Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you in advance! What is the present value of a $15,000 lump sum that you will receive three years from now and that was

Thank you in advance!

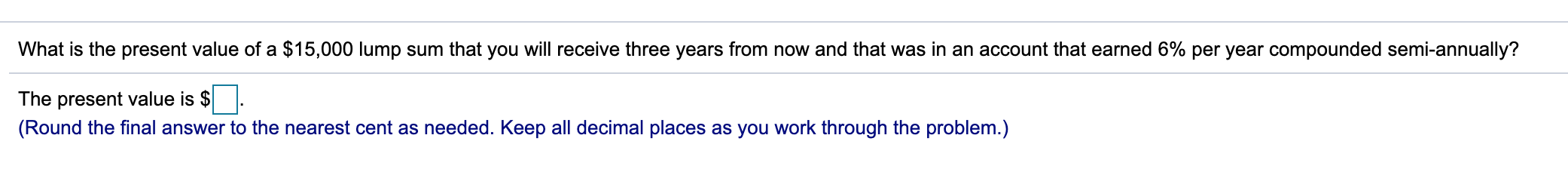

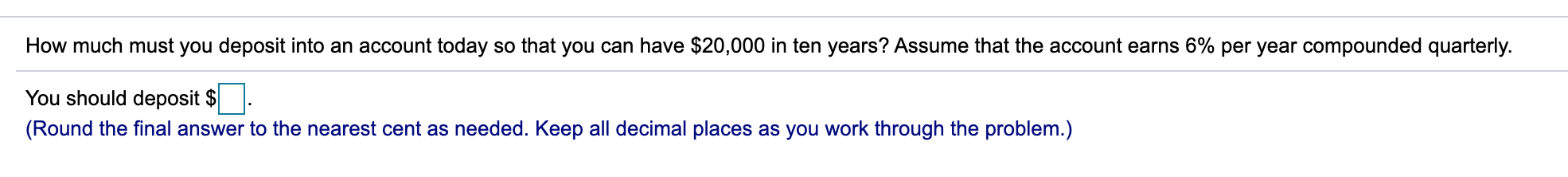

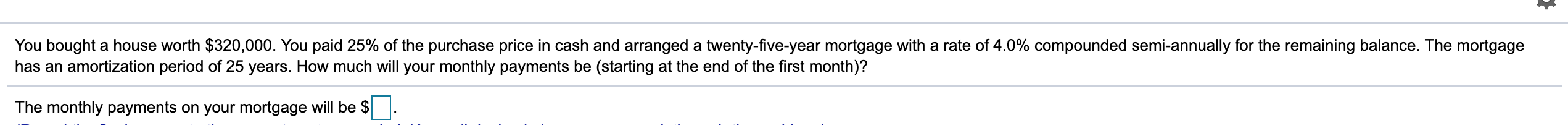

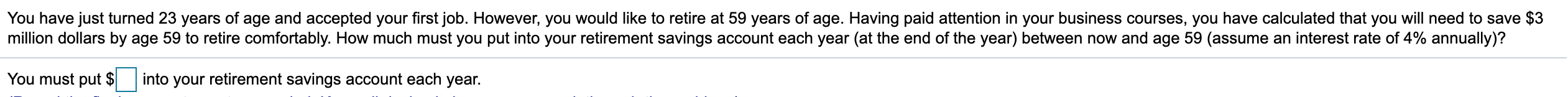

What is the present value of a $15,000 lump sum that you will receive three years from now and that was in an account that earned 6% per year compounded semi-annually? The present value is $ (Round the final answer to the nearest cent as needed. Keep all decimal places as you work through the problem.) How much must you deposit into an account today so that you can have $20,000 in ten years? Assume that the account earns 6% per year compounded quarterly. You should deposit $ (Round the final answer to the nearest cent as needed. Keep all decimal places as you work through the problem.) > You bought a house worth $320,000. You paid 25% of the purchase price in cash and arranged a twenty-five-year mortgage with a rate of 4.0% compounded semi-annually for the remaining balance. The mortgage has an amortization period of 25 years. How much will your monthly payments be (starting at the end of the first month)? The monthly payments on your mortgage will be $0. You have just turned 23 years of age and accepted your first job. However, you would like to retire at 59 years of age. Having paid attention in your business courses, you have calculated that you will need to save $3 million dollars by age 59 to retire comfortably. How much must you put into your retirement savings account each year (at the end of the year) between now and age 59 (assume an interest rate of 4% annually)? You must put $ into your retirement savings account each yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started