Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you ! You need the following information for the next 2 questions (18 and 19). 18) Consider a bond with a market price of

Thank you !

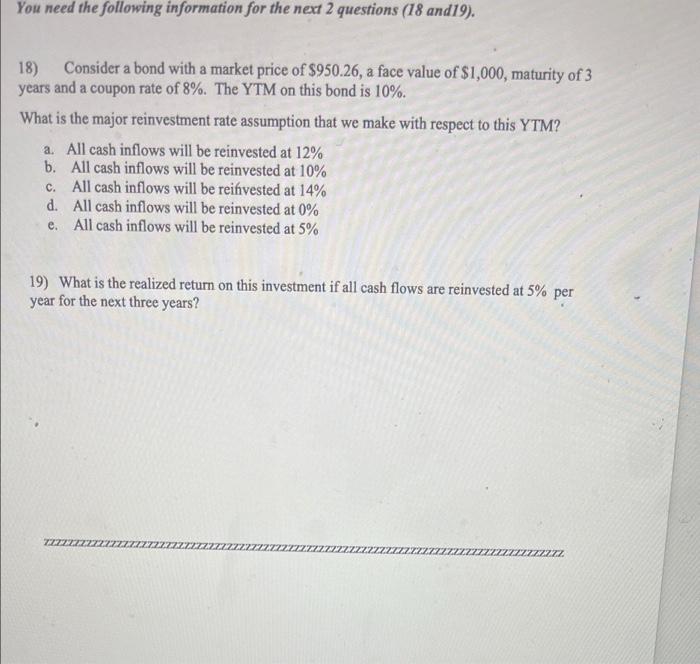

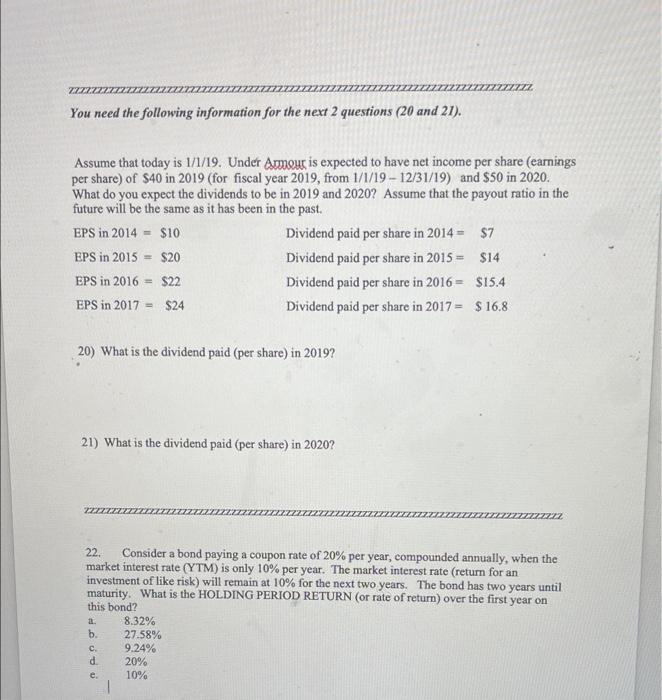

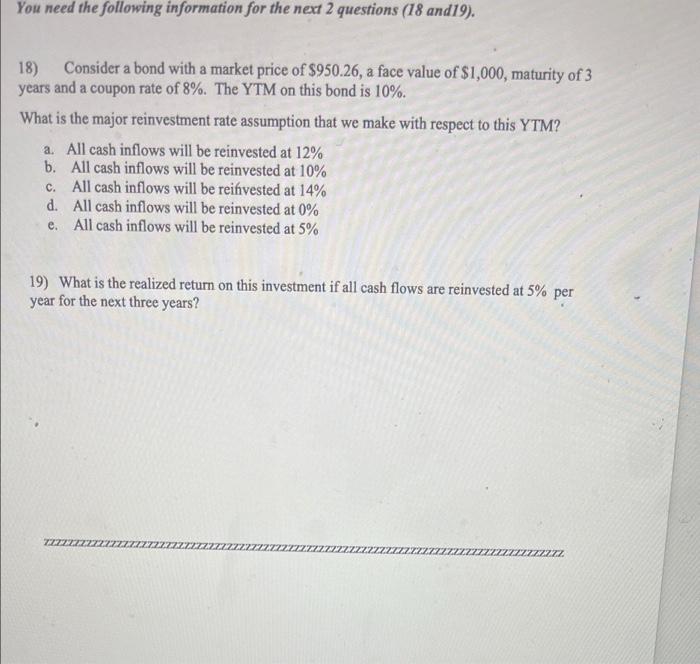

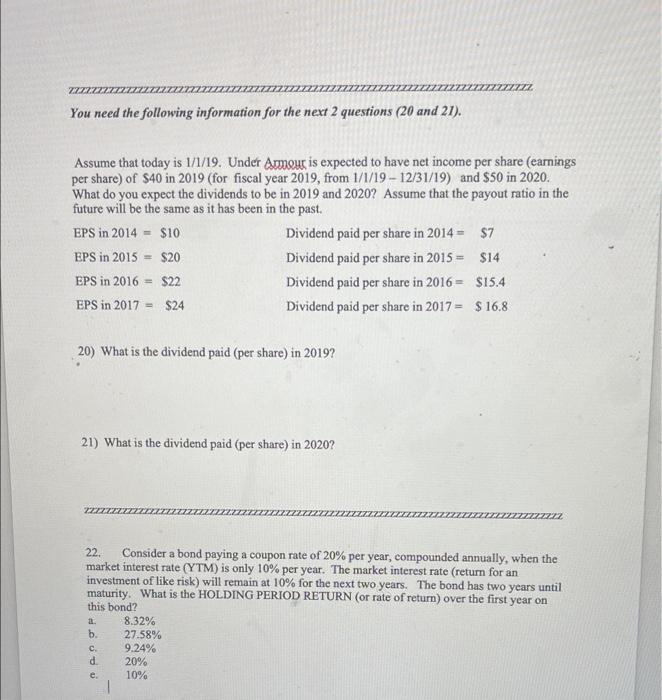

You need the following information for the next 2 questions (18 and 19). 18) Consider a bond with a market price of $950.26, a face value of $1,000, maturity of 3 years and a coupon rate of 8%. The YTM on this bond is 10%. What is the major reinvestment rate assumption that we make with respect to this YTM? a. All cash inflows will be reinvested at 12% b. All cash inflows will be reinvested at 10% c. All cash inflows will be reinvested at 14% All cash inflows will be reinvested at 0% e. All cash inflows will be reinvested at 5% d. 19) What is the realized return on this investment if all cash flows are reinvested at 5% per year for the next three years? ZZZZZZZZ ZZZZZZZ ZZZZZZZZZZZ muum You need the following information for the next 2 questions (20 and 21). Assume that today is 1/1/19. Under Armour is expected to have net income per share (earnings per share) of $40 in 2019 (for fiscal year 2019, from 1/1/19-12/31/19) and $50 in 2020. What do you expect the dividends to be in 2019 and 2020? Assume that the payout ratio in the future will be the same as it has been in the past. EPS in 2014 $10 $7 EPS in 2015 = $20 $14 Dividend paid per share in 2014 = Dividend paid per share in 2015 = Dividend paid per share in 2016= $15.4 Dividend paid per share in 2017 = $ 16.8 EPS in 2016 $22 EPS in 2017 $24 = 20) What is the dividend paid (per share) in 2019? 21) What is the dividend paid (per share) in 2020? 22. Consider a bond paying a coupon rate of 20% per year, compounded annually, when the market interest rate (YTM) is only 10% per year. The market interest rate (return for an investment of like risk) will remain at 10% for the next two years. The bond has two years until maturity. What is the HOLDING PERIOD RETURN (or rate of return) over the first year on this bond? a. 8.32% b. 27.58% C. 9.24% 20% 10% d. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started