Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you for answering in advance :) Kirkdand Company had no trading debt securities prior to this year. It had the following transactions this year

thank you for answering in advance :)

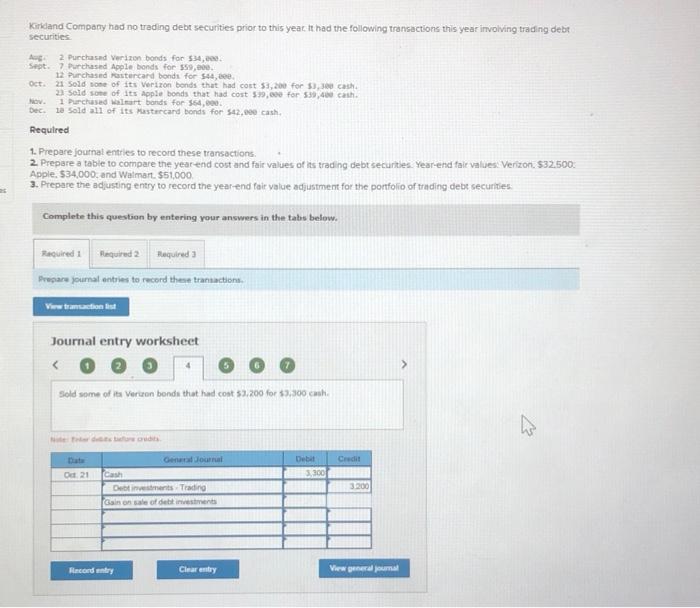

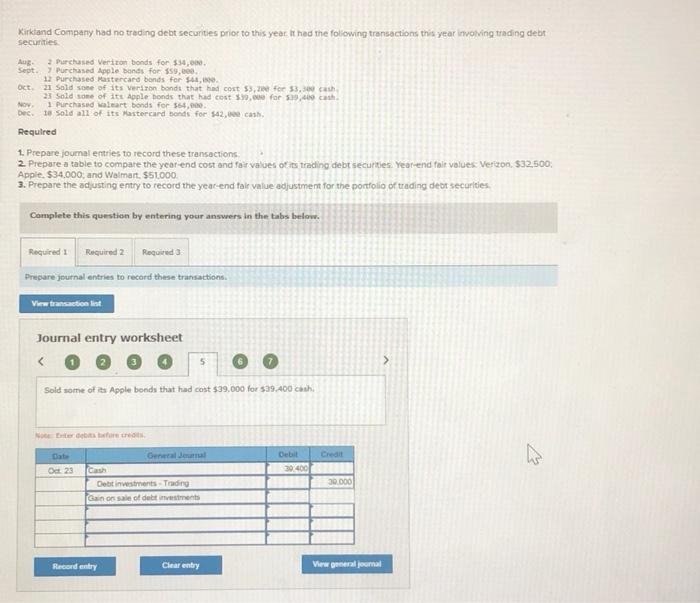

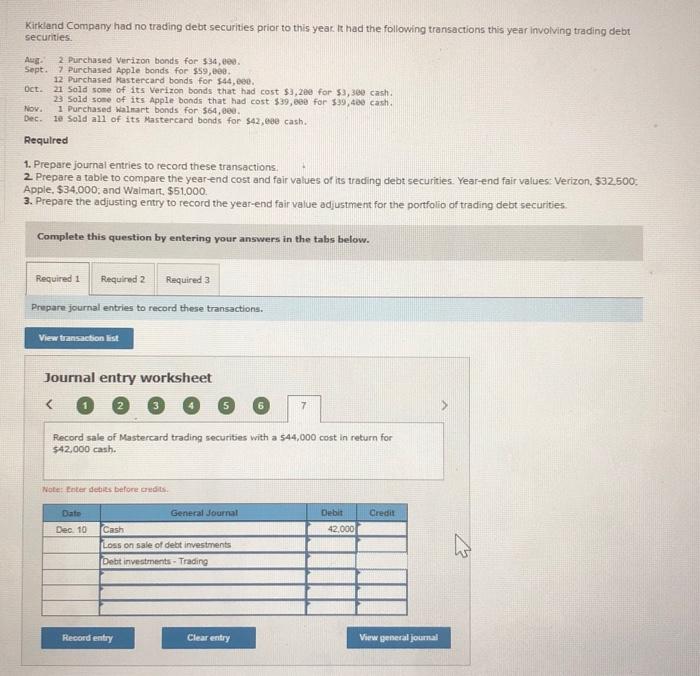

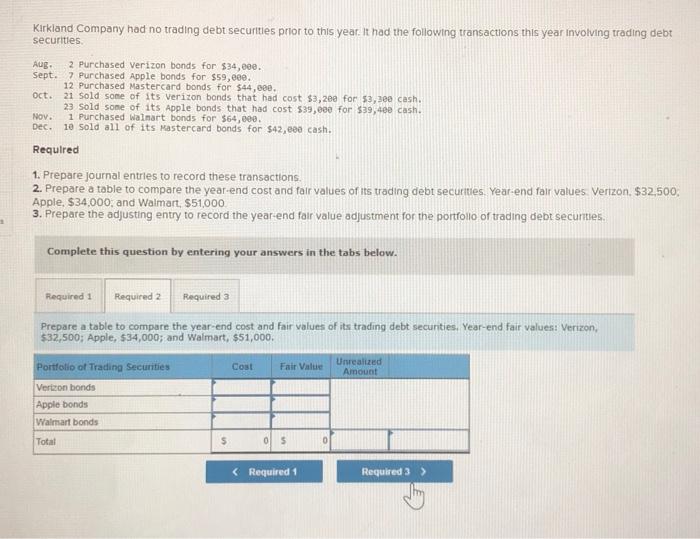

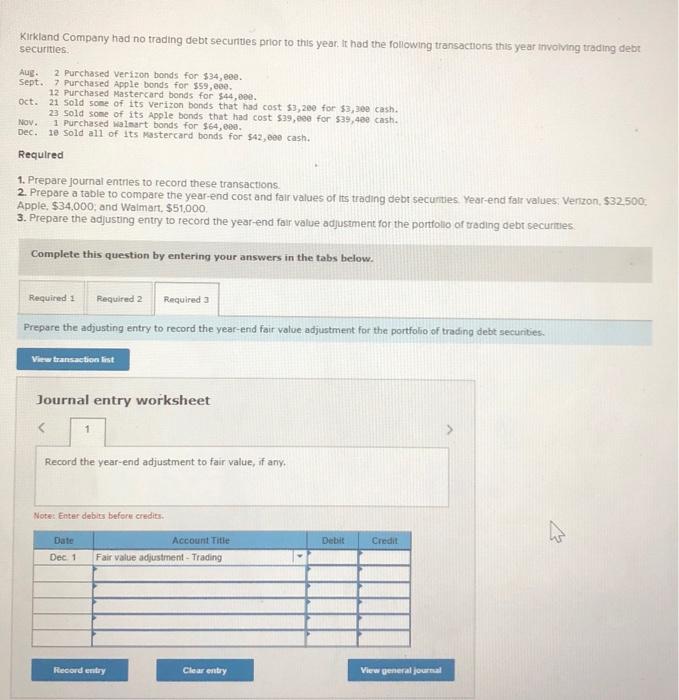

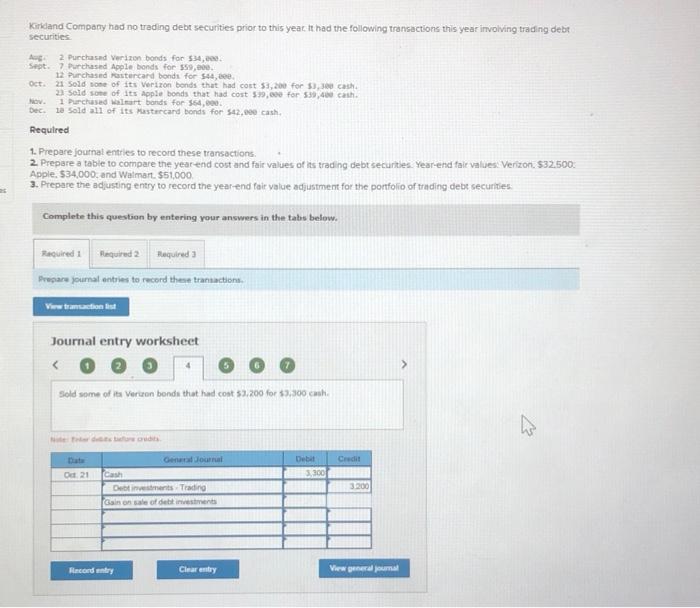

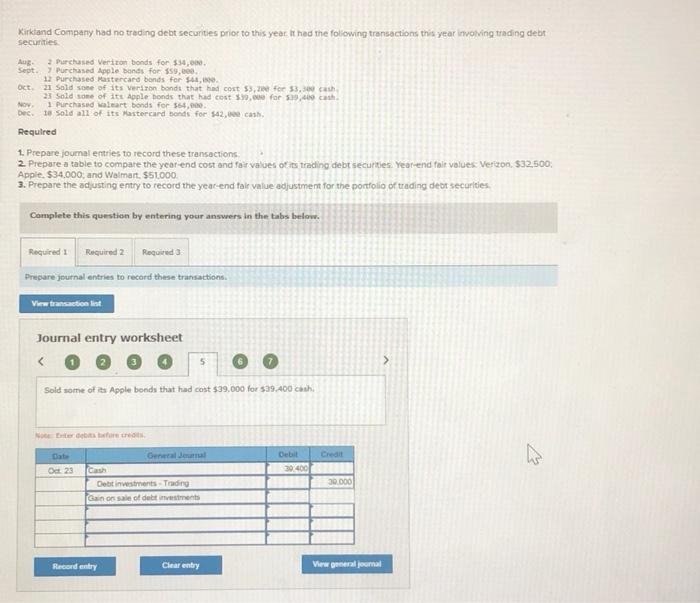

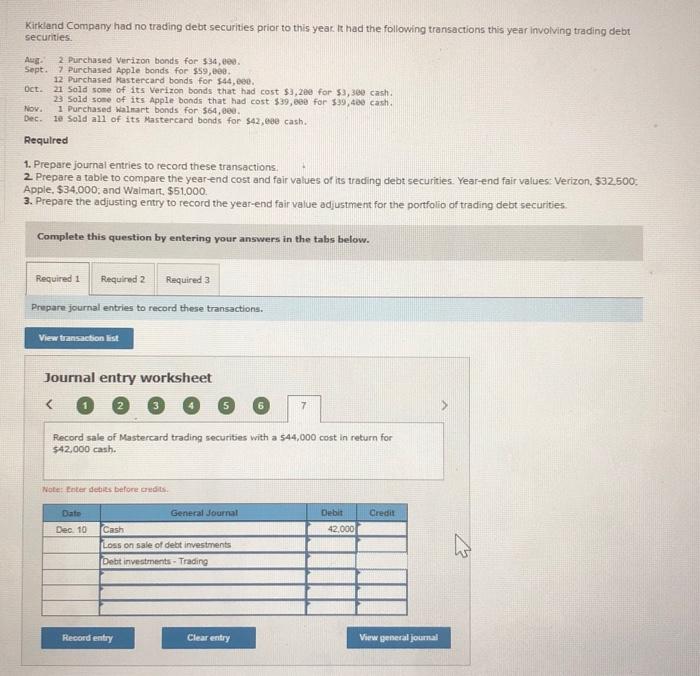

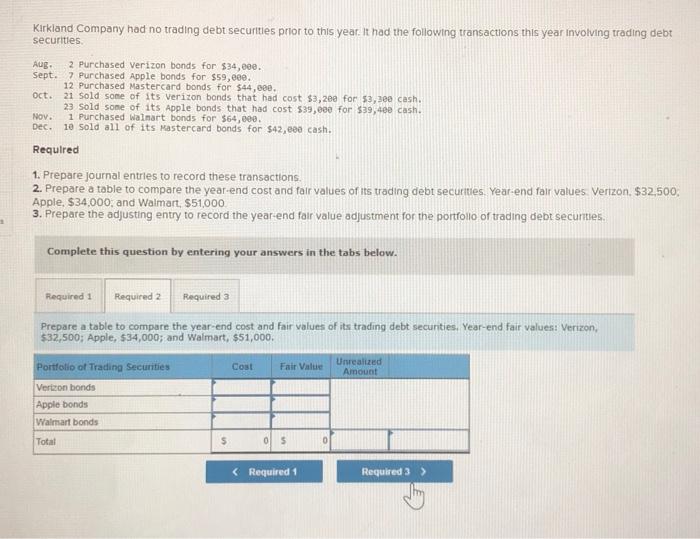

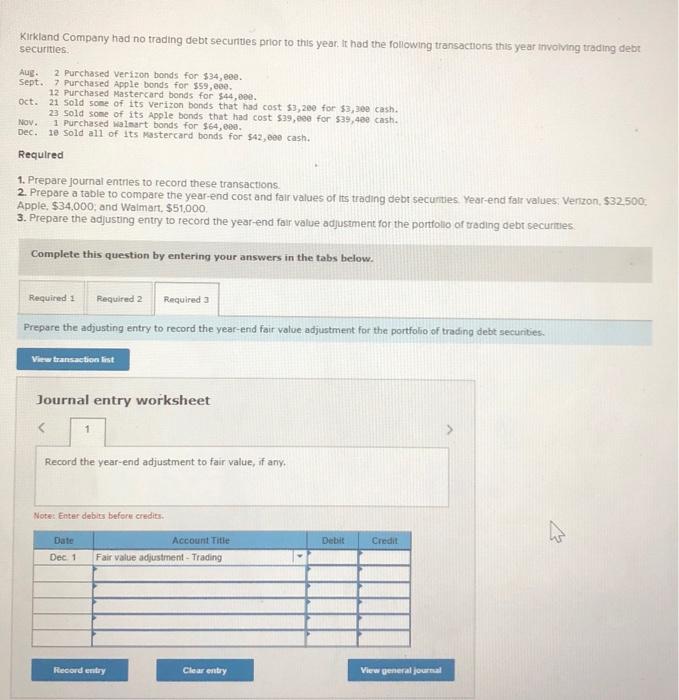

Kirkdand Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt securities Aug 2 Purchased Verizon bonds for 534,00 Sept.7 Purchased Apple bonds for 559,000 12 Purchased Mastercard bondt for 544,00 Oct. 21 Sold one of its Verizon bonds that had cost $3,200 for $3,300 cash 23 Sold one of its Apple bonds that had cost 599,000 for 539,400 cash 1 Purchased alat bands for $64.000 Dec. 10 Sold all of its Mastercard bonds for $42.000 cash Required 1. Prepare journal entries to record these transactions 2. Prepare a table to compare the yearend cost and Fair values of its trading debt securities Year-end fair values: Verizon. $32,500 Apple, $34,000, and Walmart. $51,000 3. Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities Complete this question by entering your answers in the tabs below. Required 1 Bequired 2 Required a Prepare youmal entries to record these transactions > Journal entry worksheet General Credit D Oct 23 30,400 30.000 Debt investments Trading Gain or sale of debt investments Record entry Clear entry View general journal Kirkland Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt securities. Aug 2. Purchased Verizon bonds for $34,000. Sept.7 Purchased Apple bonds for $59,000 12 Purchased Mastercard bonds for $44,000 Oct. 21 Sold some of its Verizon bonds that had cost $3,200 for $3,300 cash 23 Sold some of its Apple bonds that had cost $39,000 for $39,400 cash Nov. 1 Purchased Walmart bonds for $64.800 Dec. 10 Sold all of its Mastercard bonds for $42,000 cash. Required 1. Prepare journal entries to record these transactions 2. Prepare a table to compare the year end cost and fair values of its trading debt securities. Year-end fair values: Verizon, 532.500 Apple, $34.000 and Walmart. $51,000 3. Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries to record these transactions. View transaction list Journal entry worksheet Kirkland Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt Securities Aug. 2 Purchased Verizon bonds for $34, eee. Sept. 7 Purchased Apple bonds for 559, eee, 12 Purchased Mastercard bonds for $44,000. Oct. 21 Sold some of its verizon bonds that had cost $3,200 for $3,300 cash. 23 sold some of its Apple bonds that had cost $39,cee for $39,400 cash. NOV. 1 Purchased walmart bonds for $64,000 Dec. 1e sold all of its Mastercard bonds for $42,000 cash. Required 1. Prepare journal entries to record these transactions 2. Prepare a table to compare the year-end cost and fair values of tes trading debt securities Year-end falr values. Verizon, $32,500, Apple, $34.000, and Walmart. 551000 3. Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the adjusting entry to record the year-end Fair value adjustment for the portfolio of trading debt securities View transaction ist Journal entry worksheet 1 Record the year-end adjustment to fair value, if any. Note: Enter debits before credits Date Account Title Dec 1 Fair value adjustment - Trading w Debit Credit & Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started