Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you. E8-9 (Algo) Computing Depreciation under Alternative Methods LO8-3 Assume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production

thank you.

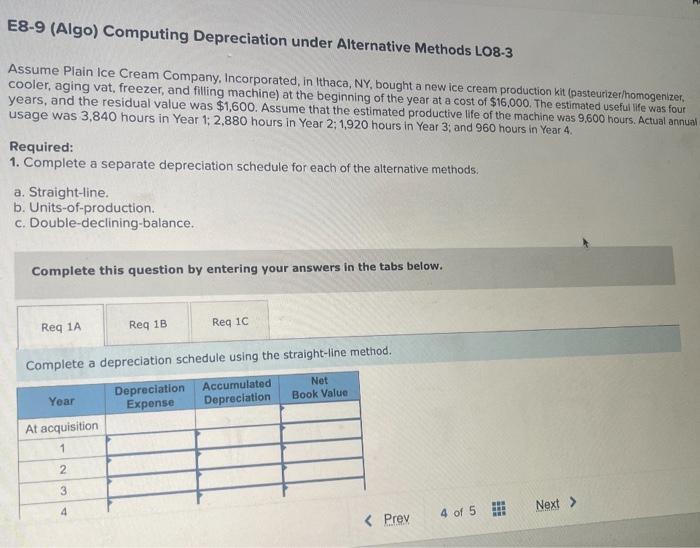

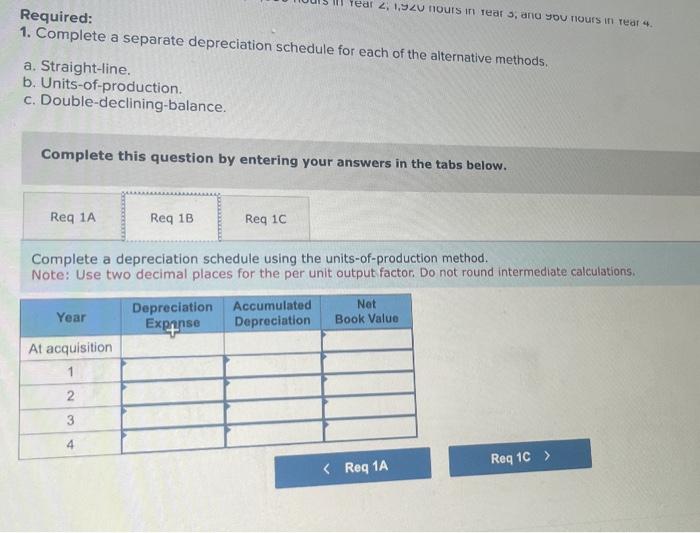

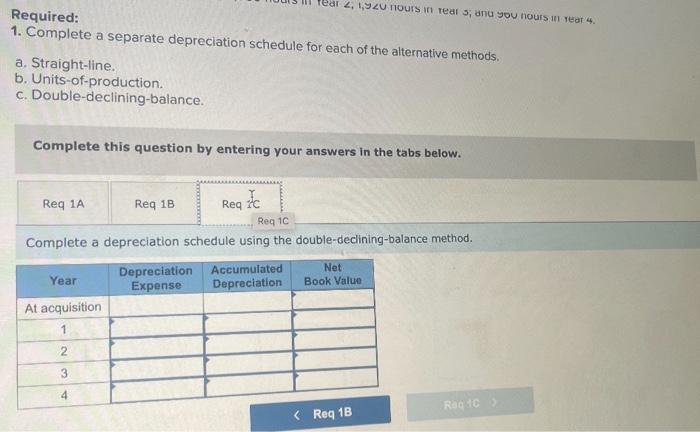

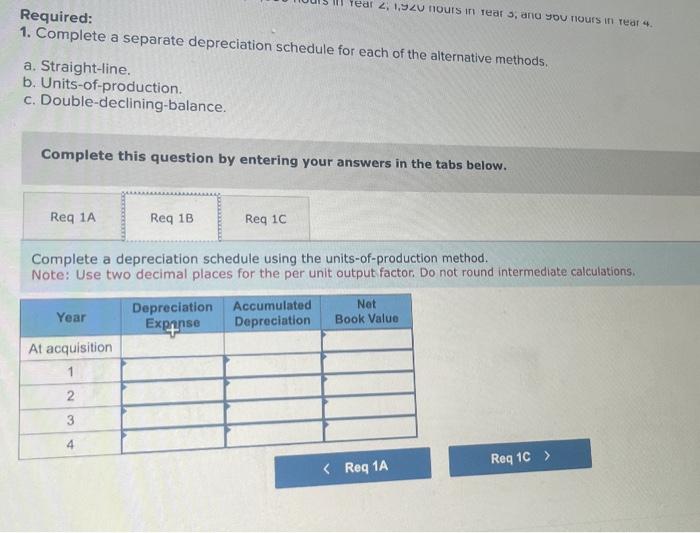

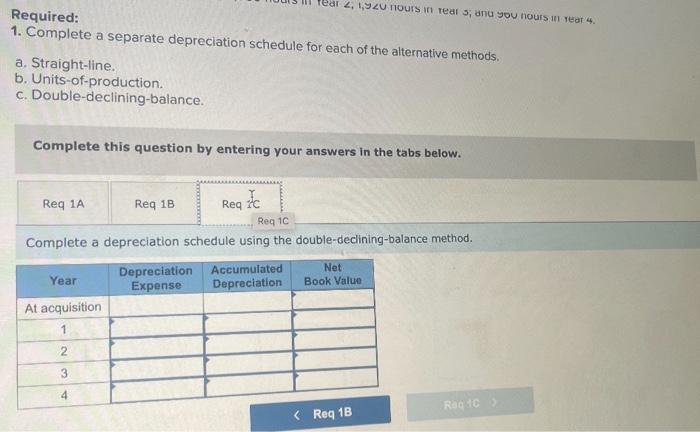

E8-9 (Algo) Computing Depreciation under Alternative Methods LO8-3 Assume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $16,000. The estimated useful life was four years, and the residual value was $1,600. Assume that the estimated productive life of the machine was 9,600 hours. Actual annua usage was 3,840 hours in Year 1; 2,880 hours in Year 2;1,920 hours in Year 3; and 960 hours in Year 4. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the straight-line method. Required: 1. Complete a separate depreciation schedule for each of the alternative methods, a. Straight-line, b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the units-of-production method. Note: Use two decimal places for the per unit output factor. Do not round intermediate calculations. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started