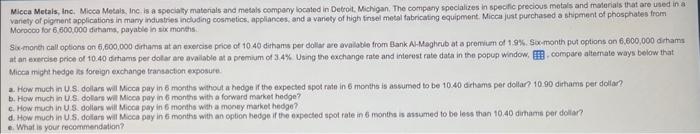

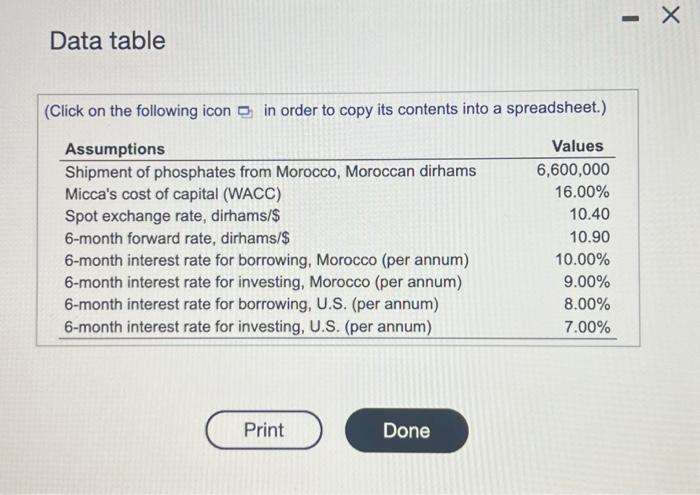

Micca Metals, Inc. Misce Mezals, inc is a speciaty materals and metals compory located in Deteot, Michigan. The compory speclalizes in specif precious motals and inateriais that are used in a vanety of pigment applications in many industrises incloding cosmetics, applianses, and a variety of high tinsel motal tabricating equipment, Micca just purchased a shipment of phosphates from Morocoo for 6,600,000 dithams, payable in six month. Six-monct call options on 6,600,000 dirhams at an exercise price of 10.40 dichams per dollur ave avaloble from Bank A-Maghrub at a premiam of 19%. So.month put options an 6,600,000 dithams at an exereise price of 10.40 dithams per dolar are avaliable at a premium of 3.4% Using the exchange rate and interest rate data in the popup widow, Micca might hedge Is foreign exchange transecton exposure. 2. How much in U.S. dollars wil Mcca pay in 6 moniths wethou a hedge it the expected spot rate in 6 months is assumed to be 10.40 dirhams per dollar 10.90 dithams per doliar? b. How much in U.S. dolars will Micos pay in 6 months with a forward market hodge? c. How much in US doliars will Micca pay in 6 morthe wath a moovy markot hedge? d. How much in U.5, dolare will Micca pay in 5 monthe with an opbon hodge if the expected spot rale in 6 montts is assumed to be less than 10.40 dirhame per dollar? e. What is your recommendatian? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Micca Metals, Inc. Misce Mezals, inc is a speciaty materals and metals compory located in Deteot, Michigan. The compory speclalizes in specif precious motals and inateriais that are used in a vanety of pigment applications in many industrises incloding cosmetics, applianses, and a variety of high tinsel motal tabricating equipment, Micca just purchased a shipment of phosphates from Morocoo for 6,600,000 dithams, payable in six month. Six-monct call options on 6,600,000 dirhams at an exercise price of 10.40 dichams per dollur ave avaloble from Bank A-Maghrub at a premiam of 19%. So.month put options an 6,600,000 dithams at an exereise price of 10.40 dithams per dolar are avaliable at a premium of 3.4% Using the exchange rate and interest rate data in the popup widow, Micca might hedge Is foreign exchange transecton exposure. 2. How much in U.S. dollars wil Mcca pay in 6 moniths wethou a hedge it the expected spot rate in 6 months is assumed to be 10.40 dirhams per dollar 10.90 dithams per doliar? b. How much in U.S. dolars will Micos pay in 6 months with a forward market hodge? c. How much in US doliars will Micca pay in 6 morthe wath a moovy markot hedge? d. How much in U.5, dolare will Micca pay in 5 monthe with an opbon hodge if the expected spot rale in 6 montts is assumed to be less than 10.40 dirhame per dollar? e. What is your recommendatian? Data table (Click on the following icon in order to copy its contents into a spreadsheet.)