Answered step by step

Verified Expert Solution

Question

1 Approved Answer

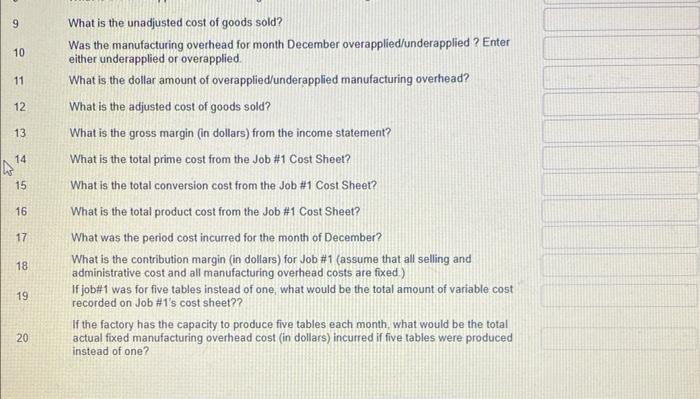

thank you for your effort! begin{tabular}{|l|l|l|l|} hline multicolumn{3}{|c|}{ Sales Revenue } hline multicolumn{2}{|c|}{ Debit } & multicolumn{2}{c|}{ Credit } hline & & Dec

thank you for your effort!

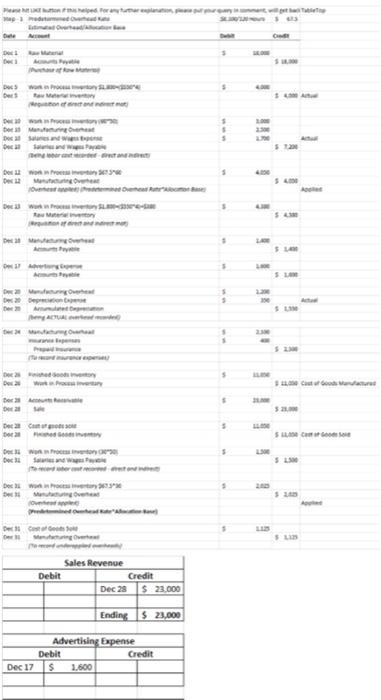

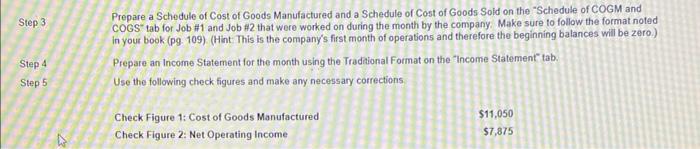

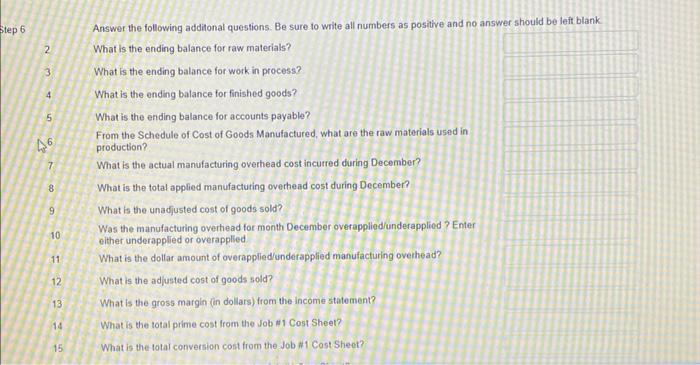

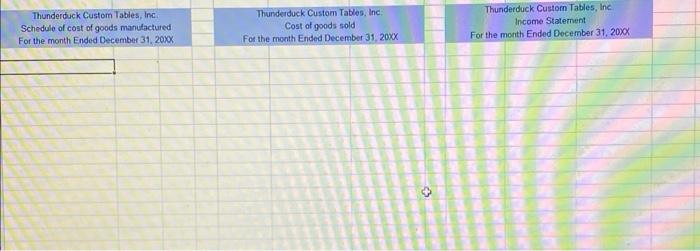

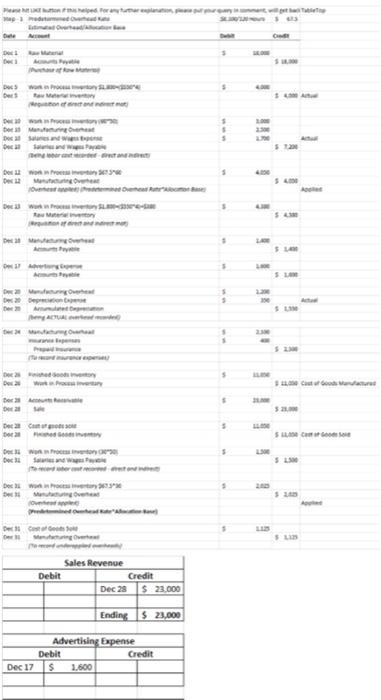

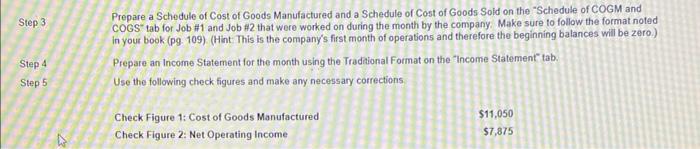

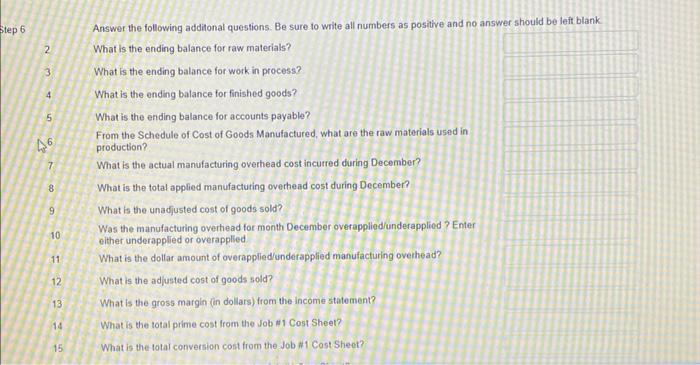

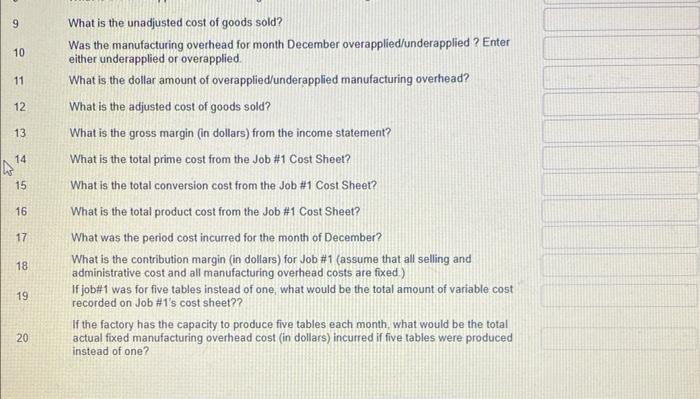

\begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Sales Revenue } \\ \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline & & Dec 23 & $23.000 \\ \hline & & & \\ \hline & & Ending & $23.000 \\ \hline \end{tabular} \begin{tabular}{|l|ll|l|l|} \hline \multicolumn{3}{|c|}{ Advertining Expense } \\ \hline \multicolumn{3}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Dec 17 & $ & 1.600 & & \\ \hline & & & \\ \hline \end{tabular} Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the "Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Make sure fo follow the format noted in your book. (p9. 109). (Hint. This is the company's first month of operations and therefore the beginning balances will be 2 ero.) Prepare an Income Statement for the month using the Tradnional Format on the "Income Statement" tab. Use the following check figures and make any necessary corrections Answer the following additonal questions. Be sure to write all numbers as positive and no answer should be leit blank What is the ending balance for raw materials? 5 What is the ending balance for work in process? 4 What is the ending balance for finished goods? 5 What is the ending balance for accounts payable? From the Schedule of Cost of Goods Manufactured, what are the raw materials used in production? 7. What is the actual manufacturing overhead cost incurred during December? 8 What is the total applied manufacturing overhead cost during December? 9 What is the unadjusted cost of goods sold? 10 Was the manufacturing overhead for month December overapplied/underapplied ? Enter 11 What is the dollat amount of overapplied/underapplied manufacturing ovehead? 12 What is the adjusted cost of goods sold? 13 What is the gross margin (in dollars) from the income statement? 14. What is the total prime cost from the Job 1 Cost Sheet? 15 What is the total conversion cost from the Job #1 Cost Sheet? 9 What is the unadjusted cost of goods sold? 10 Was the manufacturing overhead for month December overapplied/underapplied ? Enter either underapplied or overapplied. 11 What is the dollar amount of overapplied/underapplied manufacturing overhead? 12 What is the adjusted cost of goods sold? 13 What is the gross margin (in dollars) from the income statement? 14 What is the total prime cost from the Job #1 Cost Sheet? 15 What is the total conversion cost from the Job #1 Cost Sheet? 16 What is the total product cost from the Job #1 Cost Sheet? 17 What was the period cost incurred for the month of December? 18 What is the contribution margin (in dollars) for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.) 19 If job#1 was for five tables instead of one, what would be the total amount of variable cost recorded on Job #1's cost sheet?? 20 If the factory has the capacity to produce five tables each month, what would be the total actual fixed manufacturing overhead cost (in dollars) incurred if five tables were produced instead of one? Thunderduck Custom Tables, Ine: Thunderduck Custom Tables, Inc: Thunderduck Custom Tables, Ine Schedule of cost of goods manufactured Cost of goods sold Income Statement For the month Ended December 31, 2000 For the month Ended December 31, 200X For the manth Ended December 31, 2000 \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Sales Revenue } \\ \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline & & Dec 23 & $23.000 \\ \hline & & & \\ \hline & & Ending & $23.000 \\ \hline \end{tabular} \begin{tabular}{|l|ll|l|l|} \hline \multicolumn{3}{|c|}{ Advertining Expense } \\ \hline \multicolumn{3}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Dec 17 & $ & 1.600 & & \\ \hline & & & \\ \hline \end{tabular} Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the "Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Make sure fo follow the format noted in your book. (p9. 109). (Hint. This is the company's first month of operations and therefore the beginning balances will be 2 ero.) Prepare an Income Statement for the month using the Tradnional Format on the "Income Statement" tab. Use the following check figures and make any necessary corrections Answer the following additonal questions. Be sure to write all numbers as positive and no answer should be leit blank What is the ending balance for raw materials? 5 What is the ending balance for work in process? 4 What is the ending balance for finished goods? 5 What is the ending balance for accounts payable? From the Schedule of Cost of Goods Manufactured, what are the raw materials used in production? 7. What is the actual manufacturing overhead cost incurred during December? 8 What is the total applied manufacturing overhead cost during December? 9 What is the unadjusted cost of goods sold? 10 Was the manufacturing overhead for month December overapplied/underapplied ? Enter 11 What is the dollat amount of overapplied/underapplied manufacturing ovehead? 12 What is the adjusted cost of goods sold? 13 What is the gross margin (in dollars) from the income statement? 14. What is the total prime cost from the Job 1 Cost Sheet? 15 What is the total conversion cost from the Job #1 Cost Sheet? 9 What is the unadjusted cost of goods sold? 10 Was the manufacturing overhead for month December overapplied/underapplied ? Enter either underapplied or overapplied. 11 What is the dollar amount of overapplied/underapplied manufacturing overhead? 12 What is the adjusted cost of goods sold? 13 What is the gross margin (in dollars) from the income statement? 14 What is the total prime cost from the Job #1 Cost Sheet? 15 What is the total conversion cost from the Job #1 Cost Sheet? 16 What is the total product cost from the Job #1 Cost Sheet? 17 What was the period cost incurred for the month of December? 18 What is the contribution margin (in dollars) for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.) 19 If job#1 was for five tables instead of one, what would be the total amount of variable cost recorded on Job #1's cost sheet?? 20 If the factory has the capacity to produce five tables each month, what would be the total actual fixed manufacturing overhead cost (in dollars) incurred if five tables were produced instead of one? Thunderduck Custom Tables, Ine: Thunderduck Custom Tables, Inc: Thunderduck Custom Tables, Ine Schedule of cost of goods manufactured Cost of goods sold Income Statement For the month Ended December 31, 2000 For the month Ended December 31, 200X For the manth Ended December 31, 2000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started