Thank you for helping on my quiz about consumer mathematics

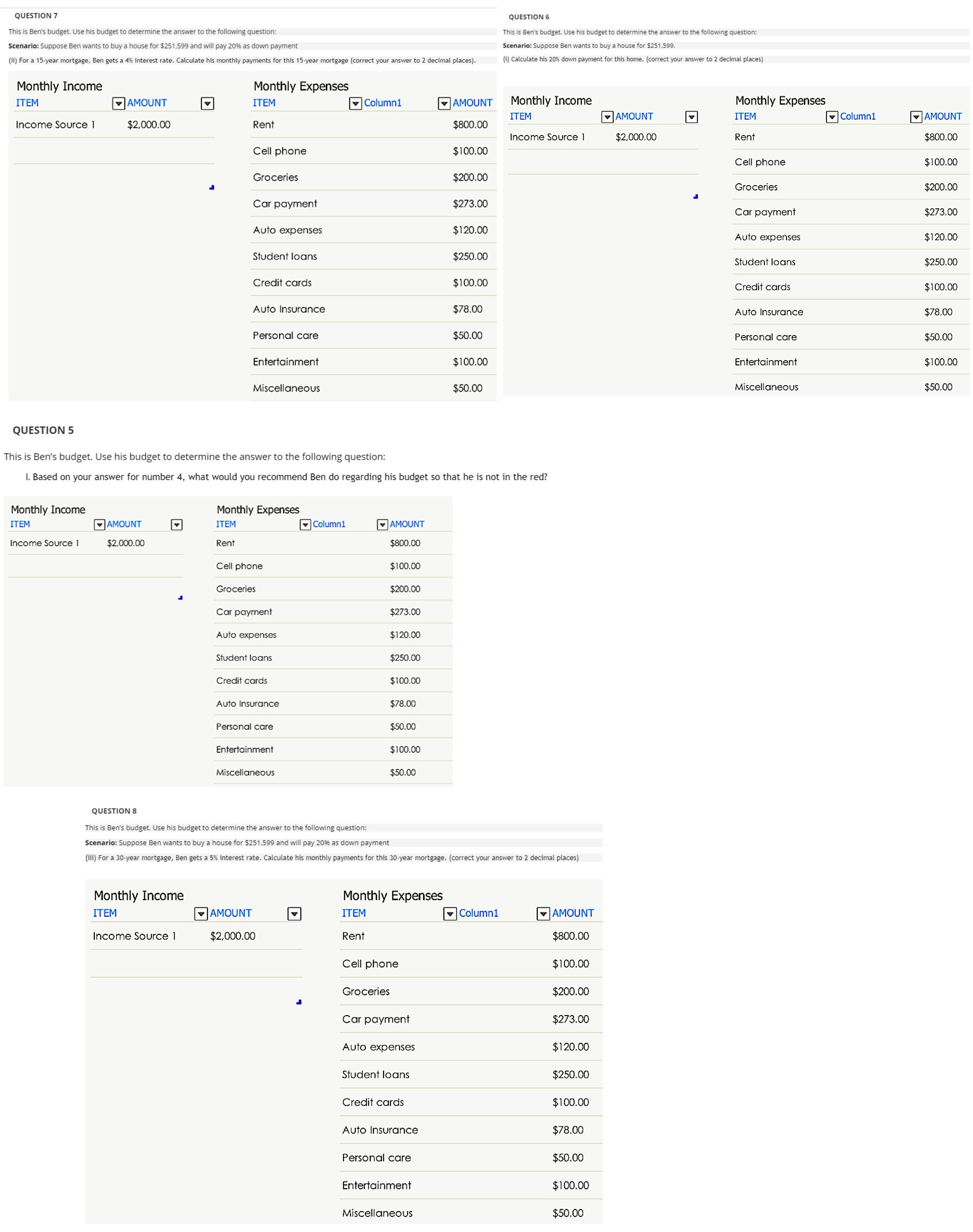

QUESTION 7 QUESTION 6 This is Ben's budget. Use his budget to determine the answer to the following question: This is Ben's budget. Use his budget to determine the answer to the following question: Scenario: Suppose Ben war down payment Scenario: Suppose Ben wants to buy a house for $251,59 (ii) For a 15-year mor ments for this 15-year mortgage (correct your answer (i) Calculate his 20% down payment for this home. (correct your answer to 2 decimal places) Monthly Income Monthly Expenses ITEM AMOUNT ITEM Column1 AMOUNT Monthly Income Monthly Expenses Income Source 1 $2,000.00 Rent $800.00 ITEM AMOUNT ITEM Column1 AMOUNT Income Source 1 $2,000.00 Rent $800.00 Cell phone $100.00 Cell phone $100.00 Groceries $200.00 Groceries $200.00 Car payment $273.00 Car payment $273.00 Auto expenses $120.00 Auto expenses $120.00 Student loans $250.00 Student loans $250.00 Credit cards $100.00 Credit cards $100.00 Auto Insurance $78.00 Auto Insurance $78.00 Personal care $50.00 Personal care $50.00 Entertainment $100.00 Entertainment $100.00 Miscellaneous $50.00 Miscellaneous $50.00 QUESTION 5 This is Ben's budget. Use his budget to determine the answer to the following question: 1. Based on your answer for number 4, what would you recommend Ben do regarding his budget so that he is not in the red? Monthly Income Monthly Expenses ITEM AMOUNT 4 ITEM Column1 AMOUNT Income Source 1 $2.000.00 Rent $800.00 Cell phone $100.00 Groceries $200.00 Car payment $273.00 Auto expenses $120.00 Student loans $250.00 Credit cards $100.00 Auto Insurance $78.00 Personal care $50.00 Entertainment $100.00 Miscellaneous $50.00 QUESTION 8 This is Ben's budget. Use his budget to d swer to the following question: Scenario: Suppose Ben wants to buy a hou 6 as down payment (iii) For a 30-year mortgage, Ben gets a 5% interes nts for this 30-year mortgage. (correct your answer to 2 decimal places) Monthly Income Monthly Expenses ITEM AMOUNT 4 ITEM Column1 AMOUNT Income Source 1 $2,000.00 Rent $800.00 Cell phone $100.00 Groceries $200.00 Car payment $273.00 Auto expenses $120.00 Student loans $250.00 Credit cards $100.00 Auto Insurance $78.00 Personal care $50.00 Entertainment $100.00 Miscellaneous $50.00