Question

thanks for helping me,you only need to answer question 5 1. Compute net profits and losses per shares ($ amounts) for Lotus stock at expiration

thanks for helping me,you only need to answer question 5

1. Compute net profits and losses per shares ($ amounts) for Lotus stock at expiration (February 19, 1994) for the following strategies for options that have a strike price of $55. For each option strategy, show payoff diagrams.

- Buying Calls

- Writing Calls

- Buying Puts

- Writing Puts

2. With respect to the strategies in (1):

- Which one of the strategies offers the greatest upside return?

- Which one of the strategies offers the least upside returns?

- Which one of the strategies offers the greatest downside potential?

- Which one of the strategies offers the least downside potential?

- Which strategy is the most aggressive?

- Which strategy is the most conservative?

3. Using numerical examples, if you owned AT&T stock, but were concerned about the possibility of bad news, how might you use options to protect yourself against the risk of a price decline? How might you "subsidize" some or all of the cost of protection? Comment on the risks of your chosen "subsidy" strategy?

4. Compare the prices of options on Lotus and AT&T stock. Why are options with identical strike prices and maturity dates written on stocks with identical prices selling for different prices? Do options on one of these two stocks provide investors with superior investment opportunities in comparison to the other?

5. If Put-Call parity was violated in the case of either AT&T or Lotus, identify a strategy that would allow you take advantage of any mispricing. Using numerical examples, state the exact nature of the mispricing (which option and by how much) and then identify your trading strategy to exploit this mispricing.

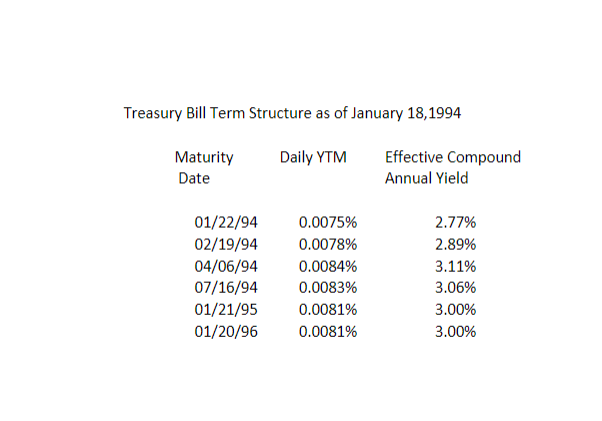

Treasury Bill Term Structure as of January 18,1994 Daily YTM Maturity Date Effective Compound Annual Yield 01/22/94 02/19/94 04/06/94 07/16/94 01/21/95 01/20/96 0.0075% 0.0078% 0.0084% 0.0083% 0.0081% 0.0081% 2.77% 2.89% 3.11% 3.06% 3.00% 3.00% Treasury Bill Term Structure as of January 18,1994 Daily YTM Maturity Date Effective Compound Annual Yield 01/22/94 02/19/94 04/06/94 07/16/94 01/21/95 01/20/96 0.0075% 0.0078% 0.0084% 0.0083% 0.0081% 0.0081% 2.77% 2.89% 3.11% 3.06% 3.00% 3.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started