Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you to Finance Expert for the chart! By looking at Tesla Financials i can see that the ratios may not look so good in

Thank you to Finance Expert for the chart!

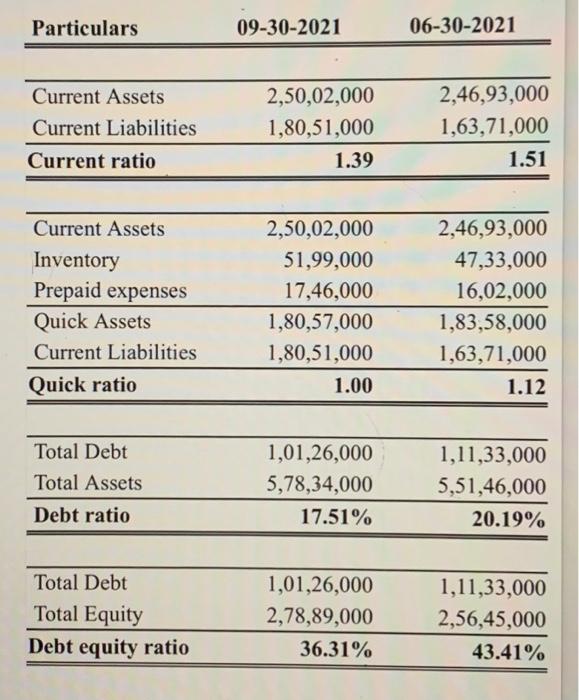

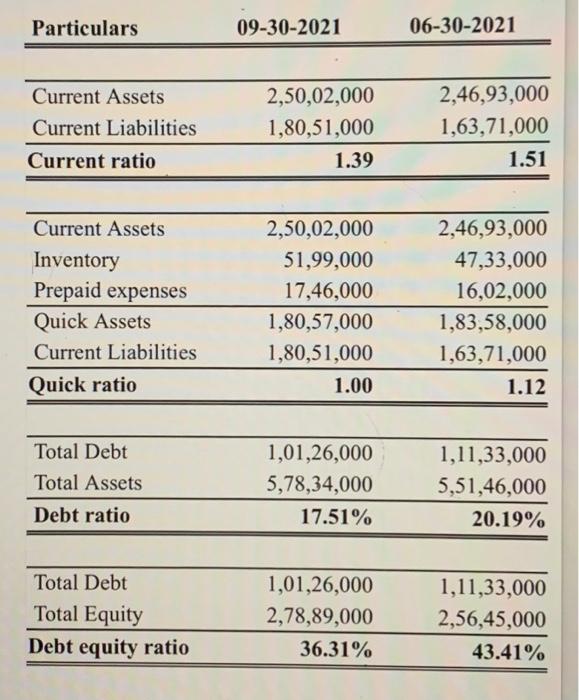

Particulars 09-30-2021 06-30-2021 Current Assets Current Liabilities Current ratio 2,50,02,000 1,80,51,000 1.39 2,46,93,000 1,63,71,000 1.51 Current Assets Inventory Prepaid expenses Quick Assets Current Liabilities Quick ratio 2,50,02,000 51,99,000 17,46,000 1,80,57,000 1,80,51,000 1.00 2,46,93,000 47,33,000 16,02,000 1,83,58,000 1,63,71,000 1.12 Total Debt Total Assets 1,01,26,000 5,78,34,000 17.51% 1,11,33,000 5,51,46,000 20.19% Debt ratio Total Debt Total Equity Debt equity ratio 1,01,26,000 2,78,89,000 36.31% 1,11,33,000 2,56,45,000 43.41% By looking at Tesla Financials i can see that the ratios may not look so good in current ratio and quick ratio but the company is investing in car factory in Germany, which is good. I need help in how to word how the company is doing. Could you help me explaine the ratios?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started