Answered step by step

Verified Expert Solution

Question

1 Approved Answer

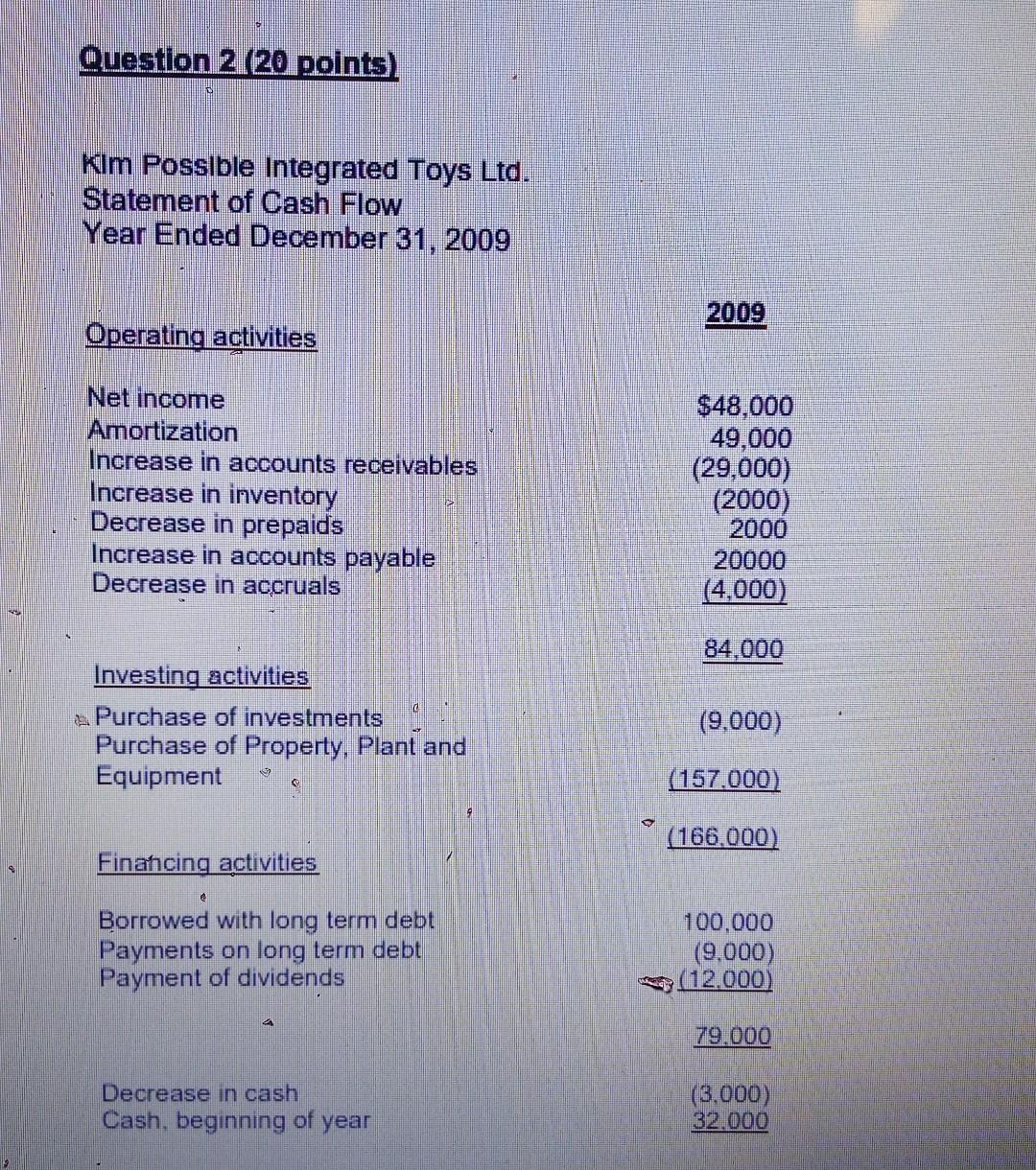

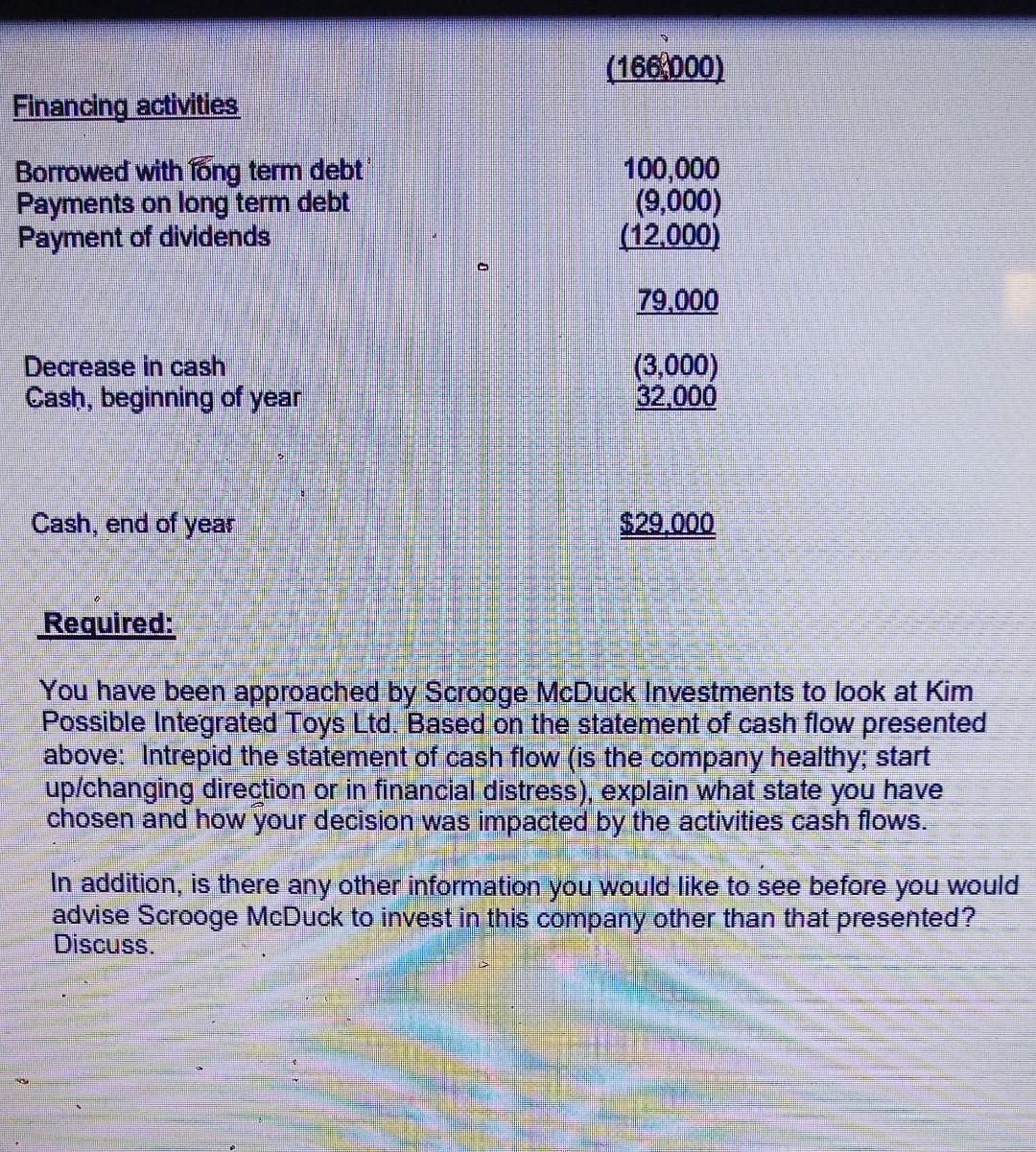

thanks in advance Question 2 (20 points) Kim Possible Integrated Toys Ltd. Statement of Cash Flow Year Ended December 31, 2009 Operating activities Net income

thanks in advance

Question 2 (20 points) Kim Possible Integrated Toys Ltd. Statement of Cash Flow Year Ended December 31, 2009 Operating activities Net income Amortization Increase in accounts receivables Increase in inventory Decrease in prepaids Increase in accounts payable Decrease in accruals Investing activities Purchase of investments Purchase of Property, Plant and Equipment Financing activities Borrowed with long term debt Payments on long term debt Payment of dividends 4 Decrease in cash Cash, beginning of year S 2009 $48,000 49,000 (29,000) (2000) 2000 20000 (4,000) 84,000 (9,000) (157.000) (166,000) 100,000 (9,000) (12.000) 79.000 (3.000) 32,000 Financing activities Borrowed with long term debt Payments on long term debt Payment of dividends Decrease in cash Cash, beginning of year Cash, end of year (166.000) 100,000 (9,000) (12,000) 79,000 (3,000) 32,000 $29.000 Required: You have been approached by Scrooge McDuck Investments to look at Kim Possible Integrated Toys Ltd. Based on the statement of cash flow presented above: Intrepid the statement of cash flow (is the company healthy; start up/changing direction or in financial distress), explain what state you have chosen and how your decision was impacted by the activities cash flows. In addition, is there any other information you would like to see before you would advise Scrooge McDuck to invest in this company other than that presented? Discuss. Question 2 (20 points) Kim Possible Integrated Toys Ltd. Statement of Cash Flow Year Ended December 31, 2009 Operating activities Net income Amortization Increase in accounts receivables Increase in inventory Decrease in prepaids Increase in accounts payable Decrease in accruals Investing activities Purchase of investments Purchase of Property, Plant and Equipment Financing activities Borrowed with long term debt Payments on long term debt Payment of dividends 4 Decrease in cash Cash, beginning of year S 2009 $48,000 49,000 (29,000) (2000) 2000 20000 (4,000) 84,000 (9,000) (157.000) (166,000) 100,000 (9,000) (12.000) 79.000 (3.000) 32,000 Financing activities Borrowed with long term debt Payments on long term debt Payment of dividends Decrease in cash Cash, beginning of year Cash, end of year (166.000) 100,000 (9,000) (12,000) 79,000 (3,000) 32,000 $29.000 Required: You have been approached by Scrooge McDuck Investments to look at Kim Possible Integrated Toys Ltd. Based on the statement of cash flow presented above: Intrepid the statement of cash flow (is the company healthy; start up/changing direction or in financial distress), explain what state you have chosen and how your decision was impacted by the activities cash flows. In addition, is there any other information you would like to see before you would advise Scrooge McDuck to invest in this company other than that presented? DiscussStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started