thanks for your assistance with step by step help with this problem.

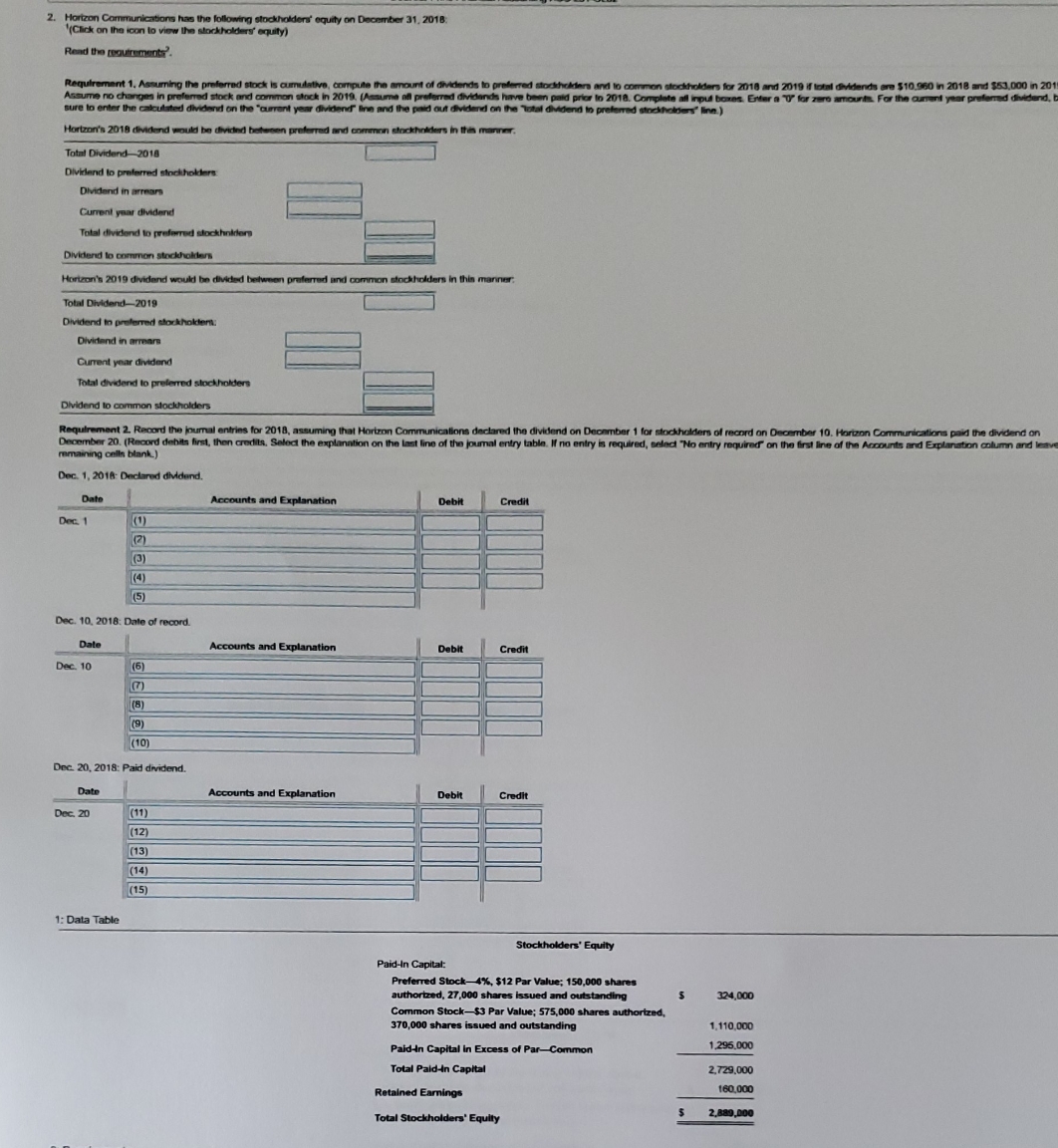

2. Horizon Communications has the following stockholders' equity on December 31, 2018: (Click on the icon to view the stockholders' equity) Read the requirements Requirement 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common stockholders for 2018 and 2019 if total dividends are $10,960 in 2018 and $53,000 in 20 Assume no changes in preferred stock and common clock in 2019. (Assume all preferred dividends have been paid prior to 2018. Complete all inpul bo es. Enter a 'D" for zero amounts. For the current year edend. sure In enter the calculated dividend on the "current year divid and line and the paid out dividend on the Total divid Horizon's 2018 dividend would be divided Total Dividend-2018 Dividend to preferred sinckholders Dividend in arrears Current year dividend Total dividend to preferred stockholders Dividend to common stockholder Horton's 2019 dividend would be divided betw on preferred and common stockholders in this manner Total Dividend-2019 Dividend in preferred stockholders Divirland in arrears Current year dividend Intal dividend to preferred stockholders Dividend to common stockholders requirement 2. Record the joumal en he journal entries for 2018, assuming that Horizon Communications declared the dividend on December 1 for stockholders of record on December 10. Horizon Communications paid the dividend on ecember 20. (Record dehits first, then credits, Seled the explanation on the last line of the journal entry table. If no entry is required, seled "No entry required" on the first line of the Accounts and Explans maining calls blank.) Dec. 1, 2018: Declared dividend, Date Accounts and Explanation Debit Credit Dec (1) (2) (3) (4) (5) Dec. 10. 2018: Date of record. Date Accounts and Explanation Debit Credit Dec. 10 (6) m (8) (9) (10) Dec. 20, 2018: Paid dividend. Date Accounts and Explanation Debit Dec. 20 (11) (12) (13) (14) (15) 1: Data Table Stockholders' Equity Paid-In Capital: Preferred Stock-4%, $12 Par Value; 150,000 shares authorized, 27,000 shares issued and outstanding 324,000 Common Stock-$3 Par Value; 575,000 shares authorized, 370,000 shares issued and outstanding 1,110,000 Paid-In Capital in Excess of Par-Common 1 295,000 Total Paid-In Capital 2,729,000 Retained Earnings 160,000 Total Stockholders' Equity 2,889,000