Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! Exercise 11-21 Novak Company owns a 8,680-acre tract of timber purchased in 2003 at a cost of $1,612 per acre. At the time

Thank you!

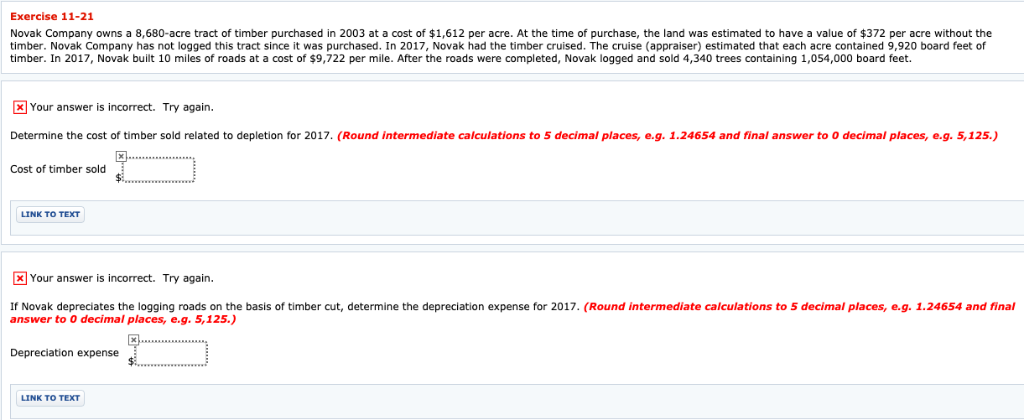

Exercise 11-21 Novak Company owns a 8,680-acre tract of timber purchased in 2003 at a cost of $1,612 per acre. At the time of purchase, the land was estimated to have a value of $372 per acre without the timber. Novak Company has not logged this tract since it was purchased. In 2017, Novak had the timber cruised. The cruise (appraiser) estimated that each acre contained 9,920 board feet of timber. In 2017, Novak built 10 miles of roads at a cost of $9,722 per mile. After the roads were completed, Novak logged and sold 4,340 trees containing 1,054,000 board feet. Your answer is incorrect. Try again. Determine the cost of timber sold related to depletion for 2017. (Round intermediate calculations to 5 decimal places, e.g. 1.24654 and final answer to 0 decimal places, e.g.5,125.) Cost of timber sold LINK TO TEXT Your answer is incorrect. Try again. If Novak depreciates the logging roads on the basis of timber cut, determine the depreciation expense for 2017. (Round intermediate calculations to 5 decimal places, e.g. 1.24654 and final answer to O decimal places, e.g. 5,125.) Depreciation expense LINK TO TEXTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started