Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you! begin{tabular}{|lcccc|} hline & & multicolumn{3}{c|}{ Balance Sheet } & multicolumn{2}{c}{2012} & 2013 & 2014 Cash & 650,000 & 350,000 & 200,000

thank you!

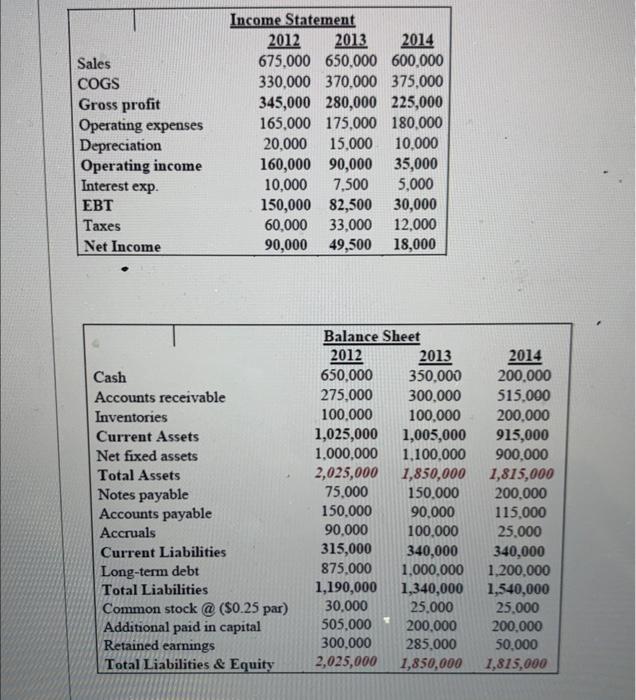

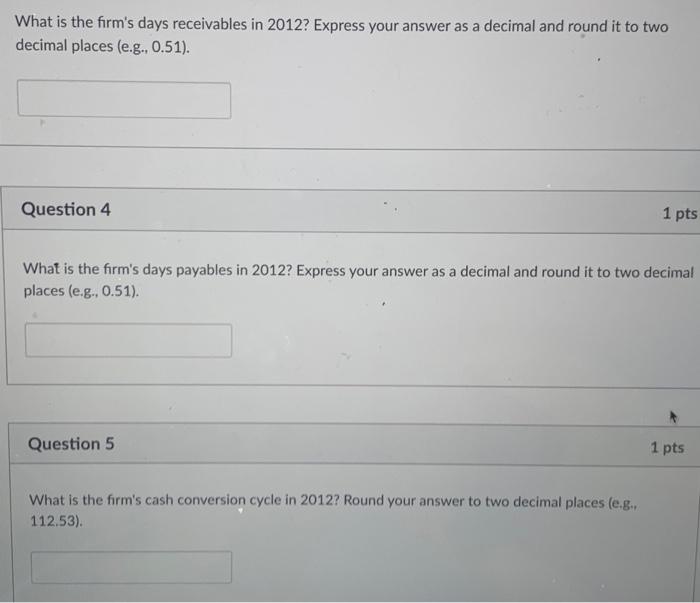

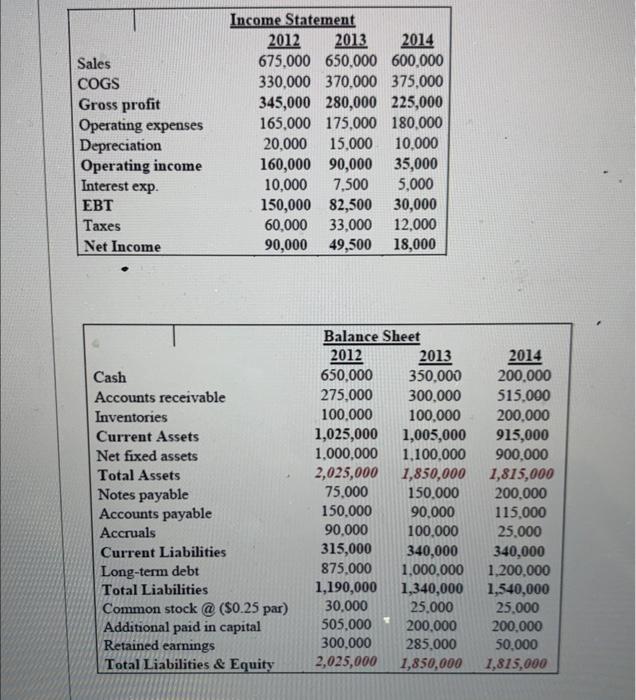

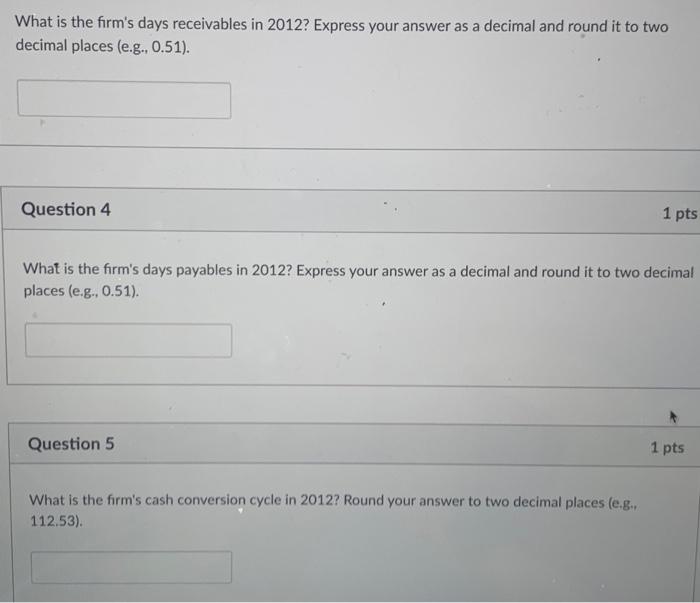

\begin{tabular}{|lcccc|} \hline & & \multicolumn{3}{c|}{ Balance Sheet } \\ & \multicolumn{2}{c}{2012} & 2013 & 2014 \\ Cash & 650,000 & 350,000 & 200,000 \\ Accounts receivable & 275,000 & 300,000 & 515,000 \\ Inventories & 100,000 & 100,000 & 200,000 \\ Current Assets & 1,025,000 & 1,005,000 & 915,000 \\ Net fixed assets & 1,000,000 & 1,100,000 & 900,000 \\ Total Assets & 2,025,000 & 1,850,000 & 1,815,000 \\ Notes payable & 75,000 & 150,000 & 200,000 \\ Accounts payable & 150,000 & 90,000 & 115,000 \\ Accruals & 90,000 & 100,000 & 25,000 \\ Current Liabilities & 315,000 & 340,000 & 340,000 \\ Long-term debt & 875,000 & 1,000,000 & 1,200,000 \\ Total Liabilities & 1,190,000 & 1,340,000 & 1,540,000 \\ Common stock @ (\$0.25 par) & 30,000 & 25,000 & 25,000 \\ Additional paid in capital & 505,000 & 200,000 & 200,000 \\ Retained earnings & 300,000 & 285,000 & 50,000 \\ Total Liabilities \& Equity & 2,025,000 & 1,850,000 & 1,815,000 \\ \hline \end{tabular} What is the firm's days receivables in 2012? Express your answer as a decimal and round it to two decimal places (e.g., 0.51). Question 4 What is the firm's days payables in 2012? Express your answer as a decimal and round it to two decimal places (e.g., 0.51). Question 5 1 pts What is the firm's cash conversion cycle in 2012? Round your answer to two decimal places (e.g., 112.53)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started