Answered step by step

Verified Expert Solution

Question

1 Approved Answer

That is the complete question In 1997, the U.S. Treasury issued Treasury inflation-protected securities (TIPS). TIPS are issued in maturities of 5, 10 and 30

That is the complete question

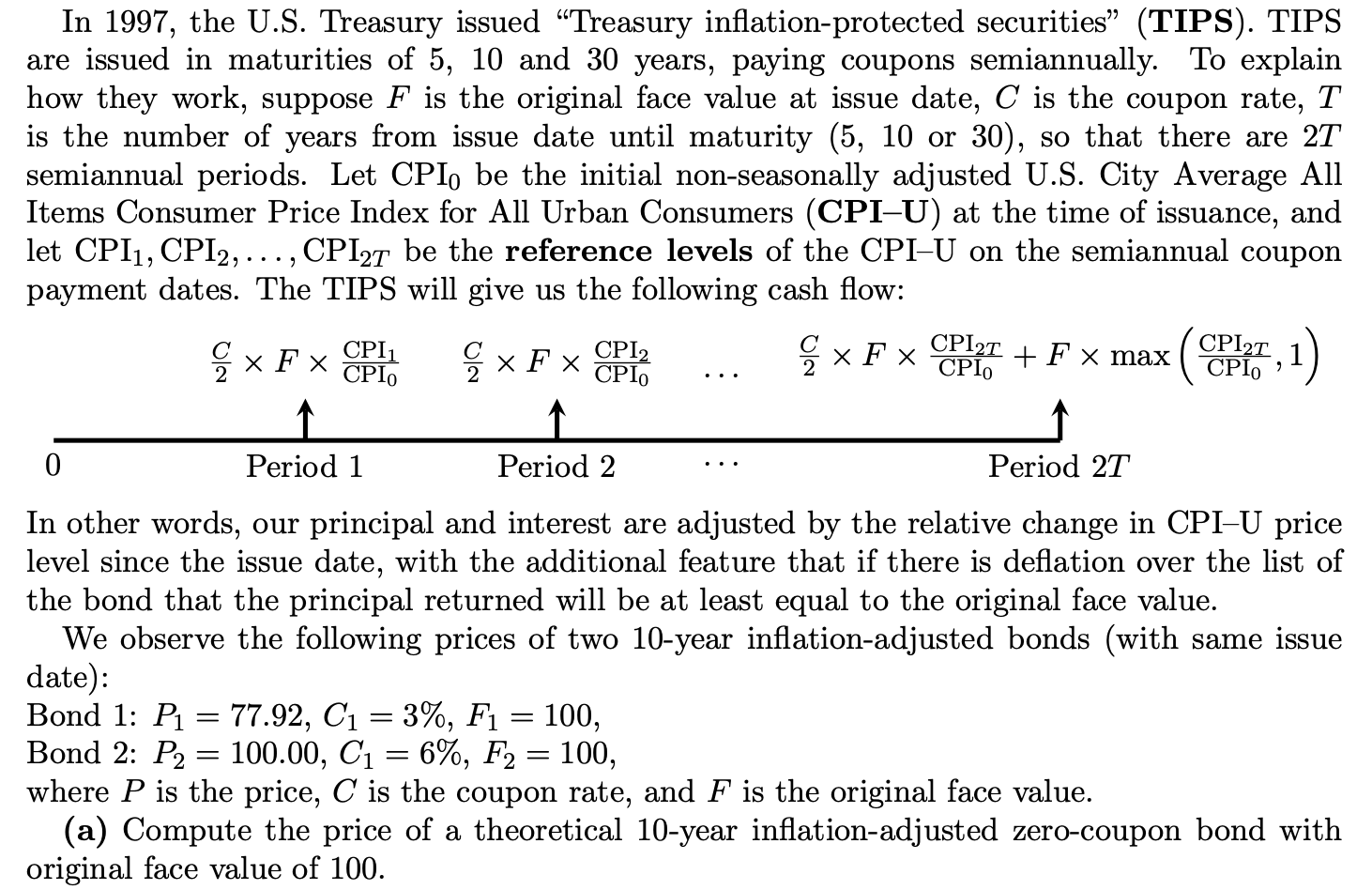

In 1997, the U.S. Treasury issued Treasury inflation-protected securities (TIPS). TIPS are issued in maturities of 5, 10 and 30 years, paying coupons semiannually. To explain how they work, suppose F is the original face value at issue date, C is the coupon rate, T is the number of years from issue date until maturity (5, 10 or 30), so that there are 2T semiannual periods. Let CPI be the initial non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U) at the time of issuance, and let CPI1, CPI2, ..., CPI2T be the reference levels of the CPI-U on the semiannual coupon payment dates. The TIPS will give us the following cash flow: 0 F CPI1 CPIO F CPI2 CPIO Period 1 Period 2 F CPI2T CPIO + F x max (CPIT, 1) Period 2T In other words, our principal and interest are adjusted by the relative change in CPI-U price level since the issue date, with the additional feature that if there is deflation over the list of the bond that the principal returned will be at least equal to the original face value. We observe the following prices of two 10-year inflation-adjusted bonds (with same issue date): Bond 1: P = 77.92, C = 3%, F = 100, Bond 2: P2100.00, C = 6%, F2 = 100, where P is the price, C is the coupon rate, and F is the original face value. (a) Compute the price of a theoretical 10-year inflation-adjusted zero-coupon bond with original face value of 100.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started