Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you Chapter 12 Financial Planning Exercise 15 Calculating current yield and return on investment Assume that an investor pays $750 for a long-term bond

thank you

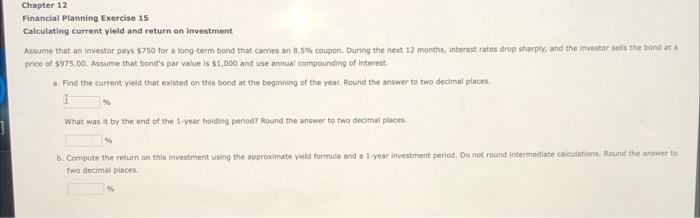

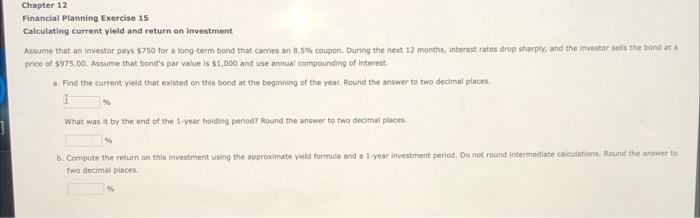

Chapter 12 Financial Planning Exercise 15 Calculating current yield and return on investment Assume that an investor pays $750 for a long-term bond that carries an 8.5% coupon, During the next 12 months, interest rates drop sharply, and the investor sells the bond at a price of $975.00. Assume that bond's par value is $1,000 and use annual compounding of interest. a. Find the current yield that existed on this bond at the beginning of the year. Round the answer to two decimal places. What was it by the end of the 1-year holding period? Round the answer to two decimal places. % b. Compute the return on this investment using the approximate yield formula and a 1-year investment period. Do not round intermediate calculations. Round the answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started