Answered step by step

Verified Expert Solution

Question

1 Approved Answer

that is all there is offered Except for the earnings per share statistics, the 2019, 2020, and 2021 Income statements for Ace Group Inc. were

that is all there is offered

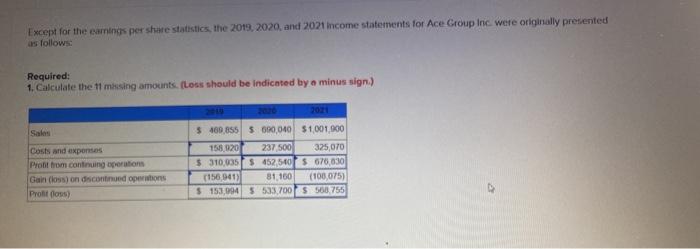

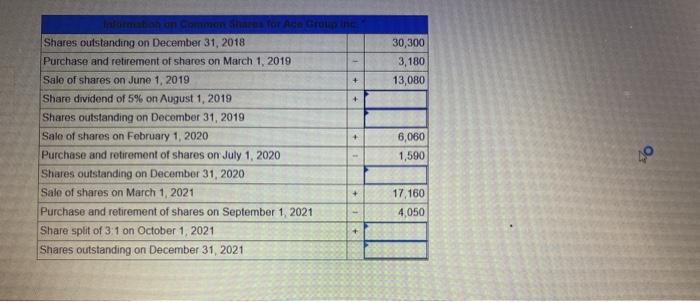

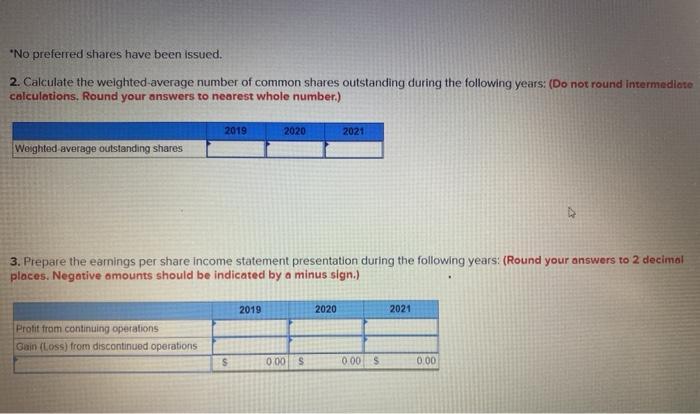

Except for the earnings per share statistics, the 2019, 2020, and 2021 Income statements for Ace Group Inc. were originally presented as follows: Required: 1. Calculate the 11 mising amounts. (Loss should be indicated by a minus sign) Sales Costs and expenses Profit from continuing operation Gain (los) on continued operations Profit (los) 2011 3460 855 500,040 51001000 158,020 237 500 325,070 $ 310,035 $452.5101 5 676,630 (156 941) 81,150 (106,075) $ 153,094 5533.700 5568755 30,300 3,180 13,080 + 4 Shares outstanding on December 31, 2018 Purchase and retirement of shares on March 1, 2019 Sale of shares on June 1, 2019 Share dividend of 5% on August 1, 2019 Shares outstanding on December 31, 2019 Sale of shares on February 1, 2020 Purchase and retirement of shares on July 1, 2020 Shares outstanding on December 31, 2020 Sale of shares on March 1, 2021 Purchase and retirement of shares on September 1, 2021 Share split of 3 1 on October 1, 2021 Shares outstanding on December 31, 2021 6,060 1,590 o + 17,160 4,050 + "No preferred shares have been issued. 2. Calculate the weighted average number of common shares outstanding during the following years: (Do not round Intermediate calculations. Round your answers to nearest whole number.) 2019 2020 2021 Weighted average outstanding shares 3. Prepare the earnings per share income statement presentation during the following years: (Round your answers to 2 decimal places. Negative amounts should be indicated by a minus sign.) 2019 2020 2021 Protit from continuing operations Gain (Loss) from discontinued operations S 000 $ 0.00 $ 0.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started