Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you Cost of Inventory Which of the following is/are the exception(s) to historical cost valuation of inventory allowed under GAAP? I. When market value

thank you

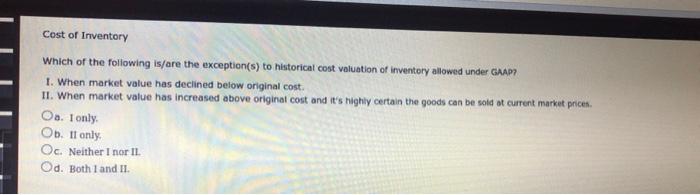

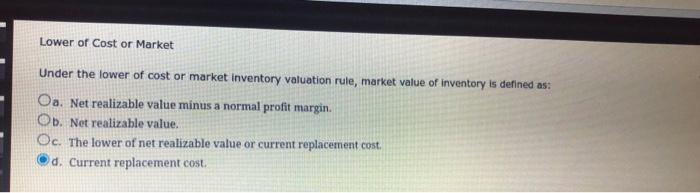

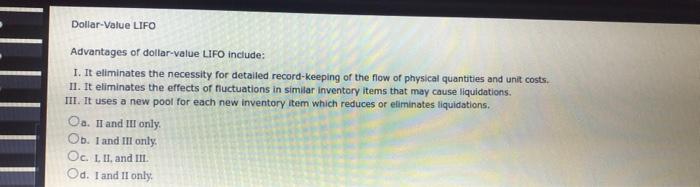

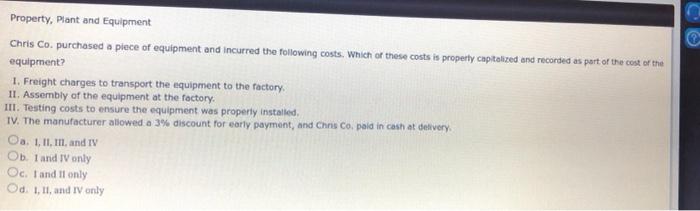

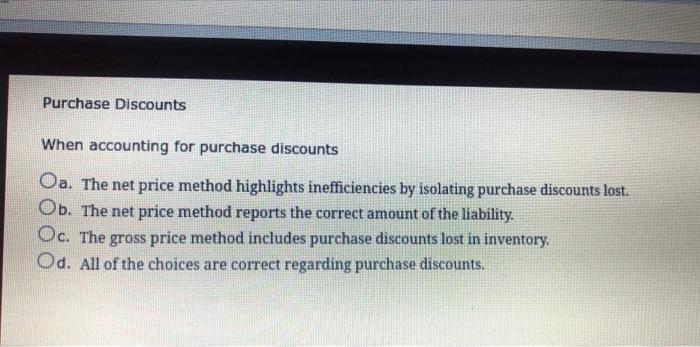

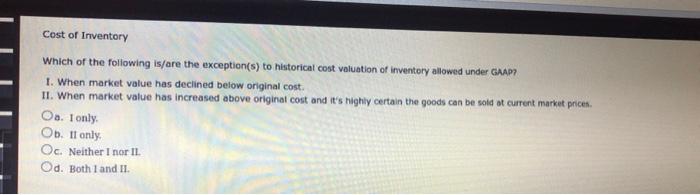

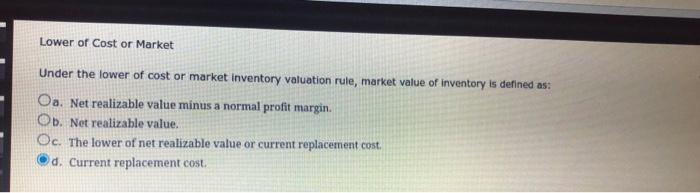

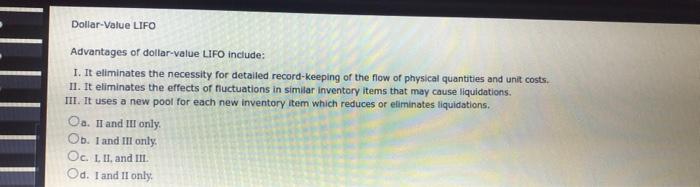

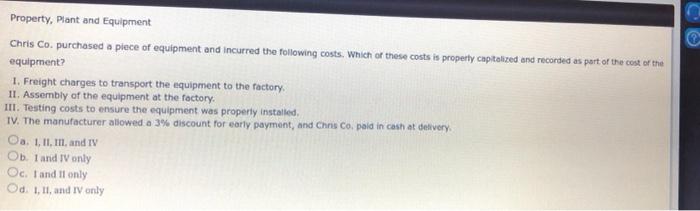

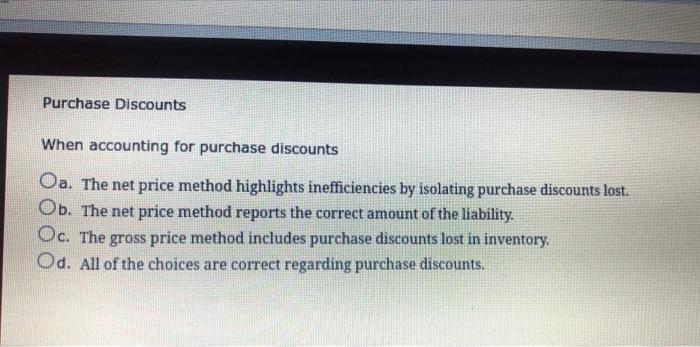

Cost of Inventory Which of the following is/are the exception(s) to historical cost valuation of inventory allowed under GAAP? I. When market value has declined below original cost. II. When market value has increased above original cost and it's highly certain the goods can be sold at current market prices. Oa. I only. Ob. II only. Oc. Neither I nor II. Od. Both I and II. Lower of Cost or Market Under the lower of cost or market inventory valuation rule, market value of inventory is defined as: Oa. Net realizable value minus a normal profit margin. Ob. Net realizable value. Oc. The lower of net realizable value or current replacement cost. d. Current replacement cost. Dollar-Value LIFO Advantages of dollar-value LIFO include: I. It eliminates the necessity for detailed record-keeping of the flow of physical quantities and unit costs. II. It eliminates the effects of fluctuations in similar inventory items that may cause liquidations. III. It uses a new pool for each new inventory item which reduces or eliminates liquidations. Oa. II and III only. Ob. I and III only. Oc. L. II, and III. Od. I and II only. Property, Plant and Equipment Chris Co. purchased a piece of equipment and incurred the following costs. Which of these costs is property capitalized and recorded as part of the cost of the equipment? 1. Freight charges to transport the equipment to the factory. II. Assembly of the equipment at the factory. III. Testing costs to ensure the equipment was properly installed. IV. The manufacturer allowed a 3% discount for early payment, and Chris Co. paid in cash at delivery. Oa. 1, II, III, and IV Ob. I and IV only Oc. I and II only Od. 1, 11, and IV only CO Purchase Discounts When accounting for purchase discounts Oa. The net price method highlights inefficiencies by isolating purchase discounts lost. Ob. The net price method reports the correct amount of the liability. Oc. The gross price method includes purchase discounts lost in inventory. Od. All of the choices are correct regarding purchase discounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started