Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you for all question:) Q30) Suppose you look in today's Wall Street Journal and see that the stock price of PaperCo. is $51. If

Thank you for all question:)

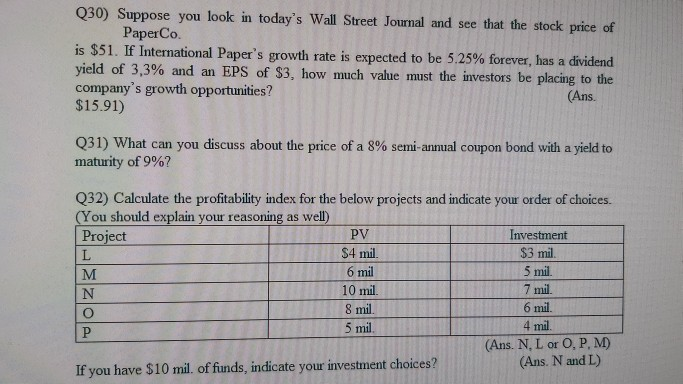

Q30) Suppose you look in today's Wall Street Journal and see that the stock price of PaperCo. is $51. If International Paper's growth rate is expected to be 5.25% forever, has a dividend yield of 3,3% and an EPS of $3, how much value must the investors be placing to the company's growth opportunities? (Ans. $15.91) Q31) What can you discuss about the price of a 8% semi-annual coupon bond with a yield to maturity of 9%? Q32) Calculate the profitability index for the below projects and indicate your order of choices. (You should explain your reasoning as well) Project PV Investment L S4 mil. $3 mil. M 6 mil 5 mil N 10 mil. 7 mil. O 8 mil. 6 mil. P 5 mil. 4 mil. (Ans. N. L or O, P, M) If you have $10 mil. of funds, indicate your investment choices? (Ans. N and L)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started