Thank you for the help, I will thumbs you up! :)

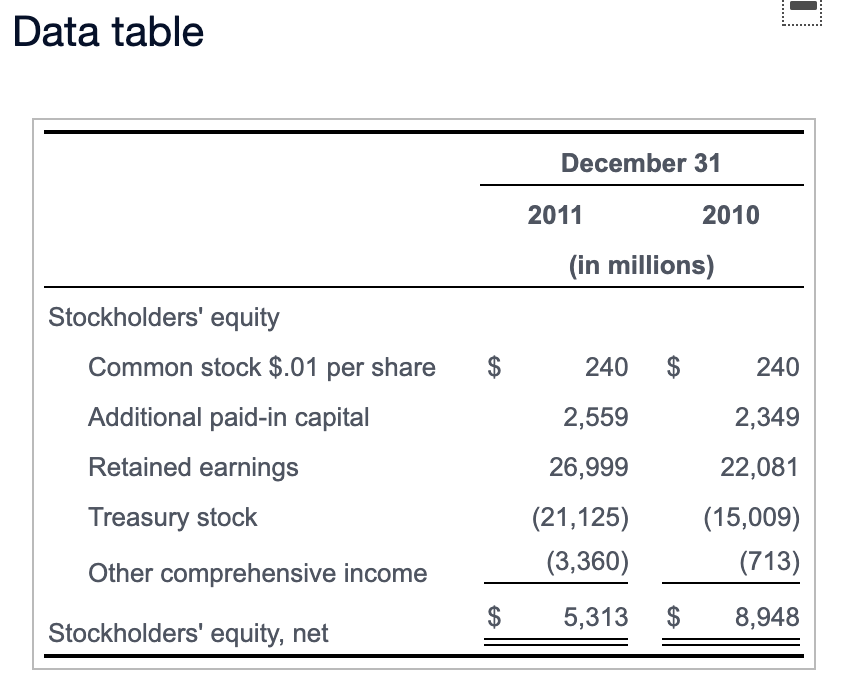

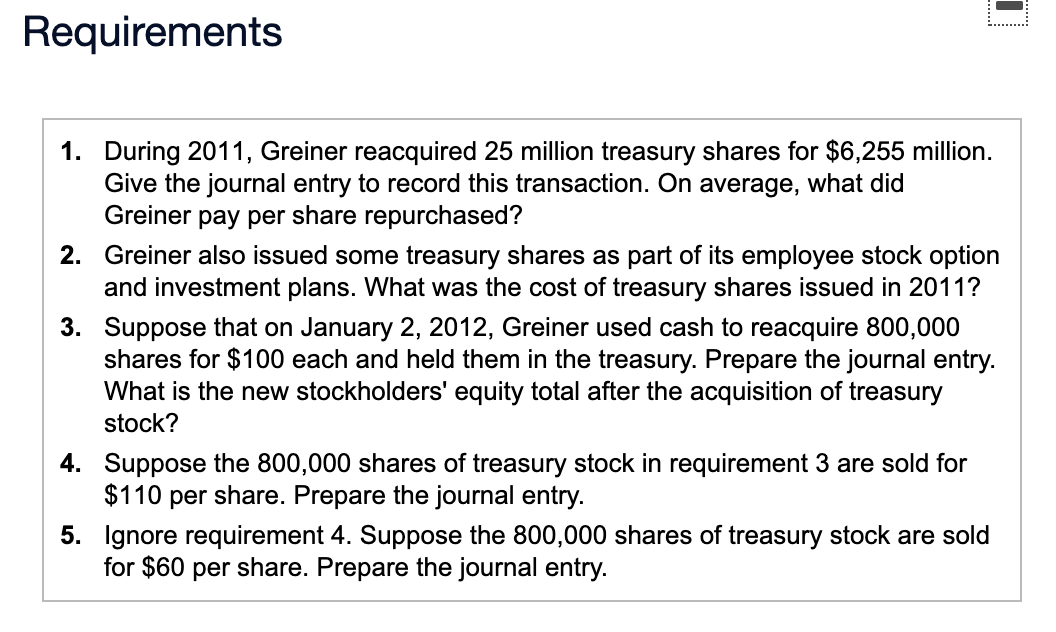

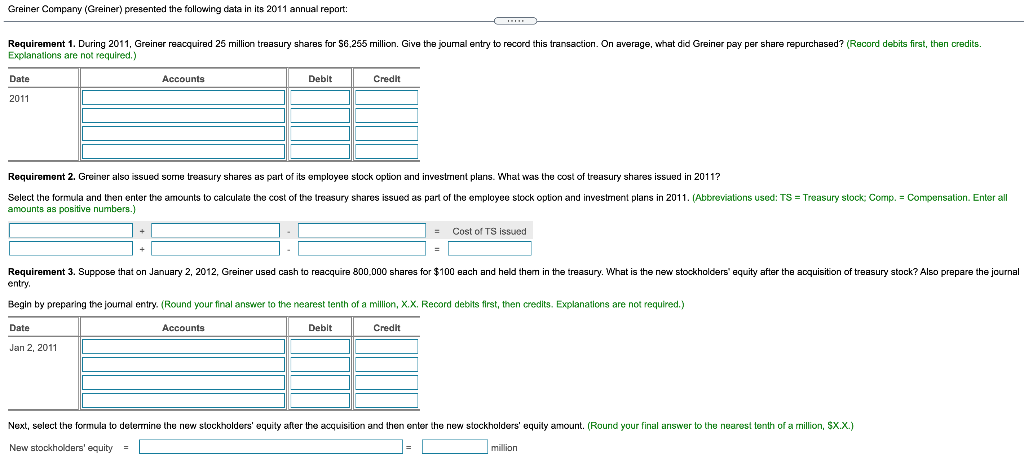

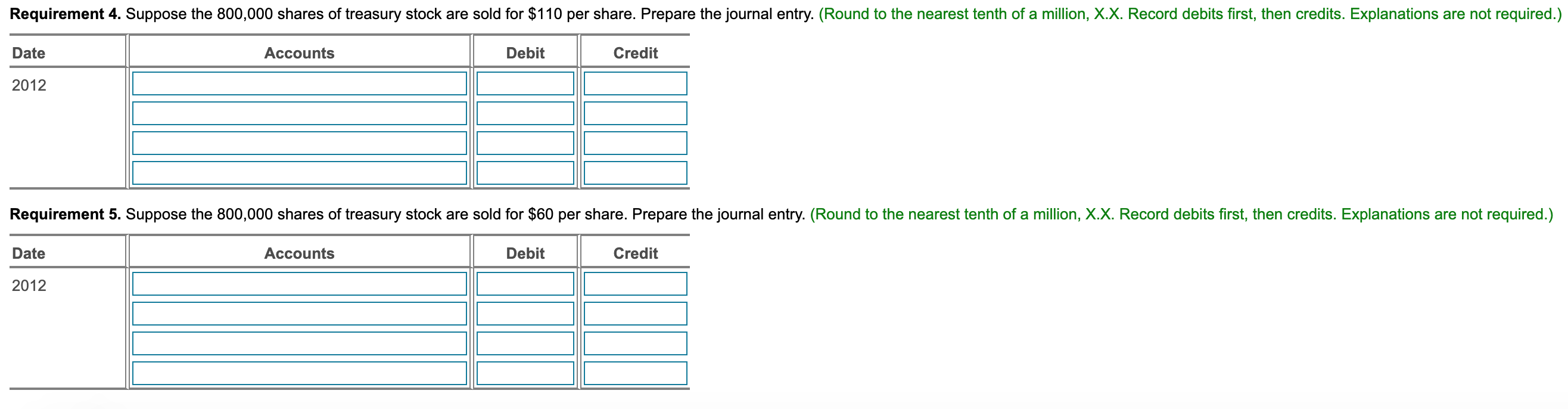

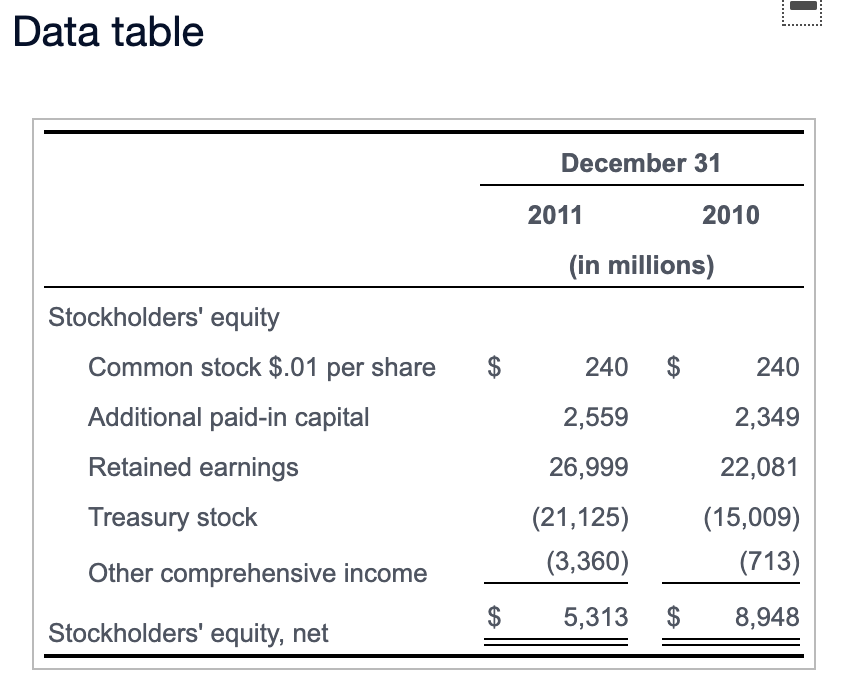

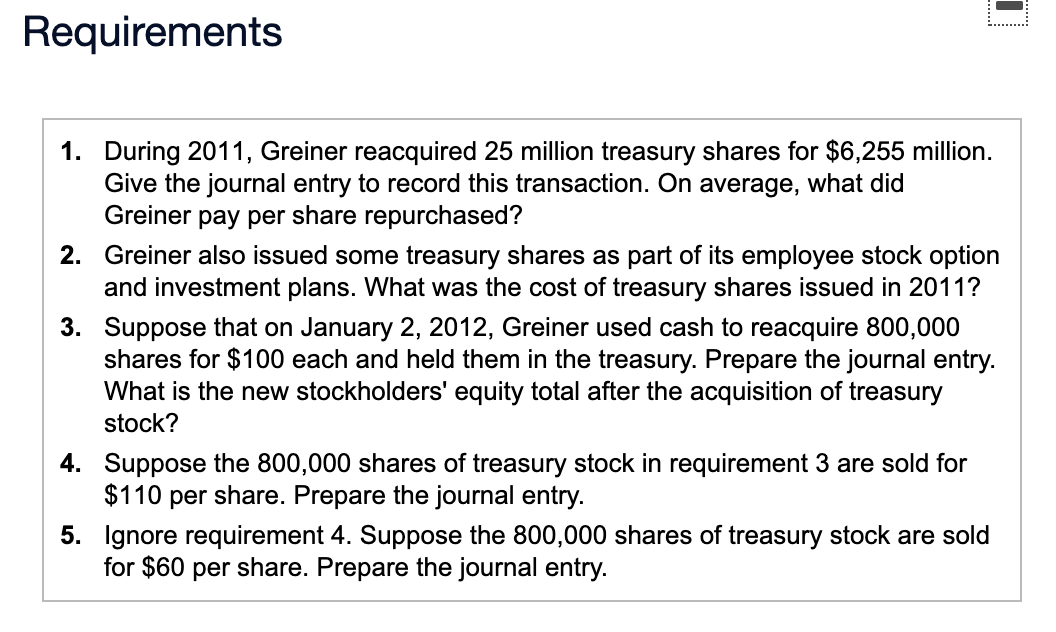

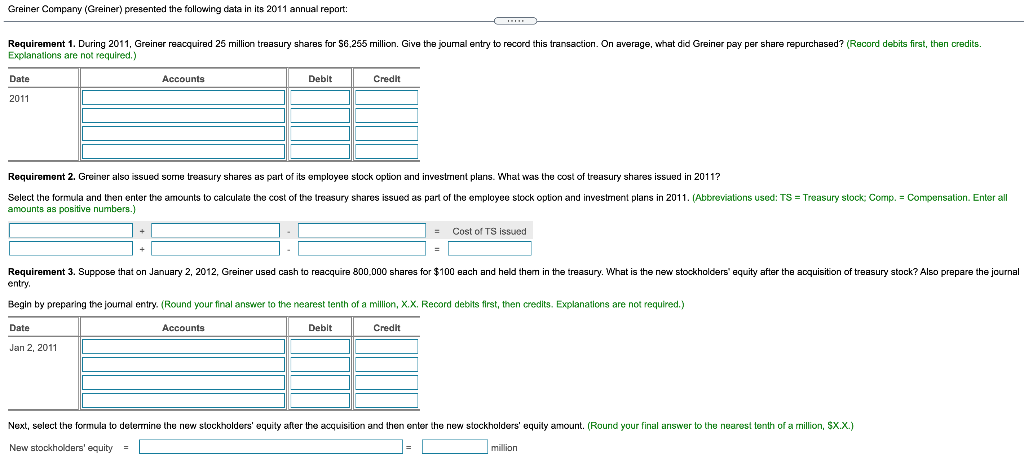

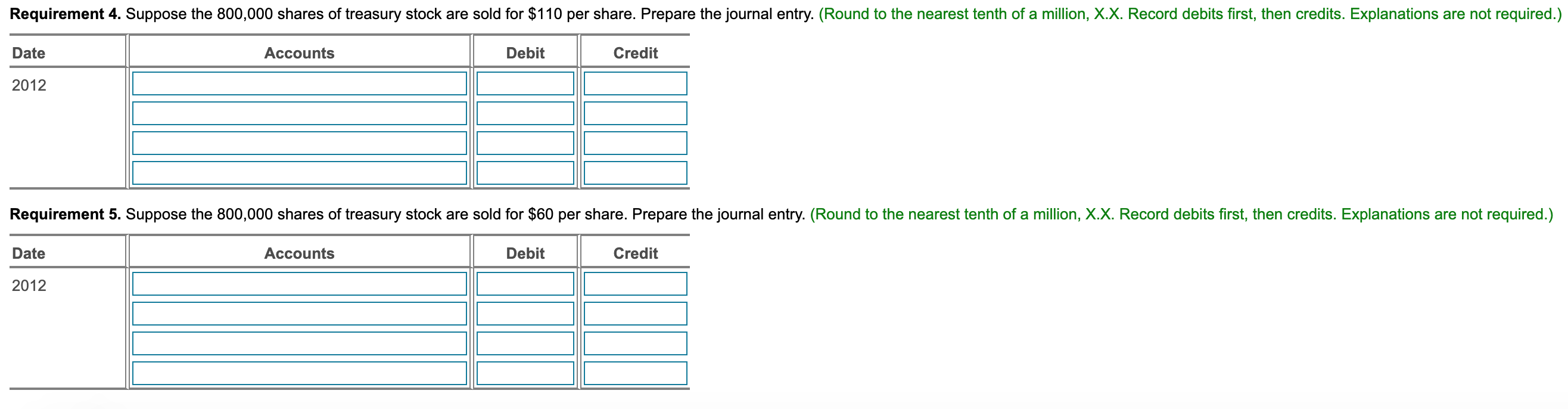

Data table December 31 2011 2010 (in millions) Stockholders' equity Common stock $.01 per share $ 240 $ 240 2,559 2,349 Additional paid-in capital Retained earnings 26,999 22,081 Treasury stock (21,125) (3,360) (15,009) (713) Other comprehensive income $ 5,313 $ 8,948 Stockholders' equity, net - Requirements 1. During 2011, Greiner reacquired 25 million treasury shares for $6,255 million. Give the journal entry to record this transaction. On average, what did Greiner pay per share repurchased? 2. Greiner also issued some treasury shares as part of its employee stock option and investment plans. What was the cost of treasury shares issued in 2011? 3. Suppose that on January 2, 2012, Greiner used cash to reacquire 800,000 shares for $100 each and held them in the treasury. Prepare the journal entry. What is the new stockholders' equity total after the acquisition of treasury stock? Suppose the 800,000 shares of treasury sto requirement 3 are sold for $110 per share. Prepare the journal entry. 5. Ignore requirement 4. Suppose the 800,000 shares of treasury stock are sold for $60 per share. Prepare the journal entry. Greiner Company (Greiner) presented the following data in its 2011 annual report: Requirement 1. During 2011, Greiner reacquired 25 million treasury shares for S6,255 million. Give the joumal entry to record this transaction. On average, what did Greiner pay per share repurchased? (Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit 2011 Requirement 2. Greiner also issued some treasury shares as part of its employee stock option and investment plans. What was the cost of treasury shares issued in 2011? Select the formula and then enter the amounts to calculate the cost of the treasury shares issued as part of the employee stock option and investment plans in 2011. (Abbreviations used: TS = Treasury stock: Comp. - Compensation. Enter all amounts as positive numbers.) = Cost of TS issued Requirement 3. Suppose that on January 2, 2012, Greiner used cash entry reacquire 800.000 shares for $100 each and held them in the treasury. What is the new stockholders' equity after the acquisition of treasury stock? Also prepare the journal Begin by preparing the journal entry. (Round your final answer to the nearest tenth of a million, X.X. Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit Jan 2, 2011 Next, select the formula to determine the new stockholders' equity after the acquisition and then enter the new stockholders' equity amount. (Round your final answer to the nearest tenth of a million, $X.X.) New stockholders' equity = million Requirement 4. Suppose the 800,000 shares of treasury stock are sold for $110 per share. Prepare the journal entry. (Round to the nearest tenth of a million, X.X. Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit 2012 Requirement 5. Suppose the 800,000 shares of treasury stock are sold for $60 per share. Prepare the journal entry. (Round to the nearest tenth of a million, X.X. Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit 2012