thanks in advance. I attached teo photos because couldn't fit the whole question in one.

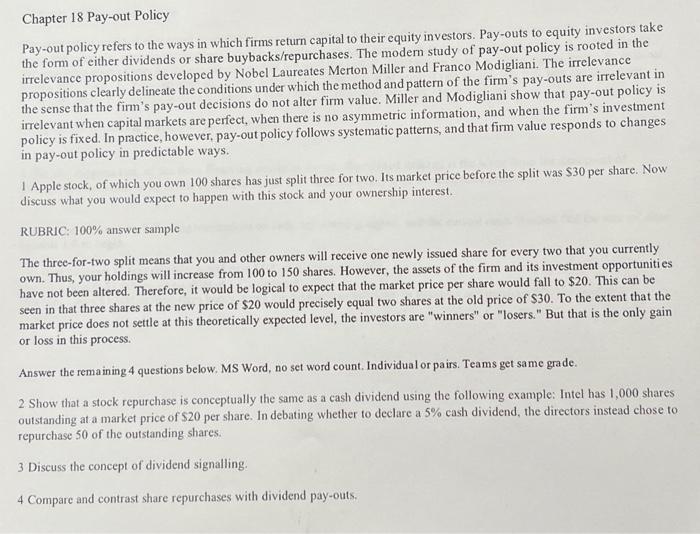

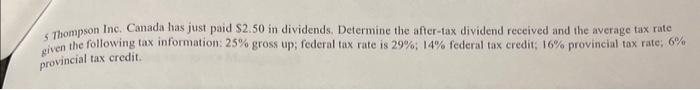

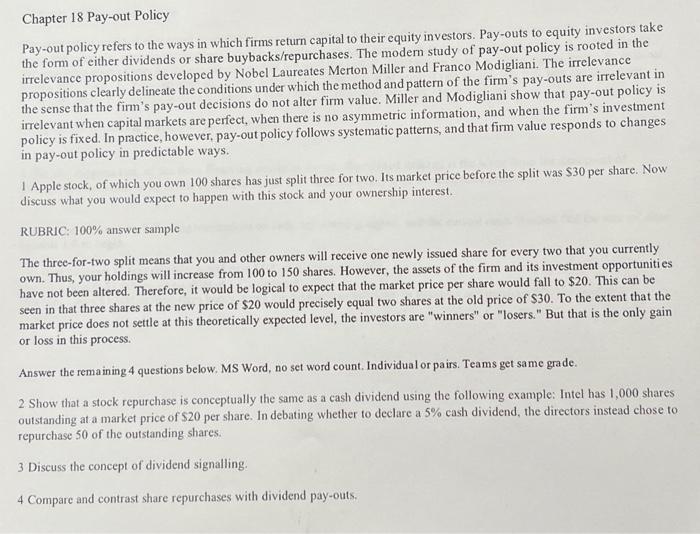

Chapter 18 Pay-out Policy Pay-out policy refers to the ways in which firms return capital to their equity investors. Pay-outs to equity investors take the form of either dividends or share buybacks/repurchases. The modern study of pay-out policy is rooted in the irrelevance propositions developed by Nobel Laureates Merton Miller and Franco Modigliani. The irrelevance propositions clearly delineate the conditions under which the method and pattern of the firm's pay-outs are irrelevant in the sense that the firm's pay-out decisions do not alter firm value. Miller and Modigliani show that pay-out policy is irrelevant when capital markets are perfect, when there is no asymmetric information, and when the firm's investment policy is fixed. In practice, however, pay-out policy follows systematic patterns, and that firm value responds to changes in pay-out policy in predictable ways. 1 Apple stock, of which you own 100 shares has just split three for two. Its market price before the split was $30 per share. Now discuss what you would expect to happen with this stock and your ownership interest. RUBRIC: 100% answer sample The three-for-two split means that you and other owners will receive one newly issued share for every two that you currently own. Thus, your holdings will increase from 100 to 150 shares. However, the assets of the firm and its investment opportunities have not been altered. Therefore, it would be logical to expect that the market price per share would fall to $20. This can be seen in that three shares at the new price of $20 would precisely equal two shares at the old price of $30. To the extent that the market price does not settle at this theoretically expected level, the investors are "winners" or "losers." But that is the only gain or loss in this process. Answer the remaining 4 questions below. MS Word, no set word count. Individual or pairs. Teams get same grade. 2. Show that a stock repurchase is conceptually the same as a cash dividend using the following example: Intel has 1,000 shares outstanding at a market price of $20 per share. In debating whether to declare a 5% cash dividend, the directors instead chose to repurchase 50 of the outstanding shares. 3 Discuss the concept of dividend signalling. 4 Comparc and contrast share repurchases with dividend pay-outs. 5 Thompson Inc. Canada has just paid $2.50 in dividends. Determine the after-tax dividend received and the average tax rate given the following tax information: 25% gross up; federal tax rate is 29%;14% federal tax credit; 16% provincial tax rate; 6% provincial tax credit