Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you Problems Portion of Test. There are six problems. Each one is worth the score indicated next to the problem number. Show all work

thank you

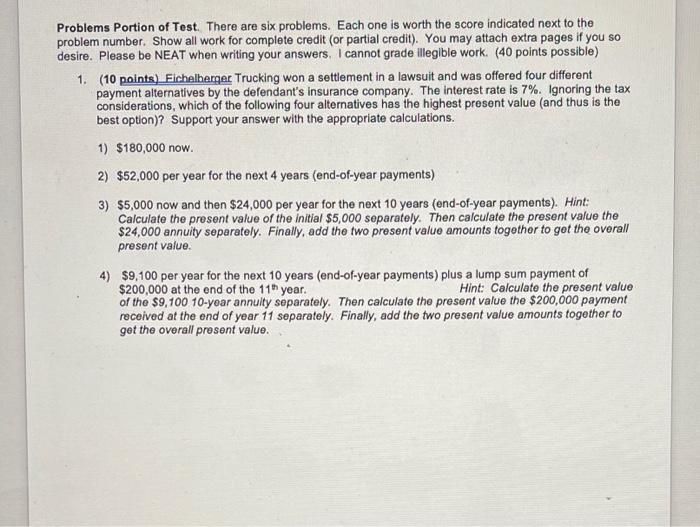

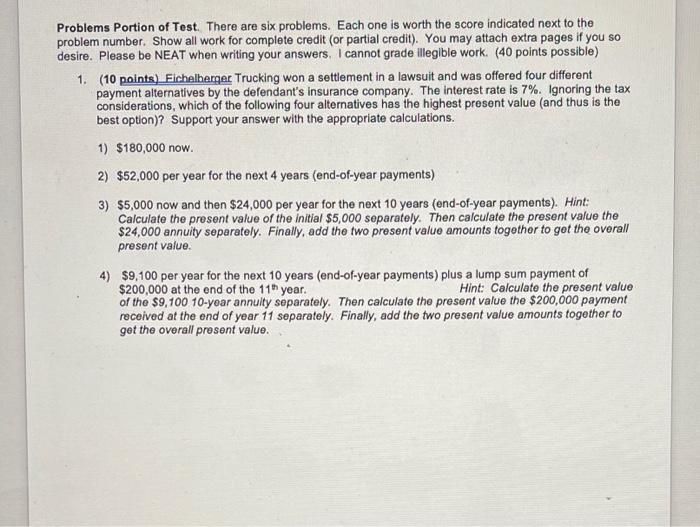

Problems Portion of Test. There are six problems. Each one is worth the score indicated next to the problem number. Show all work for complete credit (or partial credit). You may attach extra pages if you so desire. Please be NEAT when writing your answers. I cannot grade illegible work. (40 points possible) 1. (10 points) Fichelberger Trucking won a settlement in a lawsuit and was offered four different payment alternatives by the defendant's insurance company. The interest rate is 7%. Ignoring the tax considerations, which of the following four alternatives has the highest present value and thus is the best option)? Support your answer with the appropriate calculations. 1) $180,000 now. 2) $52,000 per year for the next 4 years (end-of-year payments) 3) $5,000 now and then $24,000 per year for the next 10 years (end-of-year payments). Hint: Calculate the present value of the initial $5,000 separately. Then calculate the present value the $24,000 annuity separately. Finally, add the two prosent value amounts togother to get the overall present value 4) $9,100 per year for the next 10 years (end-of-year payments) plus a lump sum payment of $200,000 at the end of the 11h year. Hint: Calculate the present value of the $9,100 10-year annuity separately. Then calculate the present value the $200,000 payment received at the end of year 11 separately. Finally, add the two present value amounts together to get the overall present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started