Answered step by step

Verified Expert Solution

Question

1 Approved Answer

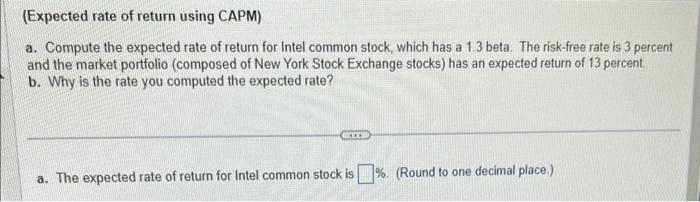

thank you!(: (Expected rate of return using CAPM) a. Compute the expected rate of return for Intel common stock, which has a 1.3 beta. The

thank you!(:

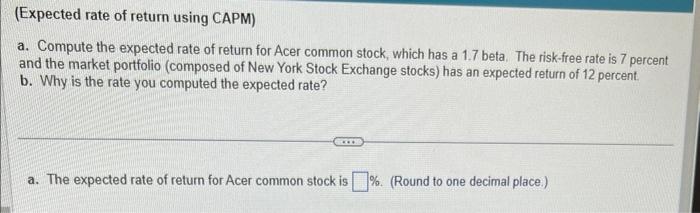

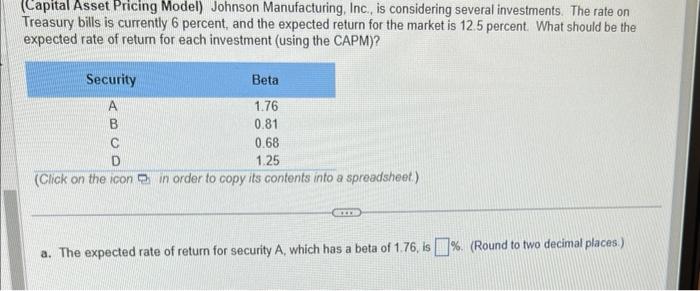

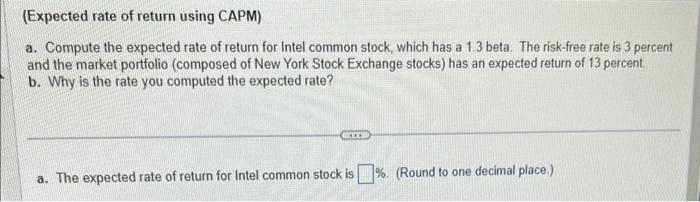

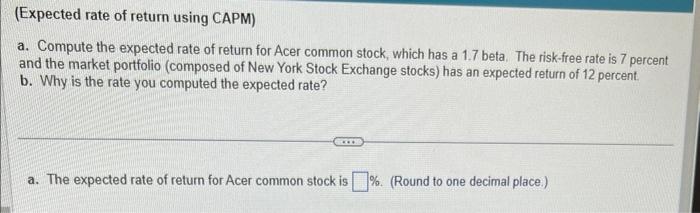

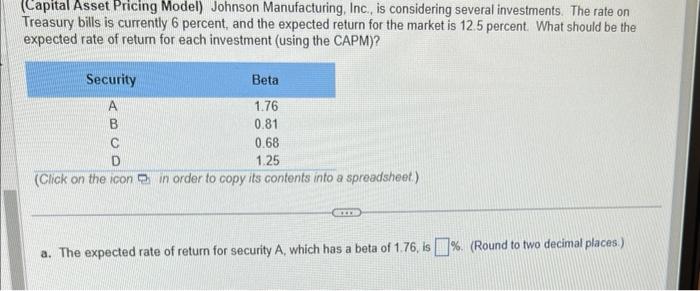

(Expected rate of return using CAPM) a. Compute the expected rate of return for Intel common stock, which has a 1.3 beta. The risk-free rate is 3 percent and the market portfolio (composed of New York Stock Exchange stocks) has an expected return of 13 percent. b. Why is the rate you computed the expected rate? a. The expected rate of return for Intel common stock is \%. (Round to one decimal place.) (Expected rate of return using CAPM) a. Compute the expected rate of return for Acer common stock, which has a 1.7 beta. The risk-free rate is 7 percent and the market portfolio (composed of New York Stock Exchange stocks) has an expected return of 12 percent. b. Why is the rate you computed the expected rate? a. The expected rate of return for Acer common stock is \%. (Round to one decimal place.) (Capital Asset Pricing Model) Johnson Manufacturing, Inc,, is considering several investments. The rate on Treasury bills is currently 6 percent, and the expected return for the market is 12.5 percent. What should be the expected rate of return for each investment (using the CAPM)? (Click on the icon [ in order to copy its contents into a spreadsheet.) a. The expected rate of return for security A, which has a beta of 1.76, is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started