Answered step by step

Verified Expert Solution

Question

1 Approved Answer

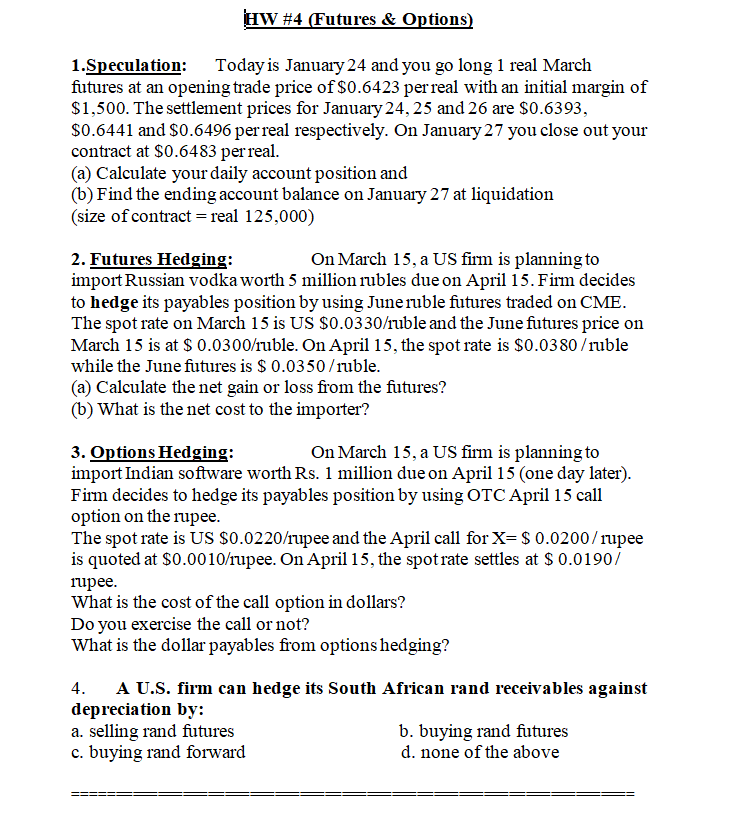

Thanks for the help. Show work pls. W #4 (Futures & Options 1.Speculation: Today is January 24 and you go long 1 real March futures

Thanks for the help. Show work pls.

W #4 (Futures & Options 1.Speculation: Today is January 24 and you go long 1 real March futures at an opening trade price of S0.6423 per real with an initial margin of S1,500. The settlement prices for January24, 25 and 26 are S0.6393 S0.6441 and S0.6496 per real respectively. On January 27 you close out your contract at $0.6483 per real (a) Calculate your daily account position and (b) Find the ending account balance on January 27 at liquidation (size of contract- real 125,000) On March 15. a US firm is planning to 2. Futures Hedging: import Russian vodka worth 5 million rubles due on April 15. Firm decides to hedge its payables position byusing June ruble futures traded on CME The spot rate on March 15 is US $0.0330/ruble and the June futures price on March 15 is at S 0.0300huble. On April 15, the spot rate is S0.0380 /ruble while the June futures is $ 0.0350/ruble (a) Calculate the net gain or loss from the futures? (b) What is the net cost to the importer? On March 15. a US firm is planning to 3. Options Hedging: import Indian software worth Rs. 1 million due on April 15 (one day later) Firm decides to hedge its payables position by using OTC April 15 call option on the rupee The spot rate is US $0.0220/rupee and the April call forX- S 0.0200/rupee is quoted at S0.0010/rupee. On April 15, the spotrate settles at S 0.0190/ rupee What is the cost of the call option in dollars? Do vou exercise the call or not? What is the dollar payables from options hedging? 4.A U.S. firm can hedge its South African rand receivables against depreciation by: a. selling rand futures c. buying rand forward b. buying rand futures d. none of the abov W #4 (Futures & Options 1.Speculation: Today is January 24 and you go long 1 real March futures at an opening trade price of S0.6423 per real with an initial margin of S1,500. The settlement prices for January24, 25 and 26 are S0.6393 S0.6441 and S0.6496 per real respectively. On January 27 you close out your contract at $0.6483 per real (a) Calculate your daily account position and (b) Find the ending account balance on January 27 at liquidation (size of contract- real 125,000) On March 15. a US firm is planning to 2. Futures Hedging: import Russian vodka worth 5 million rubles due on April 15. Firm decides to hedge its payables position byusing June ruble futures traded on CME The spot rate on March 15 is US $0.0330/ruble and the June futures price on March 15 is at S 0.0300huble. On April 15, the spot rate is S0.0380 /ruble while the June futures is $ 0.0350/ruble (a) Calculate the net gain or loss from the futures? (b) What is the net cost to the importer? On March 15. a US firm is planning to 3. Options Hedging: import Indian software worth Rs. 1 million due on April 15 (one day later) Firm decides to hedge its payables position by using OTC April 15 call option on the rupee The spot rate is US $0.0220/rupee and the April call forX- S 0.0200/rupee is quoted at S0.0010/rupee. On April 15, the spotrate settles at S 0.0190/ rupee What is the cost of the call option in dollars? Do vou exercise the call or not? What is the dollar payables from options hedging? 4.A U.S. firm can hedge its South African rand receivables against depreciation by: a. selling rand futures c. buying rand forward b. buying rand futures d. none of the abovStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started