Thank you very much and please answer in a table format like a data table with rows and colums to make clear. Will upvote and share

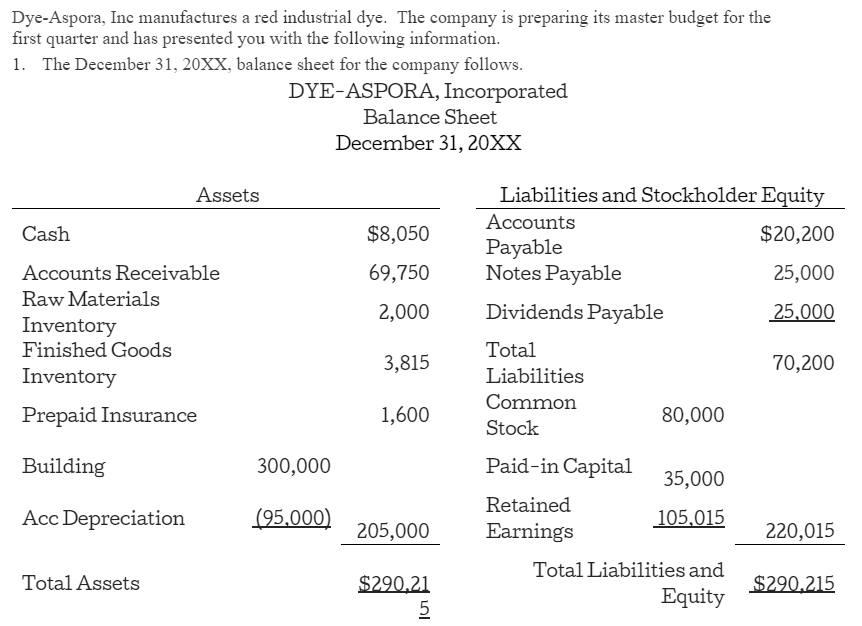

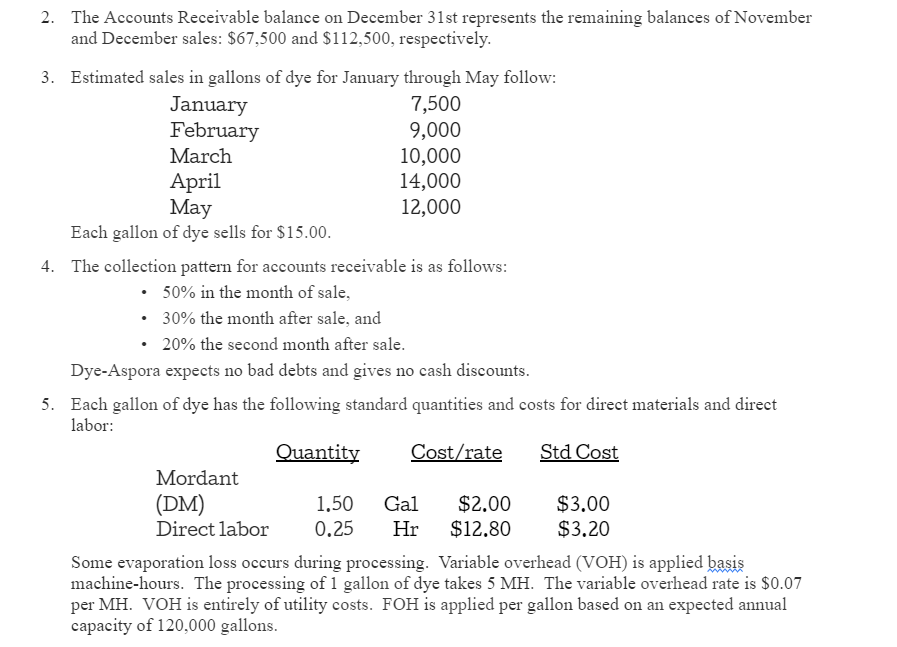

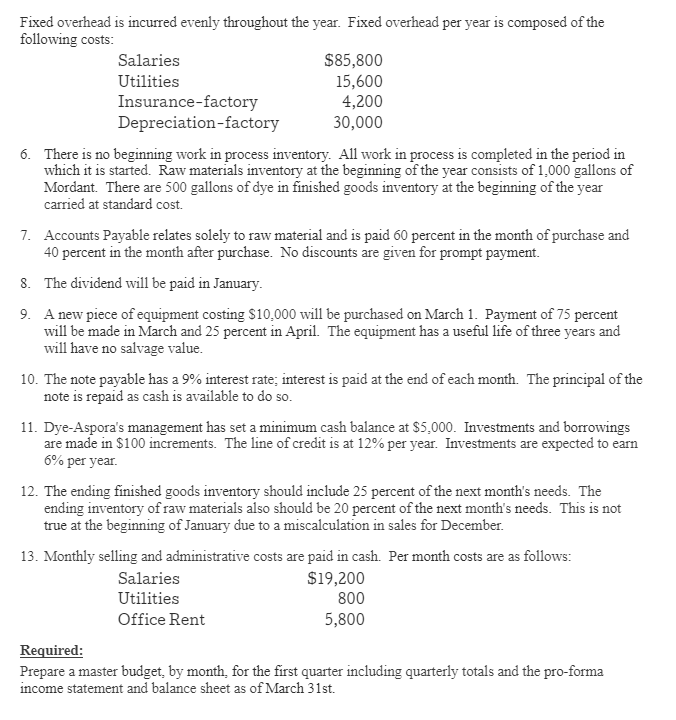

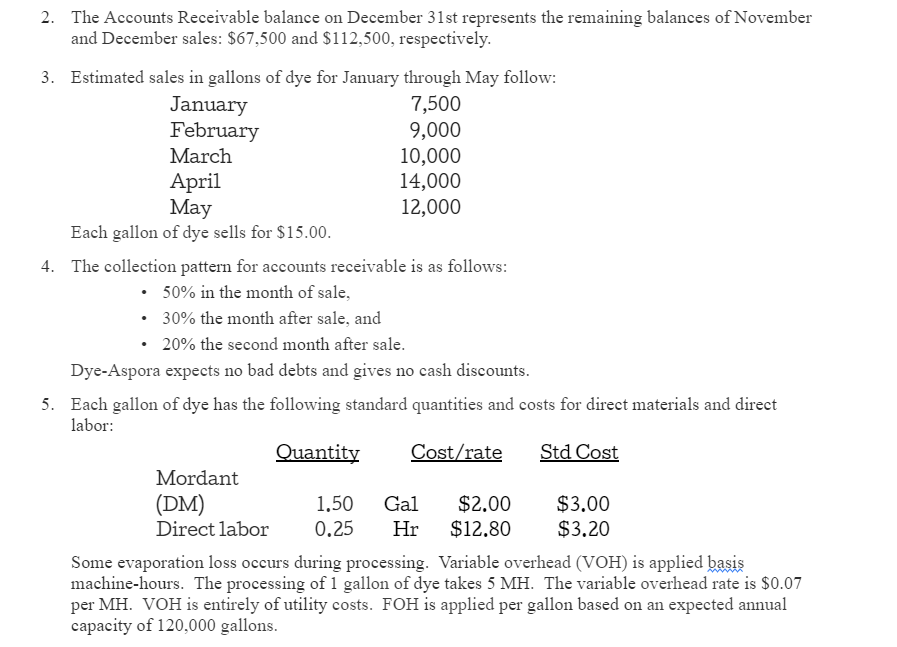

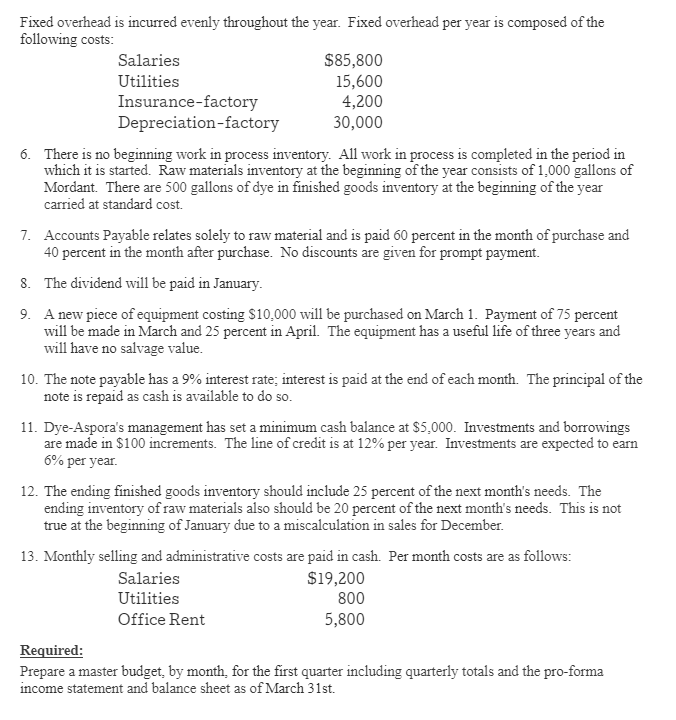

Dye-Aspora, Inc manufactures a red industrial dye. The company is preparing its master budget for the first quarter and has presented you with the following information. 1. The December 31, 20XX, balance sheet for the company follows. 2. The Accounts Receivable balance on December 31 st represents the remaining balances of November and December sales: $67,500 and $112,500, respectively. 3. Estimated sales in gallons of dye for January through May follow: Each gallon of dye sells for $15.00. 4. The collection pattern for accounts receivable is as follows: - 50% in the month of sale, - 30% the month after sale, and - 20% the second month after sale. Dye-Aspora expects no bad debts and gives no cash discounts. 5. Each gallon of dye has the following standard quantities and costs for direct materials and direct labor: Some evaporation loss occurs during processing. Variable overhead (VOH) is applied basis machine-hours. The processing of 1 gallon of dye takes 5MH. The variable overhead rate is $0.07 per MH. VOH is entirely of utility costs. FOH is applied per gallon based on an expected annual capacity of 120,000 gallons. Fixed overhead is incurred evenly throughout the year. Fixed overhead per year is composed of the following costs: 6. There is no beginning work in process inventory. All work in process is completed in the period in which it is started. Raw materials inventory at the beginning of the year consists of 1,000 gallons of Mordant. There are 500 gallons of dye in finished goods inventory at the beginning of the year carried at standard cost. 7. Accounts Payable relates solely to raw material and is paid 60 percent in the month of purchase and 40 percent in the month after purchase. No discounts are given for prompt payment. 8. The dividend will be paid in January. 9. A new piece of equipment costing $10,000 will be purchased on March 1. Payment of 75 percent will be made in March and 25 percent in April. The equipment has a useful life of three years and will have no salvage value. 10. The note payable has a 9% interest rate; interest is paid at the end of each month. The principal of the note is repaid as cash is available to do so. 11. Dye-Aspora's management has set a minimum cash balance at $5,000. Investments and borrowings are made in $100 increments. The line of credit is at 12% per year. Investments are expected to earn 6% per year. 12. The ending finished goods inventory should include 25 percent of the next month's needs. The ending inventory of raw materials also should be 20 percent of the next month's needs. This is not true at the beginning of January due to a miscalculation in sales for December. 13. Monthly selling and administrative costs are paid in cash. Per month costs are as follows: Required: Prepare a master budget, by month, for the first quarter including quarterly totals and the pro-forma income statement and balance sheet as of March 31st