiking and active walking sector was one of the fastest growing areas of the footwear industry and one they had not yet entered. She was confident that hiking shoes would be the newest footwear trend in the coming decade. The target market for this shoe would be men and women in the 25- to 40-year-old age category. The business case for the hiking shoe needed some work; but after preliminary analysis, she focused on the following information: 1. The life of the Persistence project would be only three years, given the steep technological learning curve for this new product line. 2. The wholesale price of Persistence (net to New Balance) would be $90.00. 3. The hiking segment of the athletic shoe market was projected to reach $350 million during 2013, and it was growing at a rate of 15% per year. New Balance's market share projections for Persistence were: 2013, 15%; 2014, 18%; and 2015, 20%. 4. The firm would be able to use an idle section of one of its factories to produce the hiking shoe. A cost accountant estimated that, according to the square footage in the factory, this section's overhead allocation would amount to $1.8 million per year. The firm would still incur these costs if the product were not undertaken. In addition, this section would remain idle for the life of the project if the Persistence project were not undertaken. 5. The firm must purchase manufacturing equipment costing $8 million. The equipment fell into the five-year MACRS depreciation category. Depreciation percentages for the first three years respectively were: 20%, 32%, and 19%. The cash outlay would be at Time o, and depreciation would start in 2013. Analysts estimated the equipment could be sold for book value at the end of the project's life. 6. Inventory and accounts receivable would increase by $25 million at Time o and would be recovered at the end of the project (2015). The accounts payable balance was projected to increase by $10 million at Time o and would also be recovered at the end of the project. 7. Because the firm had not yet entered the hiking shoe market, introduction of this product was not expected to impact sales of the firm's other shoe lines. 8. Variable costs of producing the shoe were expected to be 38% of the shoe's sales. 9. General and administrative expenses for Persistence would be 12% of revenue in 2013. This would drop to 10% in 2014 and 8% in 2015. 10. The product would not have a celebrity endorser. Advertising and promotion costs would initially be $3 million in 2013, then $2 million in both 2014 and 2015. 11. The company's federal plus state marginal tax rate was 40%. 12. In order to begin immediate production of Persistence, the design technology and the manufacturing specifications for a new hiking shoe would be purchased from an outside source for $50 million. This outlay was to take place immediately and be expensed immediately for tax purposes. 13. Annual interest costs on the debt for this project would be $600,000. In addition, Rodriguez estimated the cost of capital for the hiking shoe would be 14%. Persistence - Assumptions $ millions This template is designed to provide a framework to analyze the Sneaker 2013 project DO NOT ASSUME THAT ALL OF THE LINE ITEMS BELOW REPRESENT WHAT SHOULD BE INCLUDED IN THE ANALYSIS IF A LINE ITEM IS NOT INCLUDED IT SHOULD BE ADDED - IF A LINE ITEM IS NOT APPLICABLE DO NOT INPUT VARIABLES FOR THAT LINE ITEM Year 0 1 2 3 Market size Market growth Market share Variable costs SG&A Adv & Promotion Technology Equipment Equipment - MACRS % Inventory & Accounts recv Accounts payable Tax rate Discount rate UTILIZE THIS SECTION TO PREPARE THE PROJECT ANALYSIS INCLUDE FORMULAS TO REFERENCE THE VARIABLES IN THE ASSUMPTIONS SECTION ABOVE Persistence - Project Cash Flows $ millions Year 0 1 2 3 Revenue Include the necessary line items to arrive at EBIT EBIT Taxes NOPAT (=NI) Add: Depreciation OCF Change in NWC Net capital spending Project cash flows NPV IRR Payback periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started