Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you for your help A Section 1035 exchange has a direct impact on A) the taxability of any cash transferred from one contract to

thank you for your help

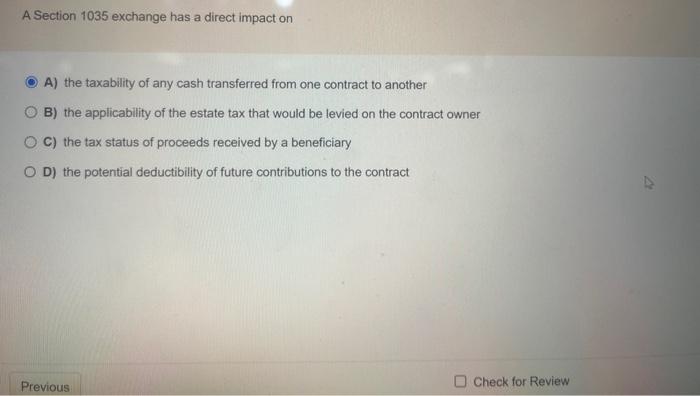

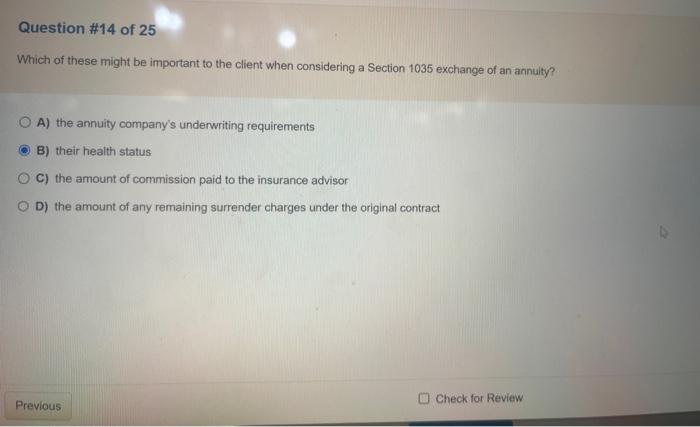

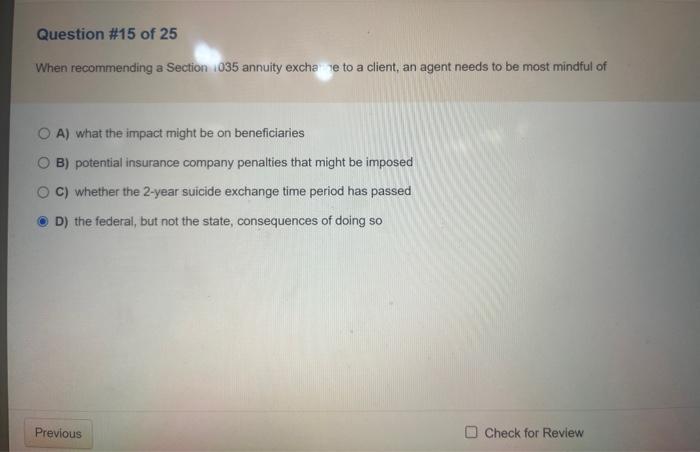

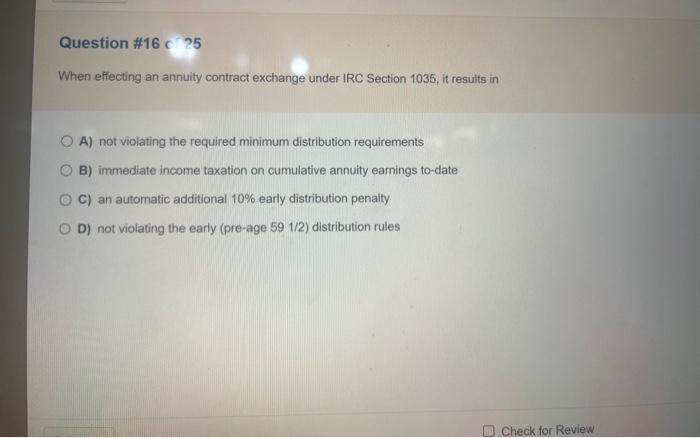

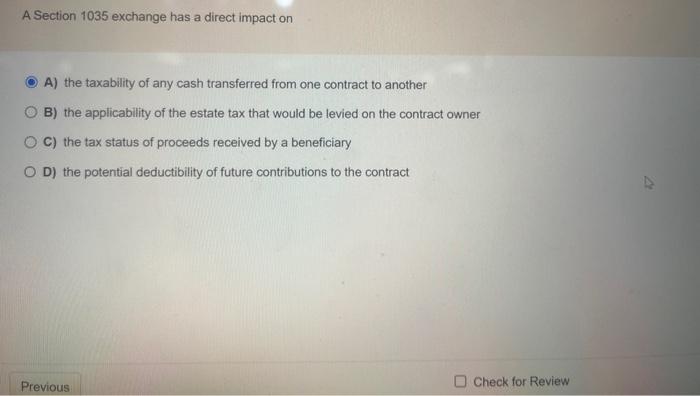

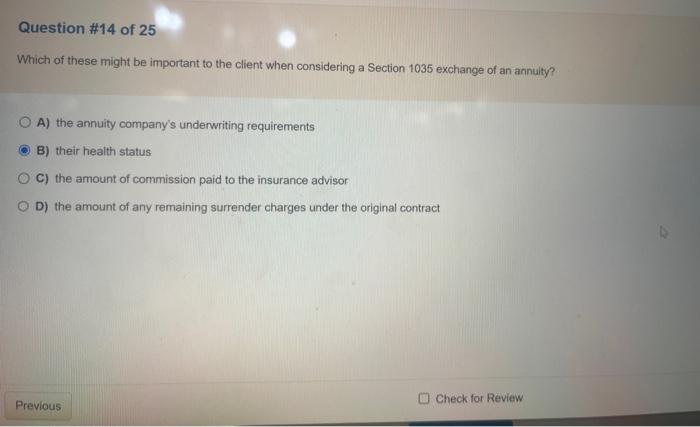

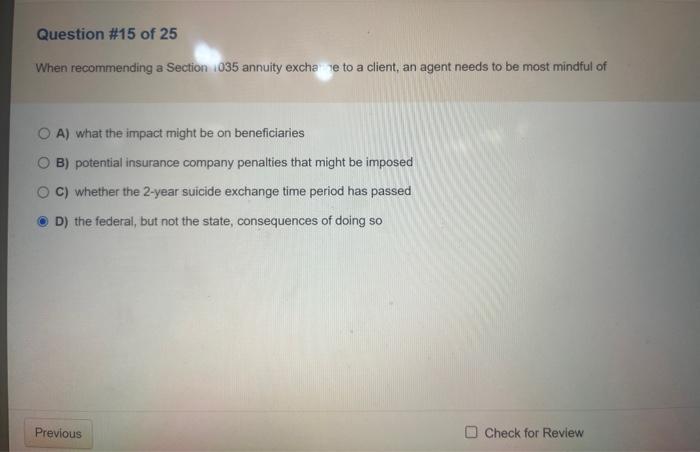

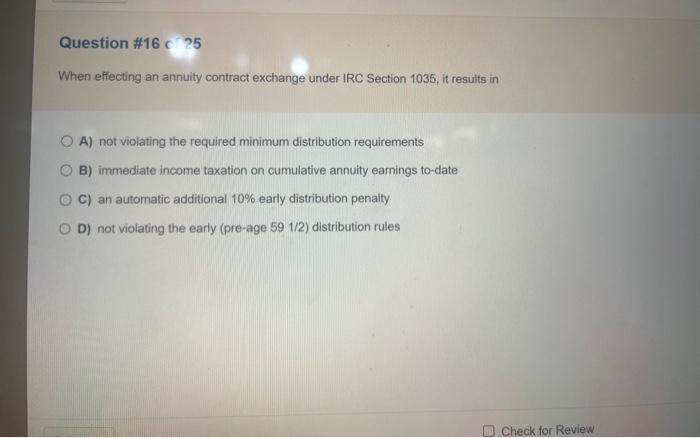

A Section 1035 exchange has a direct impact on A) the taxability of any cash transferred from one contract to another B) the applicability of the estate tax that would be levied on the contract owner C) the tax status of proceeds received by a beneficiary D) the potential deductibility of future contributions to the contract Which of these might be important to the client when considering a Section 1035 exchange of an annuity? A) the annuity company's underwriting requirements B) their health status C) the amount of cornmission paid to the insurance advisor D) the amount of any remaining surrender charges under the original contract When recommending a Section 1035 annuity excha ye to a client, an agent needs to be most mindful of A) what the impact might be on beneficiaries B) potential insurance company penalties that might be imposed C) whether the 2-year suicide exchange time period has passed D) the federal, but not the state, consequences of doing so Check for Review When effecting an annuity contract exchange under IRC Section 1035, it resuits in A) not violating the required minimum distribution requirements B) immedlate income taxation on cumulative annuity eamings to-date C) an automatic additional 10% early distribution penalty D) not violating the early (pre-age 591/2 ) distribution rules

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started