Thanks

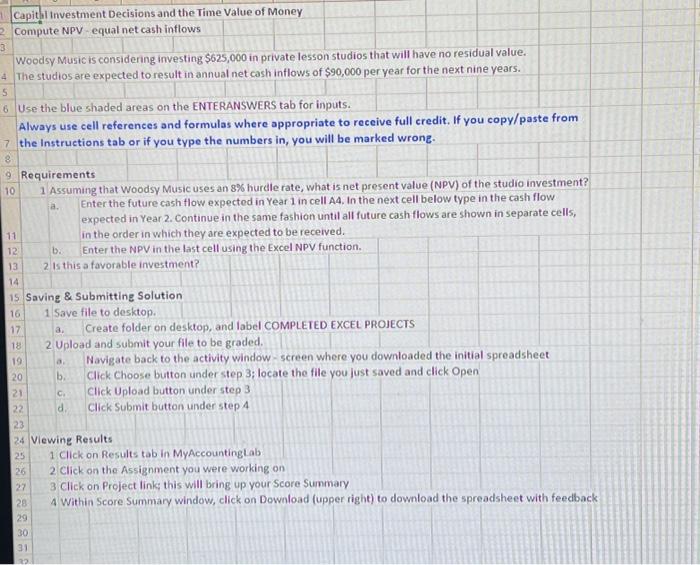

Capithi Investment Decisions and the Time Value of Money Compute NPV - equal net cash inflows Woodsy Music is considering investing $625,000 in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows of $90,000 per year for the next nine years. Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruetions tab or if you type the numbers in, you will be marked wrone. Requirements 1 Assuming that woodsy Music uses an 8% hurdle rate, what is net present value (NPV) of the studio investment? a. Enter the future cash flow expected in Year 1 in cell A4. In the next cell below type in the cash flow expected in Year 2. Continue in the same fashion until all future cash flows are shown in separate cells, in the order in which they are expected to be received. b. Enter the NPV in the last cell using the Excel NPV function. 2 Is this a favorable investment? Saving \& Submitting Solution 1 Save file to desktop. a. Create folder on desktop, and label COMPLETED EXCEL PROJECTS 2 Upload and submit your file to be graded. a. Navigate back to the activity window-screen where you downloaded the initial spreadsheet b. Click Choose button under step 3; locate the file you just saved and click Open c. Click Upload button under step 3 d. Click Submit button under step 4 Viewing Results 1 Click on Results tab in MyAccountingLab 2 Click on the Assignment you were working on 3 Click on Project link; this will bring up your Score Summary 4 Within Score Summary window, click on Download (upper right) to download the spreadsheet with feedback 1. Assuming that Woodsy Music uses an 8% hurdle rate, what is net present value (NPV) of the studio investment? (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab or if you type the numbers in, you will be marked wrong.) 2. Is this a favorable investment? Yes or No? Capithi Investment Decisions and the Time Value of Money Compute NPV - equal net cash inflows Woodsy Music is considering investing $625,000 in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows of $90,000 per year for the next nine years. Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruetions tab or if you type the numbers in, you will be marked wrone. Requirements 1 Assuming that woodsy Music uses an 8% hurdle rate, what is net present value (NPV) of the studio investment? a. Enter the future cash flow expected in Year 1 in cell A4. In the next cell below type in the cash flow expected in Year 2. Continue in the same fashion until all future cash flows are shown in separate cells, in the order in which they are expected to be received. b. Enter the NPV in the last cell using the Excel NPV function. 2 Is this a favorable investment? Saving \& Submitting Solution 1 Save file to desktop. a. Create folder on desktop, and label COMPLETED EXCEL PROJECTS 2 Upload and submit your file to be graded. a. Navigate back to the activity window-screen where you downloaded the initial spreadsheet b. Click Choose button under step 3; locate the file you just saved and click Open c. Click Upload button under step 3 d. Click Submit button under step 4 Viewing Results 1 Click on Results tab in MyAccountingLab 2 Click on the Assignment you were working on 3 Click on Project link; this will bring up your Score Summary 4 Within Score Summary window, click on Download (upper right) to download the spreadsheet with feedback 1. Assuming that Woodsy Music uses an 8% hurdle rate, what is net present value (NPV) of the studio investment? (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab or if you type the numbers in, you will be marked wrong.) 2. Is this a favorable investment? Yes or No