Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks for your help, I'll be sure to like! Problem #1 During September, 2022, Ms. Asha Chen sells capital property with an ACB of $185,500,

Thanks for your help, I'll be sure to like!

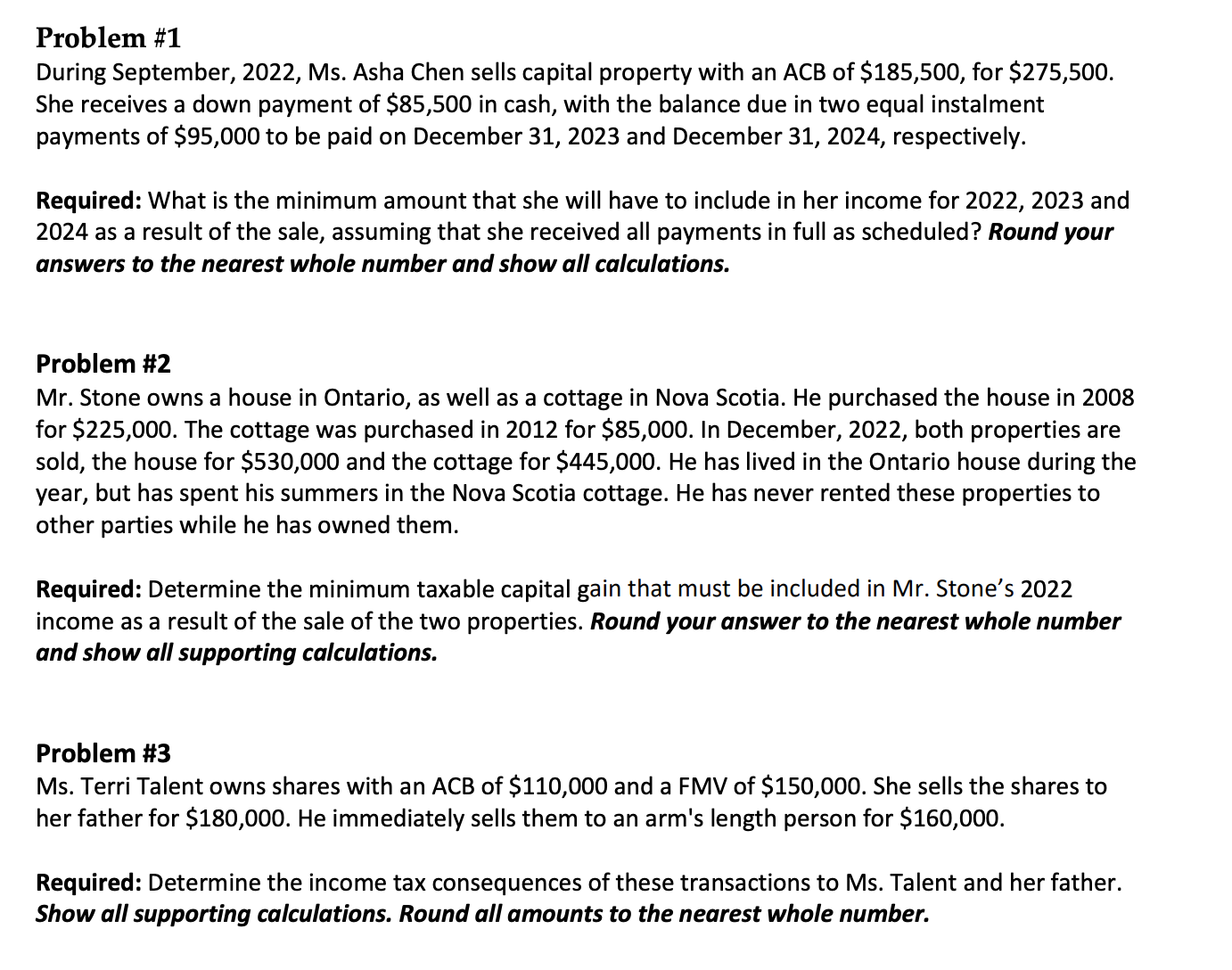

Problem \#1 During September, 2022, Ms. Asha Chen sells capital property with an ACB of $185,500, for $275,500. She receives a down payment of $85,500 in cash, with the balance due in two equal instalment payments of $95,000 to be paid on December 31, 2023 and December 31, 2024, respectively. Required: What is the minimum amount that she will have to include in her income for 2022, 2023 and 2024 as a result of the sale, assuming that she received all payments in full as scheduled? Round your answers to the nearest whole number and show all calculations. Problem \#2 Mr. Stone owns a house in Ontario, as well as a cottage in Nova Scotia. He purchased the house in 2008 for $225,000. The cottage was purchased in 2012 for $85,000. In December, 2022, both properties are sold, the house for $530,000 and the cottage for $445,000. He has lived in the Ontario house during the year, but has spent his summers in the Nova Scotia cottage. He has never rented these properties to other parties while he has owned them. Required: Determine the minimum taxable capital gain that must be included in Mr. Stone's 2022 income as a result of the sale of the two properties. Round your answer to the nearest whole number and show all supporting calculations. Problem \#3 Ms. Terri Talent owns shares with an ACB of $110,000 and a FMV of $150,000. She sells the shares to her father for $180,000. He immediately sells them to an arm's length person for $160,000. Required: Determine the income tax consequences of these transactions to Ms. Talent and her father. Show all supporting calculations. Round all amounts to the nearest whole number

Problem \#1 During September, 2022, Ms. Asha Chen sells capital property with an ACB of $185,500, for $275,500. She receives a down payment of $85,500 in cash, with the balance due in two equal instalment payments of $95,000 to be paid on December 31, 2023 and December 31, 2024, respectively. Required: What is the minimum amount that she will have to include in her income for 2022, 2023 and 2024 as a result of the sale, assuming that she received all payments in full as scheduled? Round your answers to the nearest whole number and show all calculations. Problem \#2 Mr. Stone owns a house in Ontario, as well as a cottage in Nova Scotia. He purchased the house in 2008 for $225,000. The cottage was purchased in 2012 for $85,000. In December, 2022, both properties are sold, the house for $530,000 and the cottage for $445,000. He has lived in the Ontario house during the year, but has spent his summers in the Nova Scotia cottage. He has never rented these properties to other parties while he has owned them. Required: Determine the minimum taxable capital gain that must be included in Mr. Stone's 2022 income as a result of the sale of the two properties. Round your answer to the nearest whole number and show all supporting calculations. Problem \#3 Ms. Terri Talent owns shares with an ACB of $110,000 and a FMV of $150,000. She sells the shares to her father for $180,000. He immediately sells them to an arm's length person for $160,000. Required: Determine the income tax consequences of these transactions to Ms. Talent and her father. Show all supporting calculations. Round all amounts to the nearest whole number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started