thanks

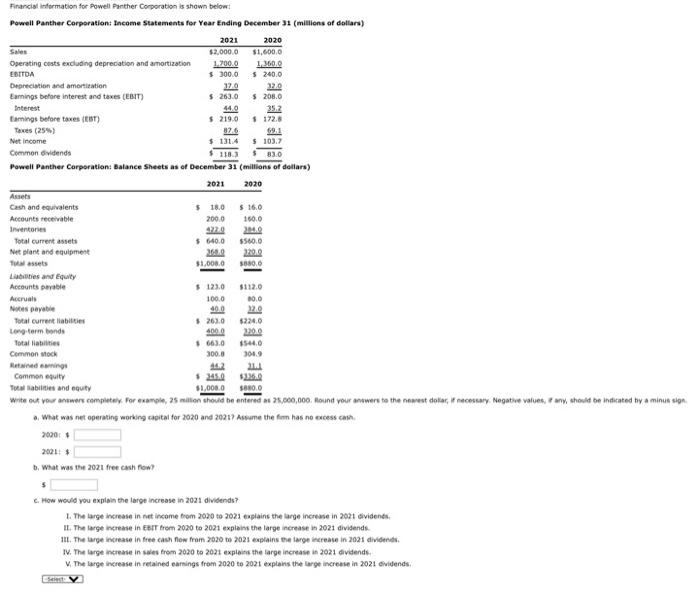

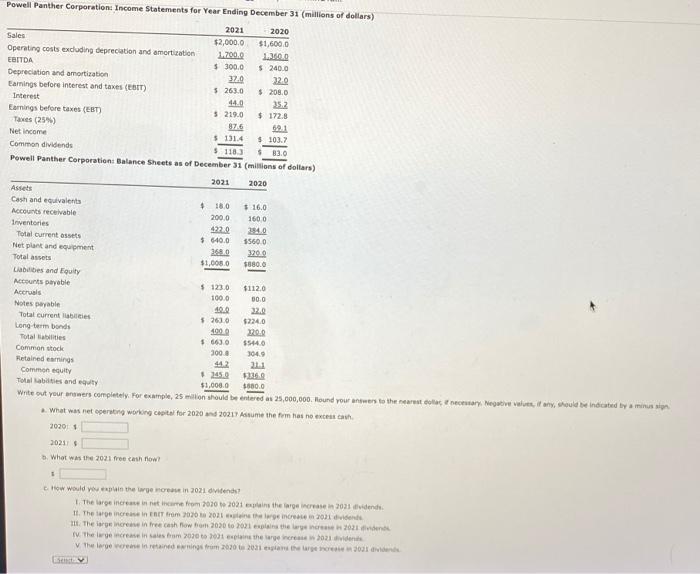

44.0 Financial information for Powell Panther Corporation is shown below Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) 2021 2020 $2,000.0 $1,600,0 Operating costs excluding deprecation and amortization 1.2000 1.0.0 EBITDA $3000 $ 2400 Depreciation and amortization 12.9 12.0 Earnings before interest and taxes (EBIT) $263.0 $ 200.0 Interest 35.2 Camings before taxes (ET) $ 219,0 172.0 826 Net Income $ 1314 $ 103.7 Common vidende 118) $83.0 Powell Panther Corporation: Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cash and equivalents $ 18.0 $ 16.0 Accounts receivable 2000 1600 Inventories 2140 Total current assets $ 6400 $500.0 Net plant and equipment 180 220,0 To asses $1,000.0 8800 Labilities and Equity Accounts payable $123.0 $112.0 Accrual 100.0 Nos payable 400 22.0 Total current liabilities 263.0 52240 Long-term bonds 40040 2200 Total abilities #663,0 544.0 Common stock 300.0 462 Common quity 24.0 24.0 Total abilities and equity $1,000.0 0.0 Write out your answer completely. For example, 25 million should be entered 25,000,000. Round your answers to the nearest dotar, necessary. Negative values, anchould be indicated by a minut sign, What was net operating working capital for 2020 and 20217 Assume the form has no excess can 2000 2001: . What was the 2021 free ashow 10.0 104.9 C. How would you explain the large increase in 2021 dividends? 1. The large increase in net income from 2000 to 2021 explains the large increase in 2021 dividends II. The large increase in EBIT from 2020 to 2021 explains the large increase in 2021 dividends III. The large increase in free cash flow from 2020 2021 explains the large increase in 2021 dividens IV. The large increase in wes from 2020 to 2021 explains the large increase in 2021 dividends. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends Powell Panther Corporation Income Statements for Year Ending December 31 (millions of dollars) 2021 2020 Sales $2,000.0 $1,600,0 Operating costs excluding depreciation and amortization 1.700.0 1200 EBITDA $ 300.0 $240.0 Depreciation and amortization 37.0 32.0 Earnings before interest and taxes (EBIT) 5263.0 $ 2080 Interest 44.0 35.2 Earnings before taxes (EBT) $ 219.0 $ 172.8 Tas (25) 875 691 Net Income 5131.4 $103.7 Common dividends $ 1103 83.0 Powell Panther Corporation Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cash and equivalents + 18.0 $ 16.0 Accounts receivable 200.0 1600 Inventories 42220 2940 Total current assets $ 640.0 1560.0 Net plant and equipment 368.0 320.2 Total assets $1,005.0 $380.0 Labies and Equity Accounts payable $123.0 $112.0 Accruals 100.0 30.0 Notes payable 400 222 Total current abilities 52630 $2240 Long term bonds 1000 2200 Totallaties $630 $5440 Common stock 300 3049 Retained emings 442 211 Common equity 24. 33360 Total abilities and equity $1,000.0 $880.0 Write out your answers completely. For example, 25 wito spould be entered as 23,000,000. Hound your answers to the nearest colles, et neemary, Negative values, it any, could be indicated by us sign . What was net operating working capital for 2020 20217 Assume the firm has no excesca 20201 2025 3. What was the 2021 free cash flow How would explain the worst in 2021 dividends? The large increase in time from 2010 2021 explains the large increase in 2031 vidende 11. The increase in the from 2070 2011 the incremen 2021 din 1. The large increase in tree cash flow for 2030 to 2021 explain the 2021 din IV. They crease in salam 2030 to 2001 is there in 021 videns The large win retained from 2070 2031 20